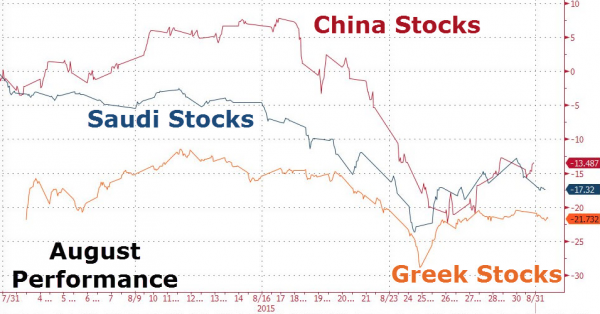

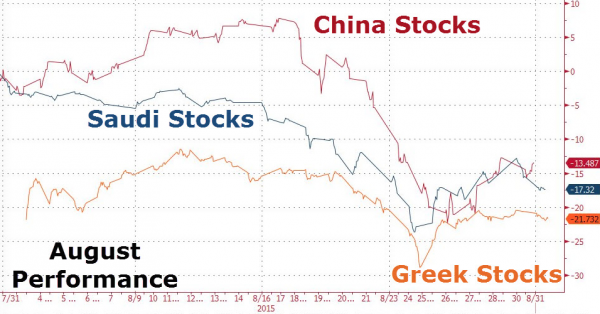

If someone asked you what the worst performing stock market in the world was in August, you might well be tempted to say the SHCOMP or the ASE, considering the fanfare around China’s equity turmoil and the fact that Greek stocks plunged after coming off a five-week halt.

But what you might be surprised to learn is that in fact, Saudi stocks fared worse than Chinese equities for the month and one more Sunday like 8/23 could well have brought the total slide to more than 20%, just a shade better than Greek shares.

Of course the comparison is distorted by the fact that the ASE was halted until August 3 and also by the fact that were it not for the efforts of China’s plunge protection “national team” there’s no telling where the SHCOMP might be today, but nevertheless, it serves to underscore how nervous investors are getting about what is an increasingly perilous financial situation in the kingdom.

As detailed here on a number of occasions of late, the country is staring down a current account/ fiscal account deficit outcome that makes Brazil look favorable by comparison, and although FX reserve draw down slowed in July, it came at the cost of reentering the bond market – i.e. raising debt to offset the petrodollar burn.

“A cloudy fiscal policy along with unattractive economic data and oil prices continuing to decline fueled negative sentiment about the market which exaggerated fears among investors,” Mohammed Al-Suwayed, Riyadh-based head of capital and money markets at Adeem Capital told Bloomberg. “There hasn’t been any official statement from King Salman on his fiscal policy or its direction, but all indications point toward a possible contractionary fiscal policy.”

“Indications” like the fact that Saudi Arabia is conferring with advisers on how to rein in spending without triggering social unrest.

Meanwhile, intervention in Yemen – which recently escalated meaningfully – doesn’t come cheap and indeed, Saudi airstrikes on supposed Houthi targets have at times served to do reputational damage, something which also does nothing to shore up investor confidence. Case in point, from Reuters on Sunday:

Leave A Comment