The S&P 500 plunged at the open and sold off through the session to its -2.17% intraday low about an hour before the close. A bit of buying in the final hour trimmed the loss to -1.87%. Today’s selloff correlated with an even more severe plunge in oil, with the end of day spot price for West Texas Crude at 29.88, a 4.60% decline. The index is now back in correction territory, down 10.69% off its record close in May of last year.

The yield on the 10-year note closed at 1.87%, down 10 basis points from the previous close.

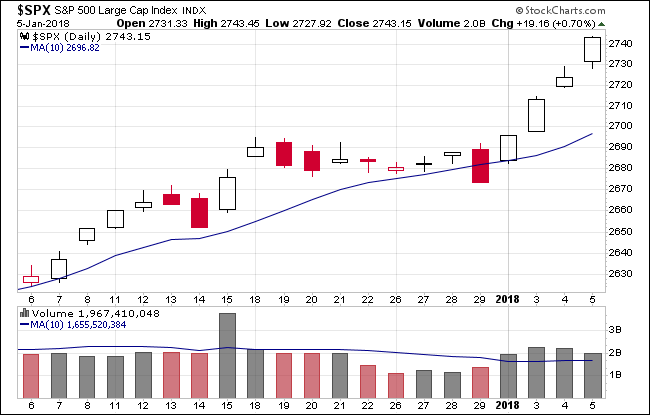

Here is a snapshot of past five sessions.

Here is a daily chart of the index. Volume was up modestly on today’s selling.

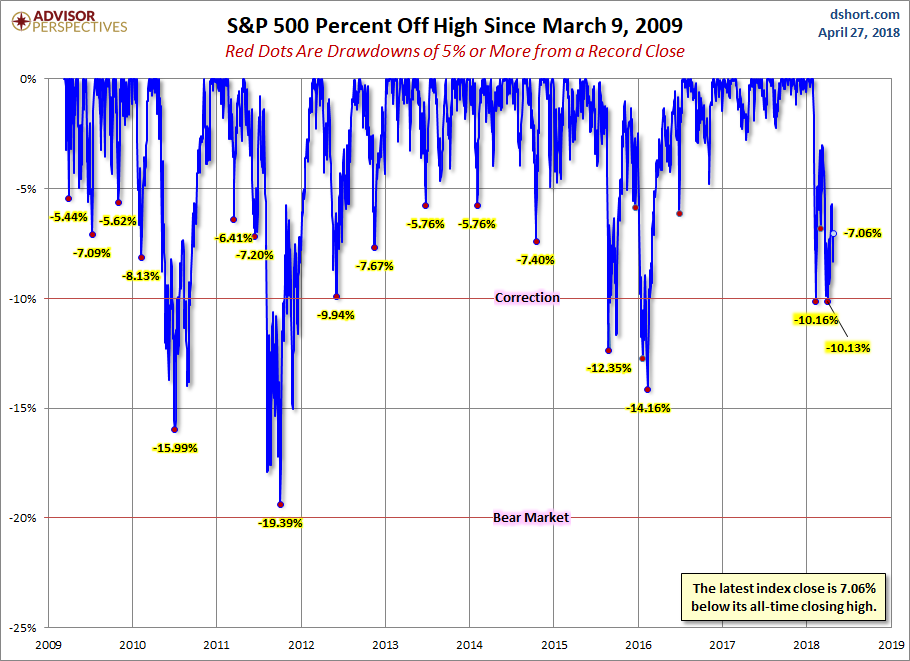

A Perspective on Drawdowns

Here’s a snapshot of selloffs since the 2009 trough.

