Major world markets were having a bad day before the US stock exchange opened. The Nikkei had fallen 0.90%, European indexes were in the red and the Euro STOXX 50 would later close down 0.98%. In addition to the weak global tone, the pre-market release of another month of contracting Durable Goods data kept futures in the red. The S&P 500 opened lower, and failed a morning rally attempt. It then sold off to its -0.60% intraday low in the early afternoon. A bit of buying in the afternoon trimmed the closing loss to -0.26%. The market’s short-term focus will now shift to tomorrow’s 2PM release of the latest Fed statement.

The yield on the 10-year note closed at 2.05%, down 2 bps from the previous close.

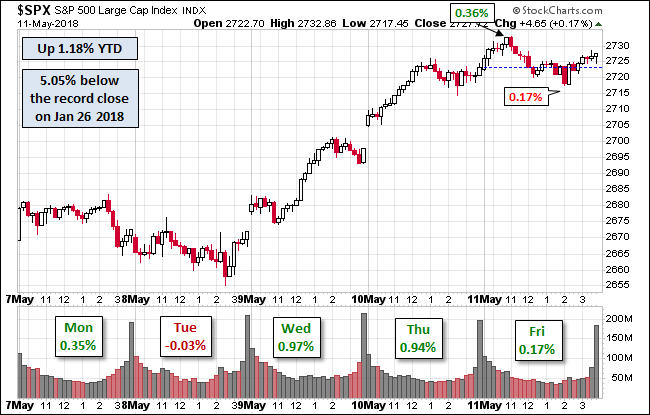

Here is a snapshot of past five sessions.

Volume was a bit below its 50-day moving average. Today’s action tested the 200-day moving average and held. We’ll see if that continues after tomorrow’s reaction to the Fed.

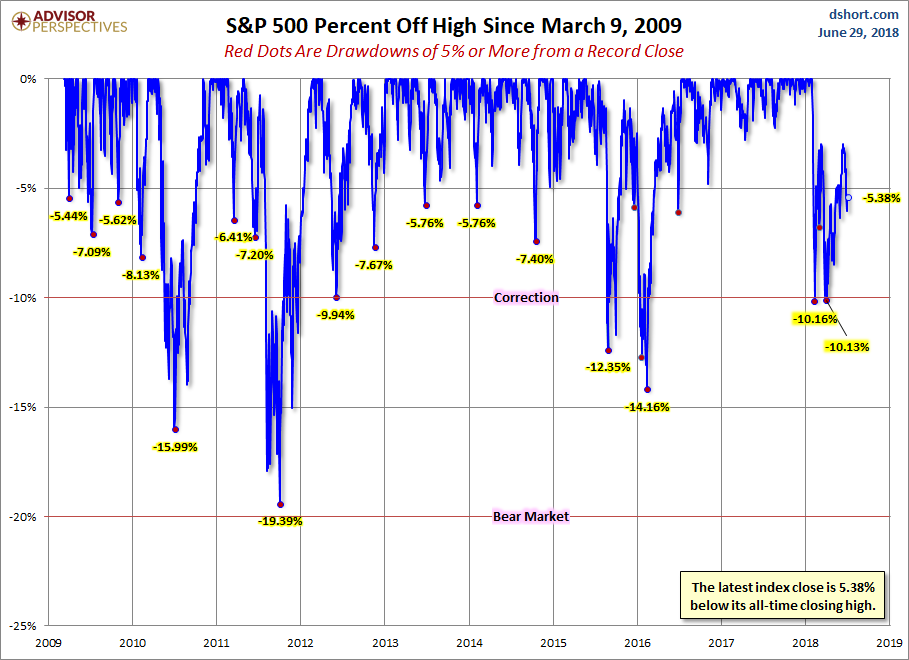

A Perspective on Drawdowns

Here’s a snapshot of selloffs since the 2009 trough.

