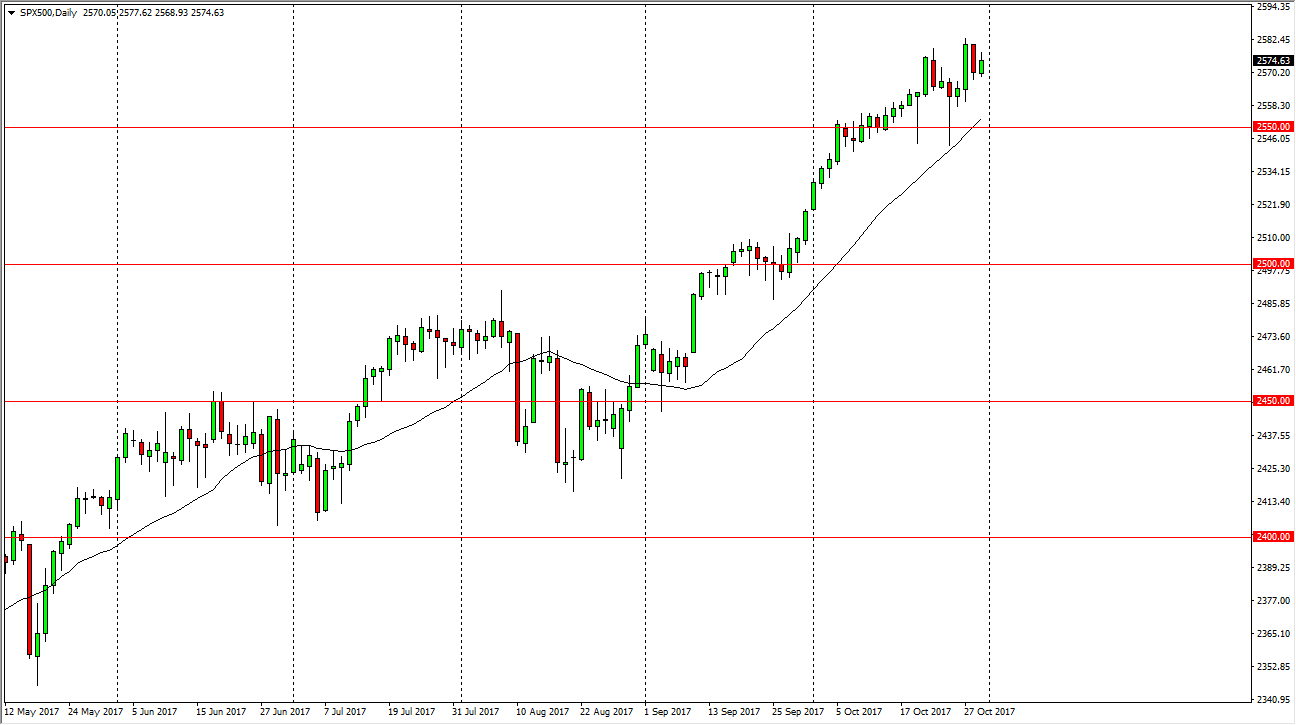

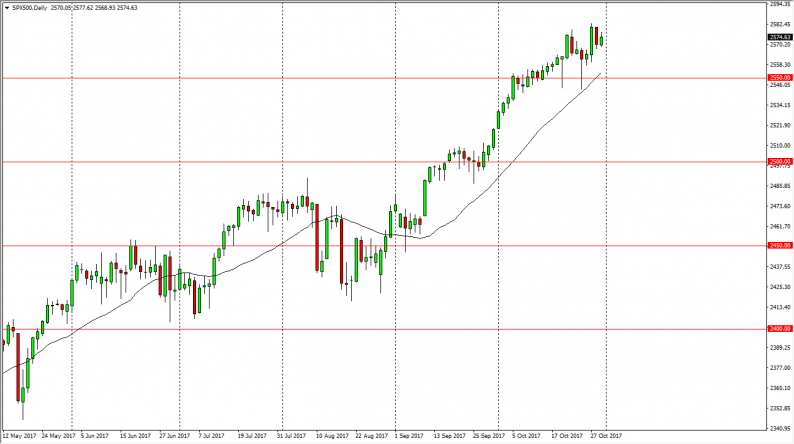

S&P 500

The S&P 500 had a slightly positive session on Tuesday, as we continue to grind back and forth. The 2550 level underneath continues to be massive support, and I believe that pullbacks will be looked at as potential buying opportunities as the market has seen so much in the way of fortitude. A break above the highs of the last couple of sessions sends this market towards the 2600 level, but quite frankly I think it’s probably more likely to grind sideways more than anything else. If we did breakdown below the 2550 handle, I believe there is a hard “floor” at the 2500 level, and that being the case I have no interest in shorting. Longer-term, I believe that we will break above the 2600 level without too many issues, as the uptrend has been very reliable.

