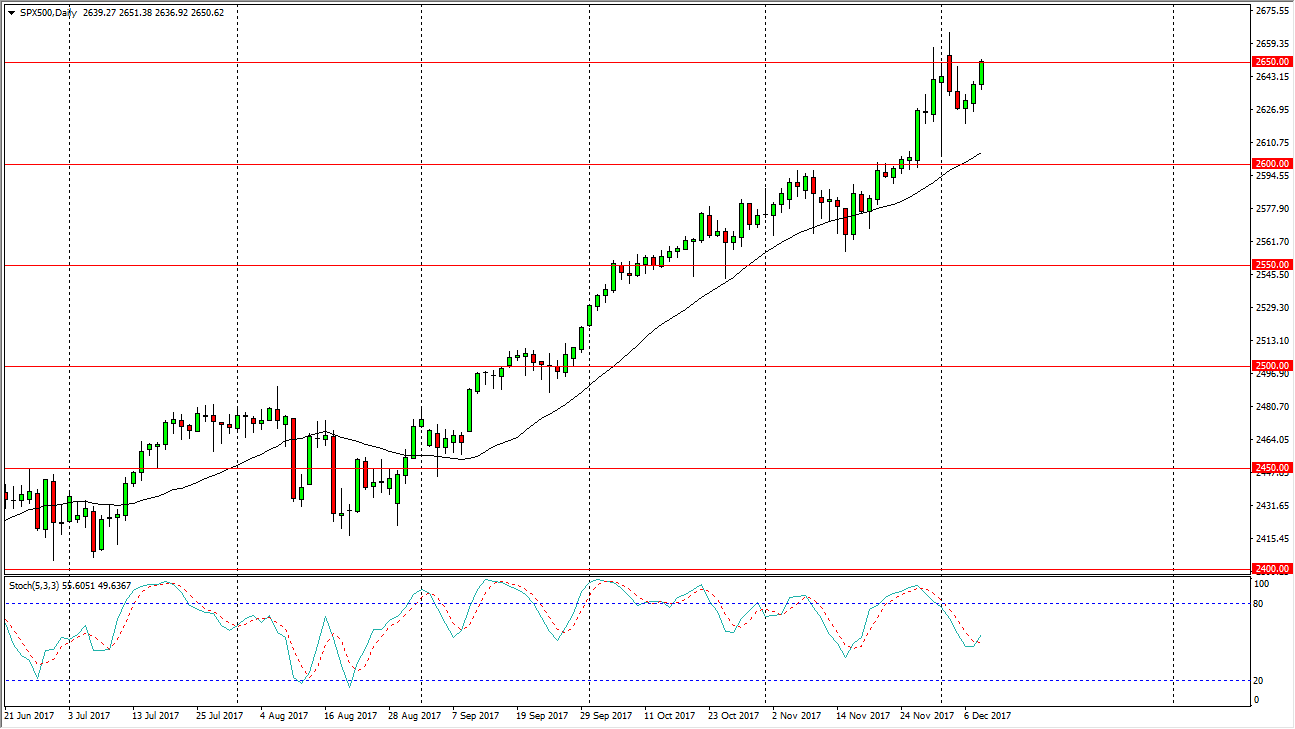

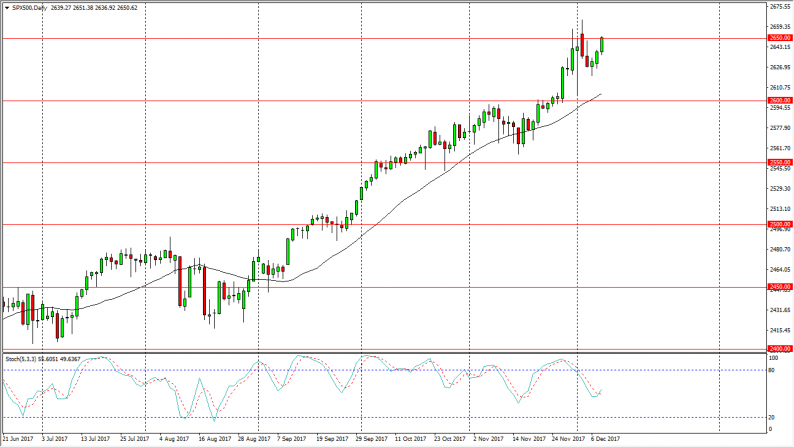

S&P 500

The S&P 500 rallied again during the trading session on Thursday, slicing through the 2650 level but pulling back towards the end of the day. Ultimately, this is a bullish market but we are a bit overbought it on the stochastic oscillator, so I suspect it’s likely to see selling pressure, but that selling pressure should end up being a buying opportunity. Longer-term, looks as if the 2600 level under current level should be a nice “floor” in the market, and I think that the support extends down to the 2550 level as well. At this point, I look at a pullback as an opportunity to take advantage of what has been a very strong rally to the upside, and perhaps the beginning of the annual “Santa Claus rally.”

