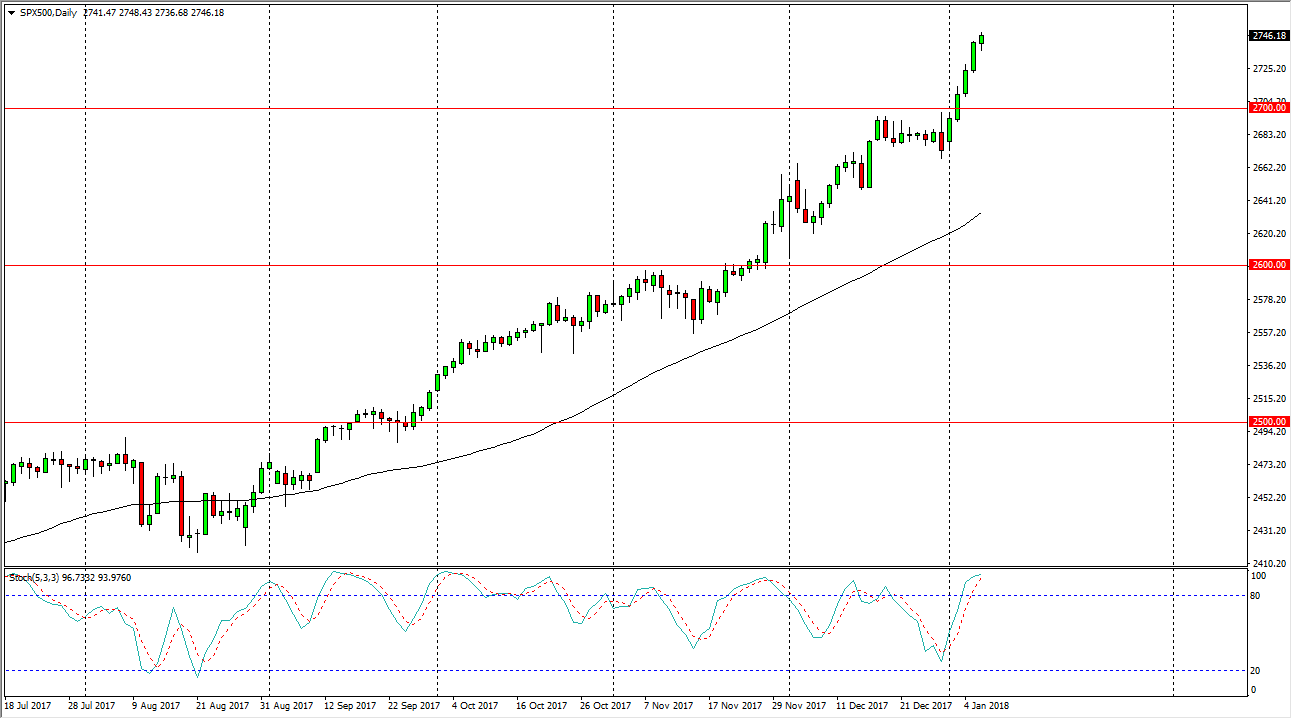

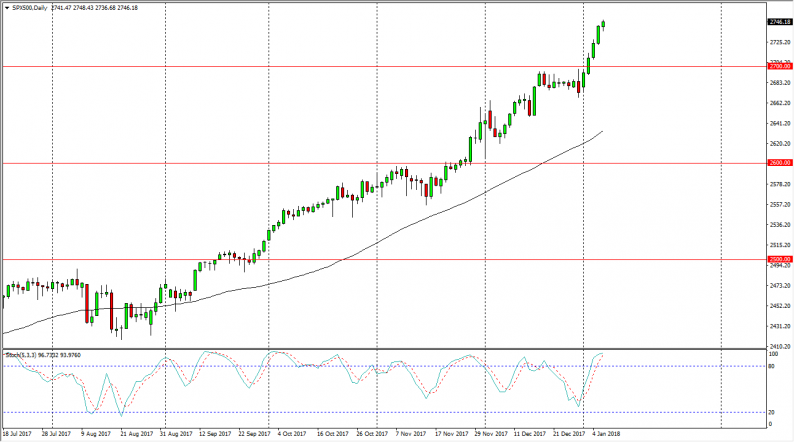

S&P 500

The S&P 500 initially dipped on Monday, but then turned around to reach towards the 2750 level. That’s an area that has been resistive in the past and has said that it’s likely that the market could pullback slightly as we are bit overbought, but I think a pullback from here is a nice buying opportunity. The stochastic oscillator is in the overbought area, and the moving averages are starting to cross. A pullback to the 2700 level would be excellent, as it is an area that has previously been resistive, and should now be supported. However, we may not get back down to that level, but either way, I look at pullbacks as potential opportunities to pick up value and take advantage of what has been a very strong uptrend.

