Salesforce.com (CRM) is the biggest name set to report earnings after the close today.

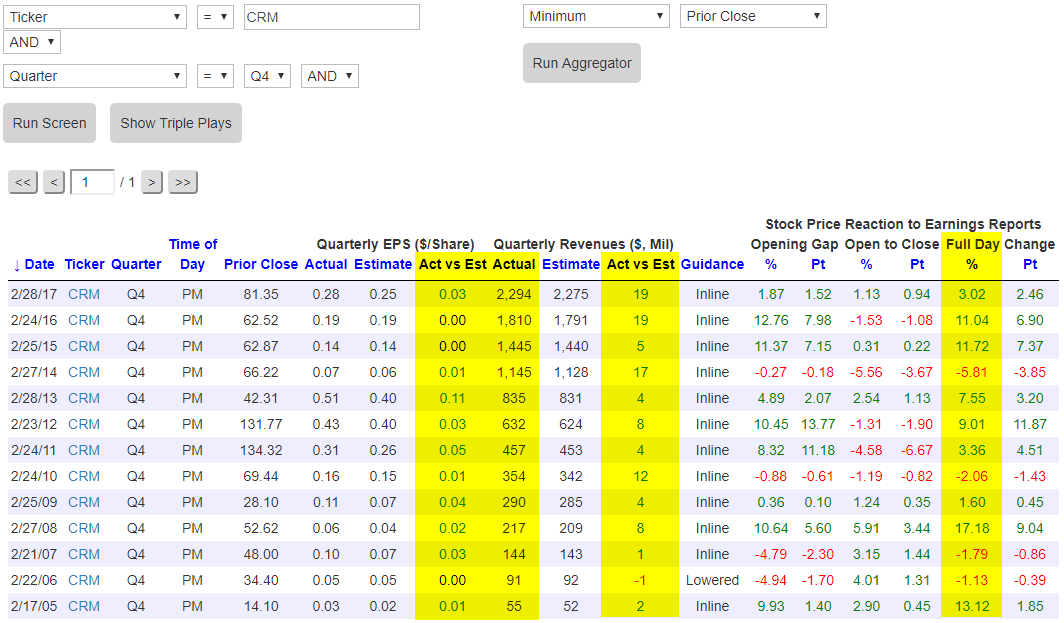

Below is a snapshot of the results that are displayed after running this earnings screen. We’ve highlighted a few columns worth pointing out.

First off, CRM has never reported weaker than expected EPS on one of its Q4 earnings releases. (In fact, it has never reported weaker than expected EPS on any of its quarterly releases!) The company has, however, posted in-line numbers quite a bit.In both 2015 and 2016, CRM’s Q4 earnings per share were right in-line with consensus estimates.

Looking at the top line, note that CRM has grown Q4 revenues on a year-over-year basis every year going back to 2005. And the company has beaten revenue estimates on its Q4 report 12 out of 13 times, with the only revenue miss coming in 2006.

Finally, salesforce’s stock price has historically done very well in reaction to its Q4 earnings report. As shown in the “Full Day % Change” column, CRM has gained on its earnings reaction day (the first trading day following its report) on 9 of its 13 Q4 reports for an average one-day change of 5.14%. Last February the stock gained 3% in reaction to its Q4 earnings report, and in 2015 and 2016, the stock gained more than 11% each time. The last time the stock fell in reaction to its Q4 report was 2014 when it dropped 5.81% on the day.

Of course, just because a stock has done something in the past doesn’t mean it will do it again in the future. It is, however, very helpful to know these types of earnings-related trends for individual stocks. While history doesn’t exactly repeat itself, it very often rhymes!

Leave A Comment