The year is only beginning, but analysts are forecasting a bleak 2016, at least in terms of earnings for the S&P 500. Expectations for the Energy sector are especially low, with at least one firm expecting the sector not to turn a profit at all this year.

The ultimate bear’s earnings forecast for 2016

In a report dated Jan. 18 titled “Gotta swing when you see it,” Deutsche Bank strategist David Bianco and team give their ultra-bearish forecasts for this year and explain why they’re expecting such a difficult year. It should be noted that their estimates are significantly lower than the consensus estimates, at least for right now.

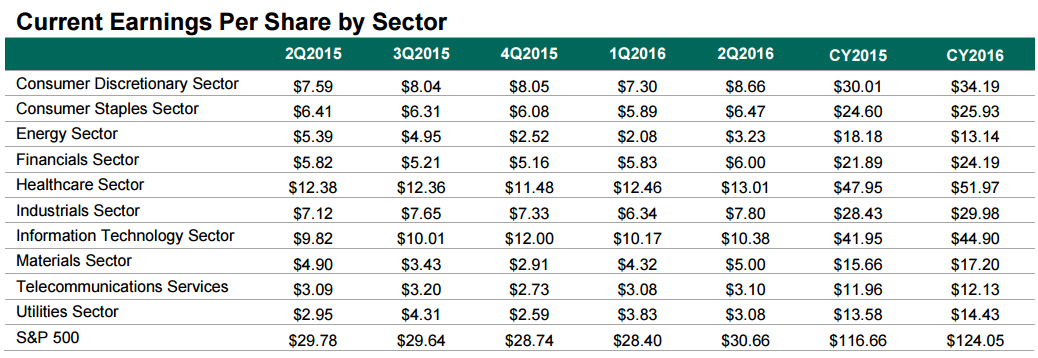

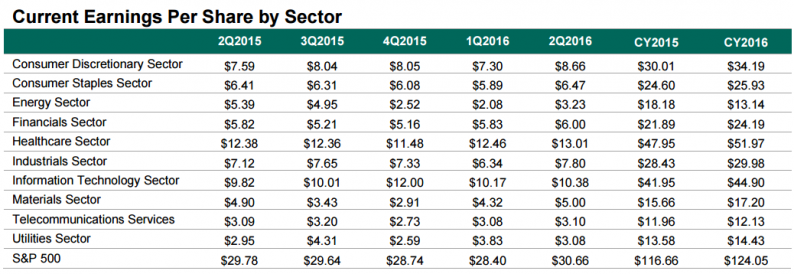

While they’re anticipating that the Energy sector won’t turn a profit in 2016, data from S&P Capital IQ indicates that Wall Street is expecting earnings of $13.14 per share from the sector for the calendar year.

As you can see from the above table, the consensus estimate for full-year earnings for the S&P 500 is $124.05 per share. The Deutsche Bank team, however, has revised their estimate downward from $125 to $120 per share.

Not worried about the market correction

The firm’s strategists try to calm investors by emphasizing that they aren’t panicking about the correction the market is currently undergoing. They argue that the driver is a “profit recession” centered just in certain industries. Further, they say that risks they’ve long acknowledged are driving the recession, and they’re preparing to assess the most recent developments, like the expected limits to the earnings damage being done to the S&P 500.

Bianco and team aim to protect against the correction, especially from Energy and Industrials, but they add that the correction has “overly punished.” As a result, they believe now is the time to take advantage of the pullback in some areas of the market. In fact, they expect the next 5% change in the price of the S&P 500 to be upward and to come soon. Here’s a look at some statistics regarding past selloffs.

Leave A Comment