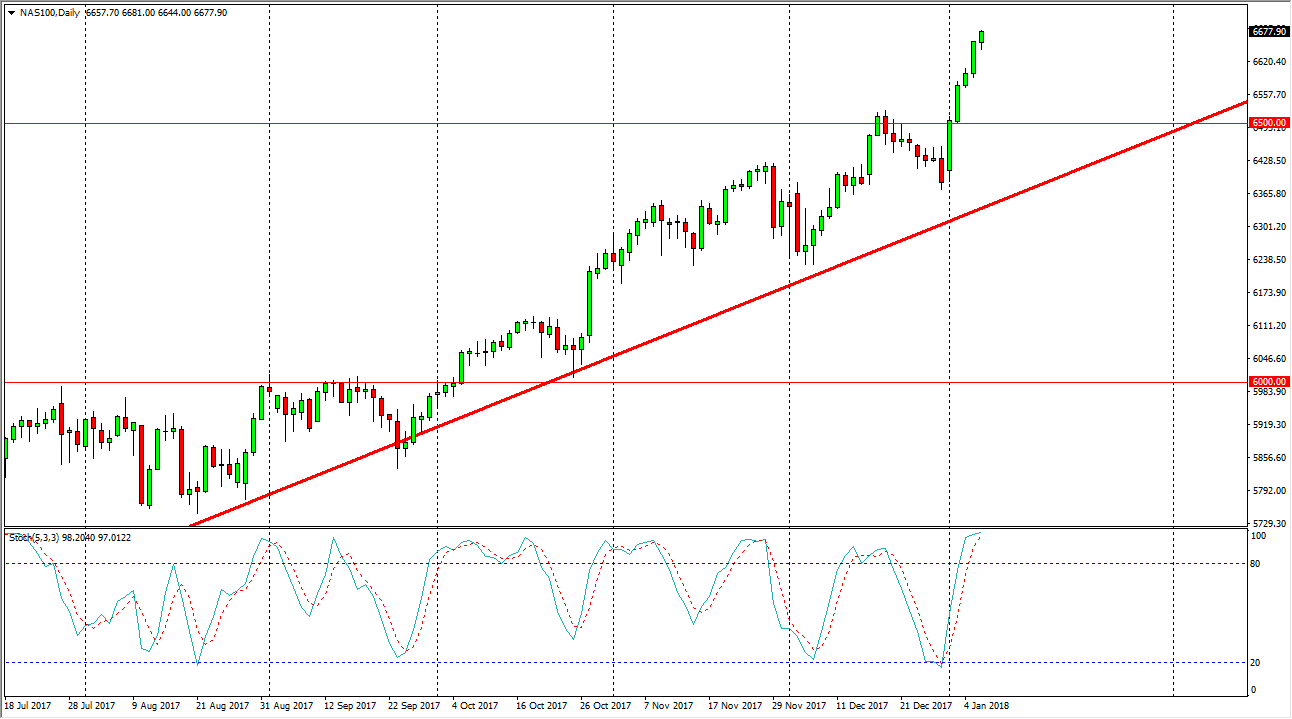

Nasdaq 100

The Nasdaq 100 initially dipped as well, but then rallied to reach the 6677 level. The market looks very bullish, but again, looks a little bit overextended so I think a pullback is likely to happen in the short term. The 6500-level underneath offers a massive amount of support, but I believe that we will probably even find buyers at the 6600-handle underneath as well. I think that the market continues to follow this attitude, as money managers have thrown fresh, new money into the marketplace at the beginning of the year. I believe that the market finds plenty of reasons to go higher over the longer term, not the least of which of course being the tax bill being passed recently, and of course just the overall momentum. With the US dollar looking a bit soft, that also helps with stock markets, so I believe that although we are bit overdone now, we do continue to go higher.

Leave A Comment