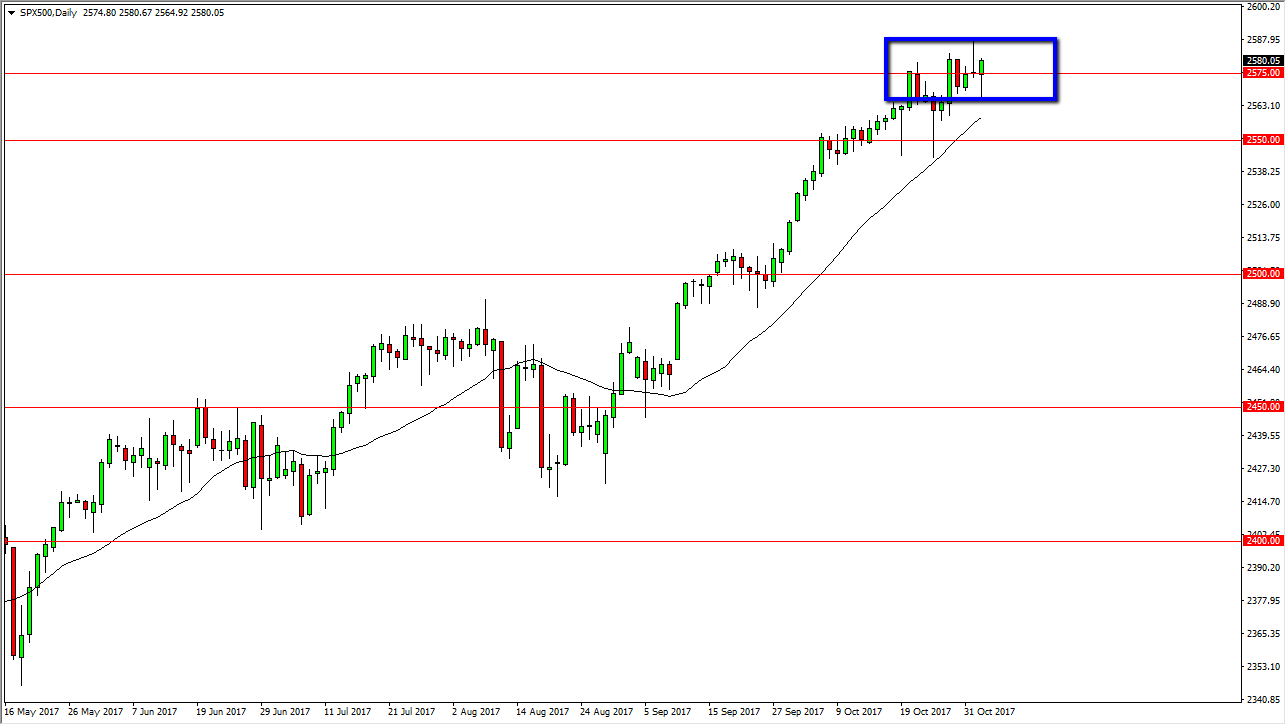

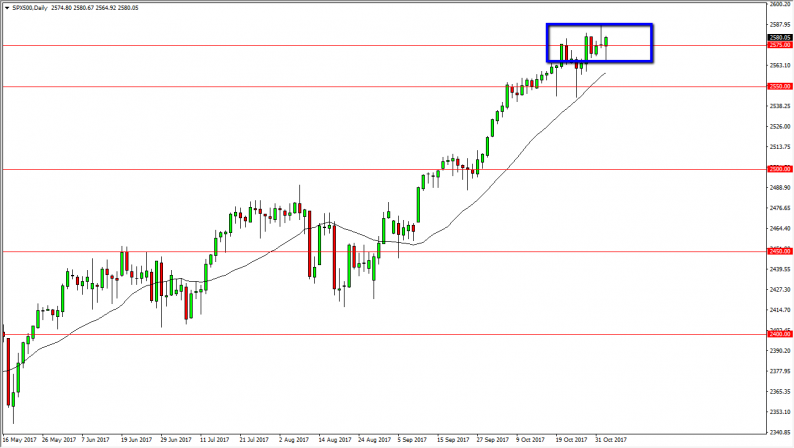

S&P 500

The S&P 500 fell initially during the trading session on Thursday, breaking down to the 2565 handle. At this point though, I think that we will probably see buyers return to the market, mainly because the jobs number should give us an opportunity to ride the volatility. We have been in an uptrend for some time, and breaking above the 2575 level suggests that we are going to go higher. We also have formed a hammer, and the market looks ready to go to the upside. The fact that we bounced the way we did towards the end of the day tells me that the market is very likely to continue to find buyers on the dips as we have seen algorithmic traders come in and lift this market.

