The S&P 500 has clawed its way back to even for the year, but investors should be cautious as the market still faces three major hurdles to overcome before an extended rally can occur.

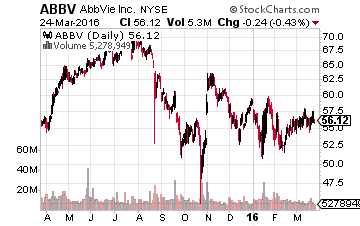

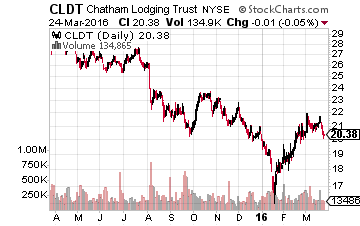

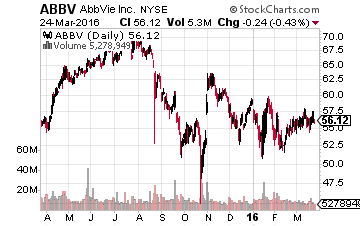

I started the New Year with a non-sanguine view of the market. With this outlook, my portfolio had a 30% allocation to cash to begin 2016. As stocks fell through most of the first month and a half of the year, I incrementally bought the dip. I added to my core stakes in cheap blue chip stocks with large dividend yields such as AbbVie (NYSE: ABBV) and Chatham Lodging Trust (NASDAQ: CLDT), an undervalued high-yield lodging REIT. By mid-February, my cash allocation was down to just over 10%.

That strategy paid dividends over the past month or so as the S&P 500 gained for five straight weeks before losing some ground last week. However, I have grown increasingly cautious as stocks have continued to claw their way back to even from deep early losses to start the year. My cash position is back to 15% and climbing as I have taken some profits. I sold out stakes in some stocks like Yahoo (NASDAQ: YHOO) that have had nice runs but now seem to have limited upside because they do not provide significant dividend payments.

Why have I turned cautious again? There are a number of reasons for my pessimism regarding if the market can continue climbing in any significant way. First, a couple of core pillars that have powered the rally seem to be fading away. One being oil recently hitting its highs for the year at just over $41 a barrel. However, crude pulled back from those levels because of the glut of oil in storage, anemic global growth, and no agreement from OPEC to cut production. Even at their highs of the year, oil prices are not sufficient to prevent myriad bankruptcies among small and even mid-tier shale producers. This will continue to be an overhang on the high-yield credit markets whose spike in volatility roiled equities at the beginning of the year.

Leave A Comment