In case you missed it, DM central banks are locked in a truly epic FX deathmatch.

Sluggish growth and trade and the attendant global deflationary supply glut have left the world stuck in a nauseating, perpetual hangover from the financial crisis. Subpar inflation and disappointing growth have become the norm in developed markets and that’s lured central bankers into a mad Keynesian dash for the bottom.

The Fed got a head start on the race in 2008 and so naturally, the FOMC is set to try and normalize first. Unfortunately, dollar strength plays havoc with an EM complex that’s already coping with collapsing demand from China, a cloudy outlook for commodity currencies, and a laundry list of idiosyncratic domestic issues (see Turkey and Brazil for instance).

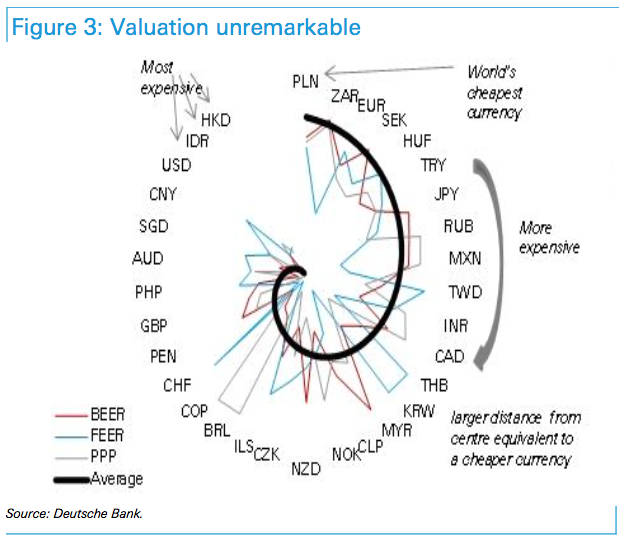

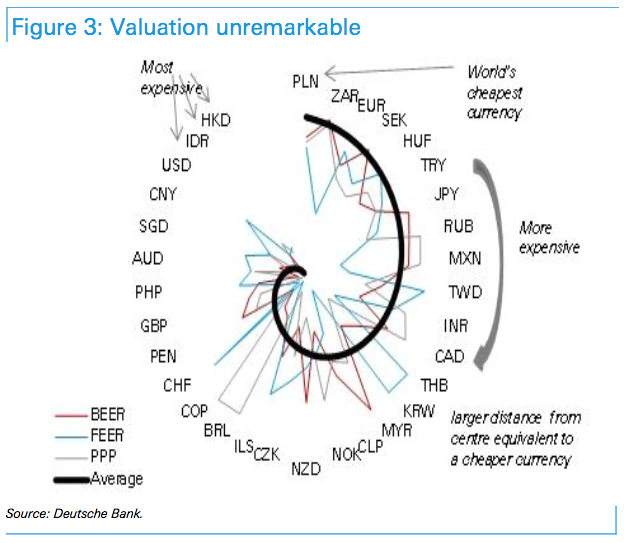

And so, in this increasingly confusing environment wherein one round of DM easing begets another and wherein strange dynamics persist such as the perverse trading pattern of the BRL- which rallies every time the government looks set to collapse entirely only to be reined in by central bank sales of reverse FX swaps so excessive currency strength doesn’t keep the CA from adjusting – we present the following swirlogram from Deutsche Bank whose analysts have taken the average of several models to determine where the world’s currencies stand on the spectrum from overvalued to undervalued.

Leave A Comment