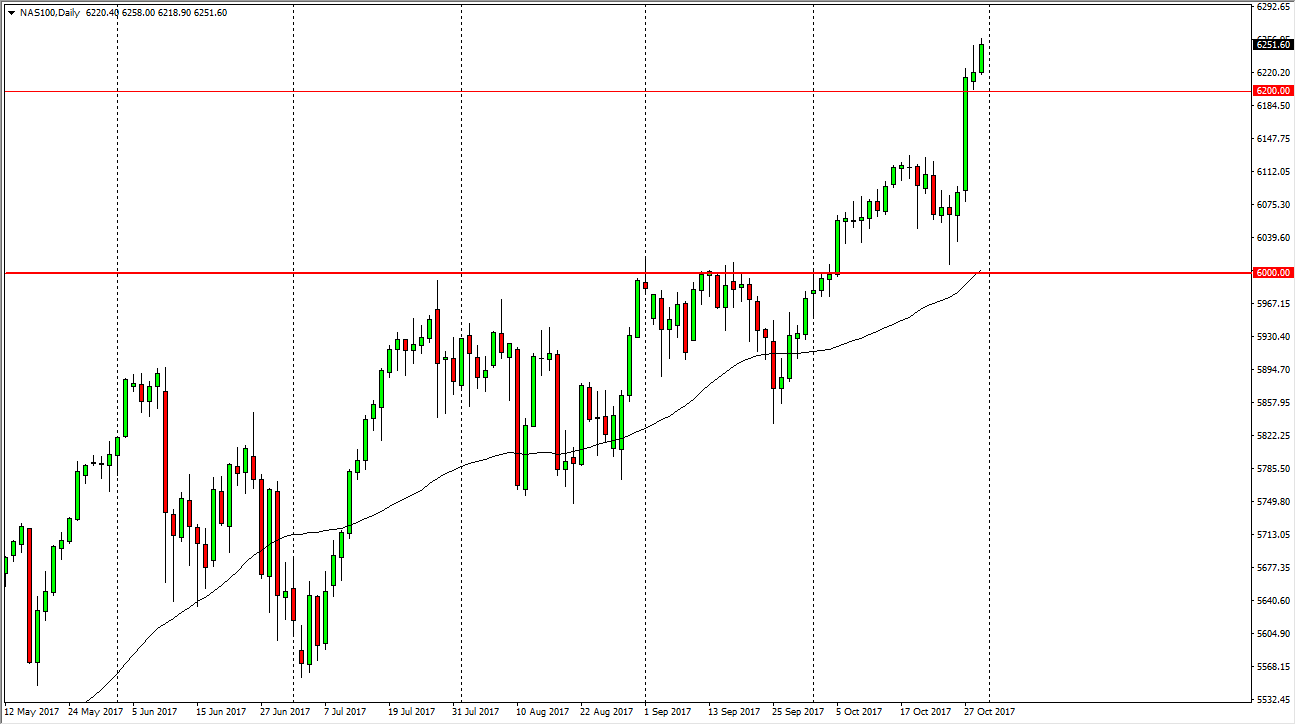

Nasdaq 100

If the S&P 500 has been reliable and strong, the Nasdaq 100 has been absolutely on fire. I believe that breaking above the top of the shooting star from the Monday session is a very strong sign, and shows that we are about to get very impulsive in this market. Pullbacks should continue to offer value, and the 6200 level, at least in theory, should be supportive. A breakdown below the 6200 level sends this market looking for the 6100 level below. I believe that the 6000-level underneath continues to be the floor of the market, as it was massively resistive in the past. Longer-term, I believe that we go to the 6500 level above. Ultimately, the volatility should continue to be a mainstay of this market, but when we pull back it only offers value from what I can see. I have no interest in shorting this market, even though we are overextended.

Leave A Comment