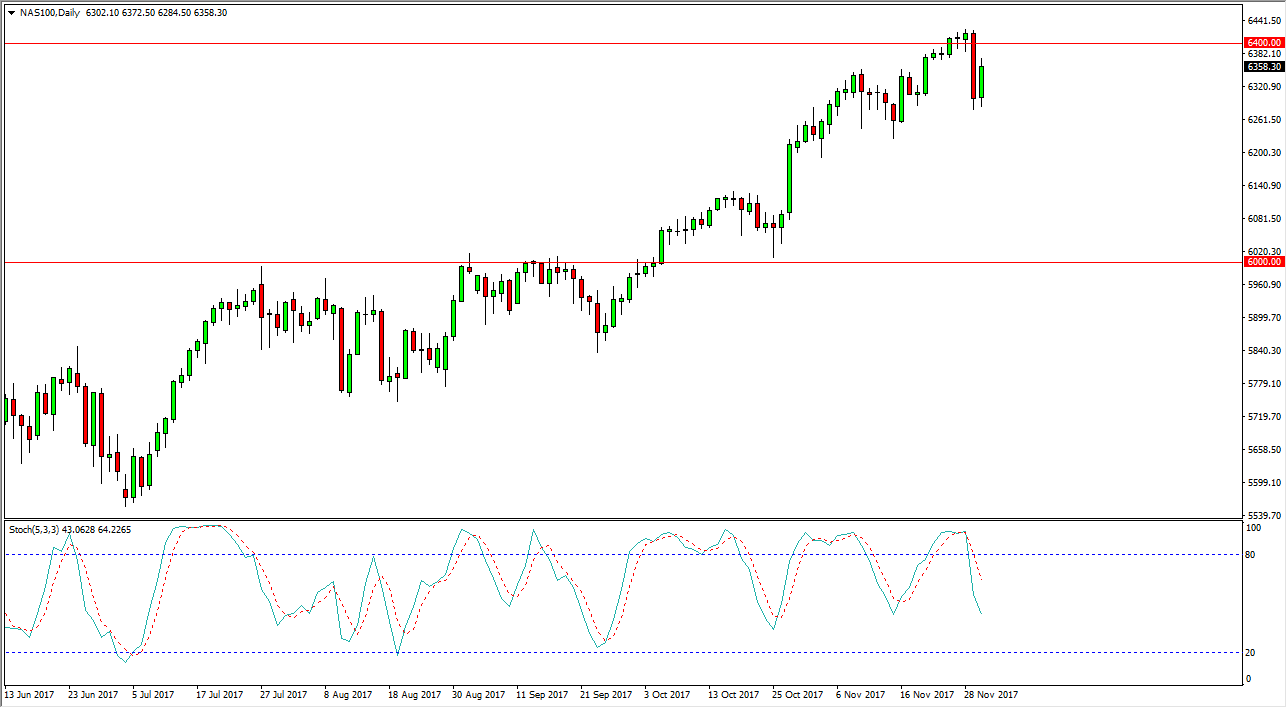

Nasdaq 100

The Nasdaq 100 rallied during the day on Thursday as well, getting back about half of the losses from the previous session. The 6400 level above should continue to be resistive, and it’s not until we break above to a fresh, new high that I would be willing to put money to work in this market to the upside. However, if we were to break down below the lows from the Wednesday session, I think that we could see a bit of a selloff, and perhaps a run down as low as the 6000 handle. The Nasdaq 100 does have a very nasty negative candle to overcome, so I think it’s likely we will see quite a bit of volatility in the short run, as the Nasdaq 100 seems to be a bit of a laggard when it comes to these 2 indices. The markets continue to be noisy, but being cautious is probably the best way to go more than anything else.

Leave A Comment