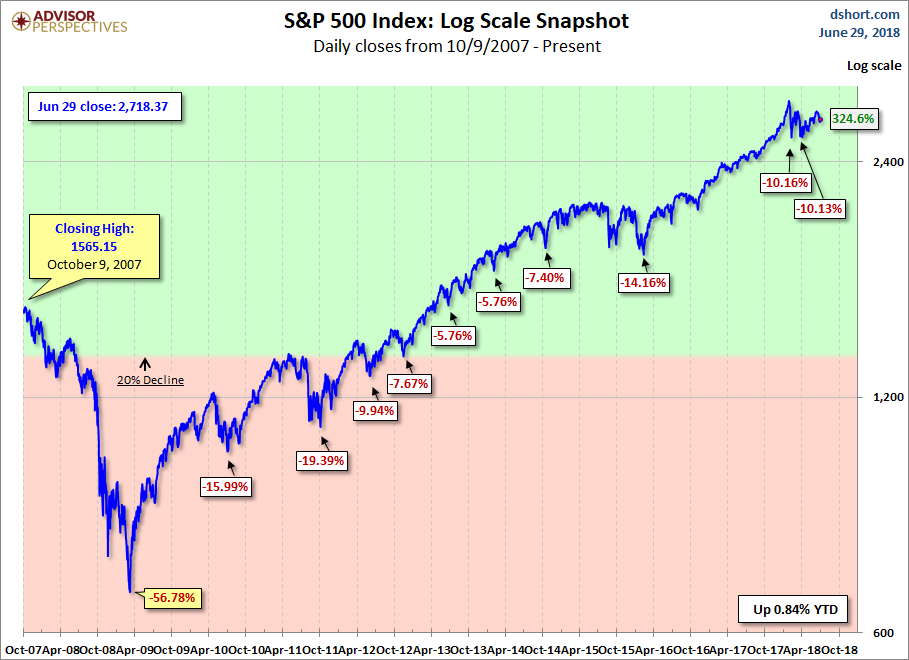

For a longer-term perspective, here is a log-scale chart base on daily closes since the all-time high prior to the Great Recession.

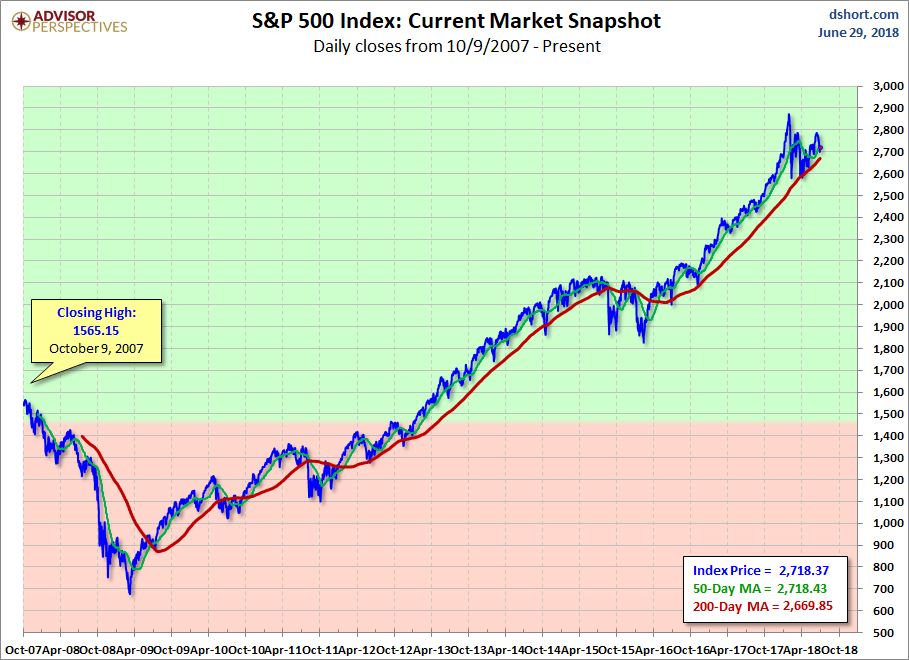

Here is the same chart with the 50- and 200-day moving averages. The 50 crossed below the 200 on August 28th.

Leave A Comment