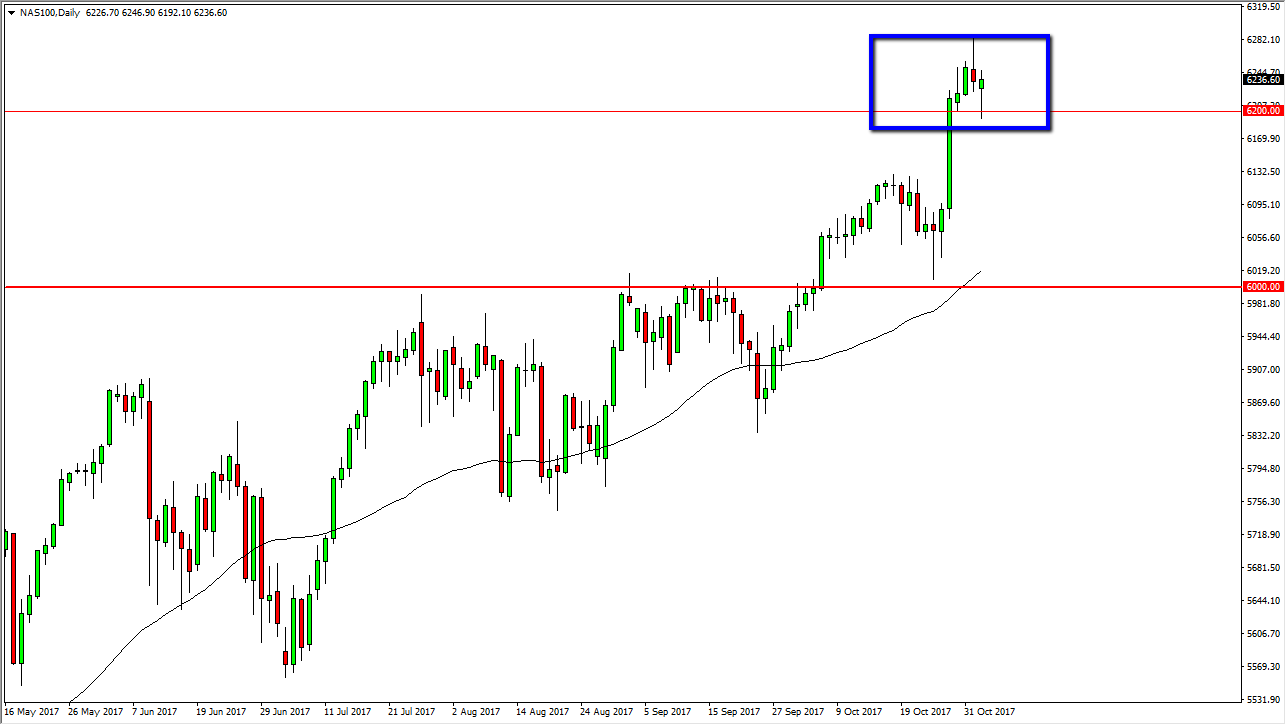

Nasdaq 100

The Nasdaq 100 fell initially during the day, testing the 6200 level for support. We turned around to form a hammer though, and that is a very bullish sign. We have a shooting star from the previous session, and it’s likely that we are going to continue to go back and forth in this area as we try to figure out what the next move is. The jobs number coming out today, of course, will have an influence on the markets, so looking to buy pullbacks if we get some type of move to the downside. I recognize that the market should eventually climb, and the 6000 level underneath will be the “floor” in the market as it was so resistive in the past, and now should be the bottom of the overall uptrend in a market that should continue to go higher over the longer term as it has in the past, and as US stock markets will in general.

Leave A Comment