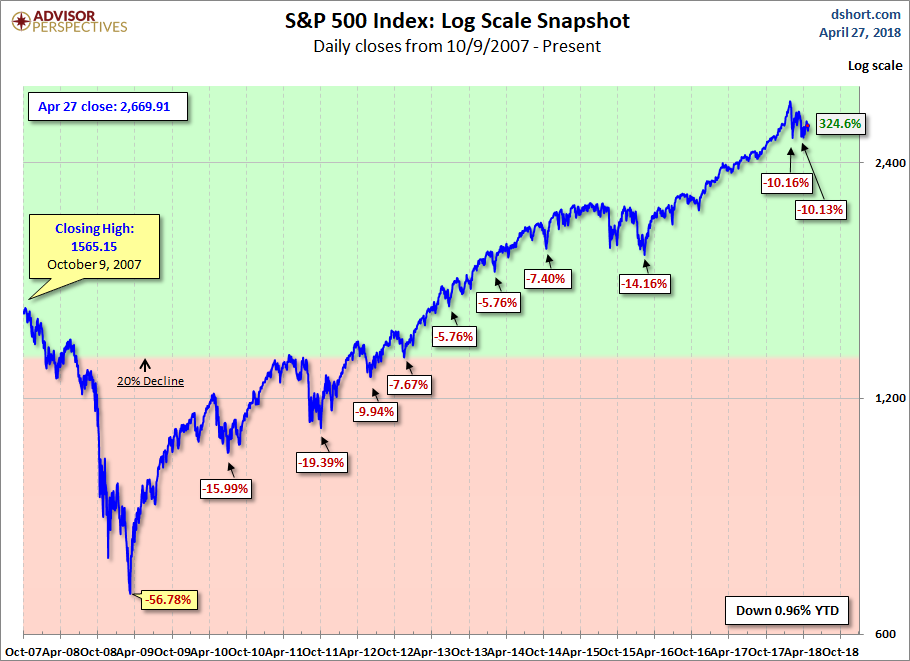

For a longer-term perspective, here is a log-scale chart base on daily closes since the all-time high prior to the Great Recession.

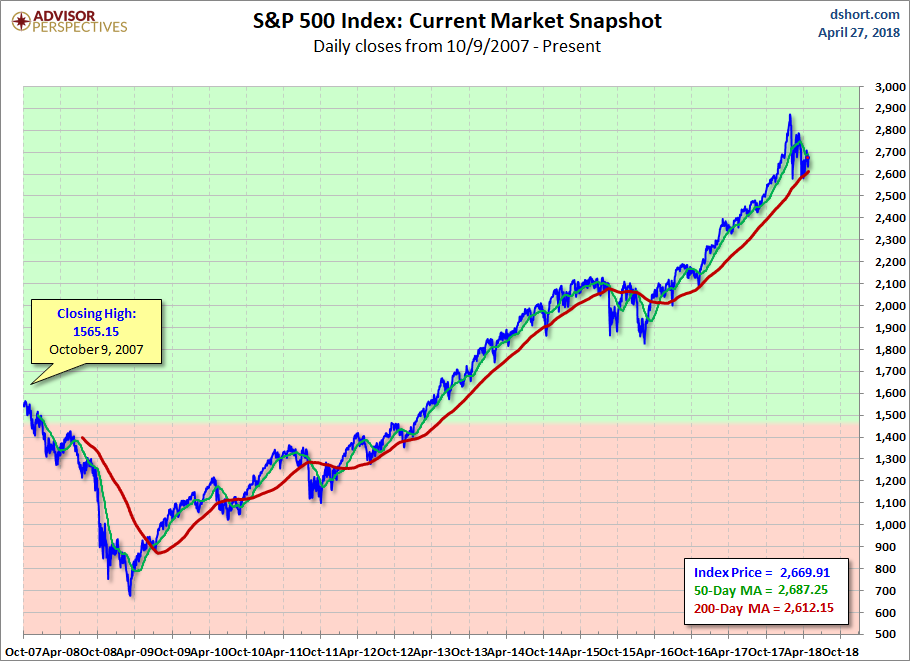

Here is the same chart with the 50- and 200-day moving averages.

Leave A Comment