Zero Indicators In A Recession

With the Atlanta Fed GDP Now forecasting 2.7% GDP growth in Q4 and the blue chip signaling a similar result, it’s not surprising to see the chart below show that 0% of indicators are in a recession. The net percentage of indicators which are accelerating has improved after a modest downturn in the middle of last year. The fact that the black line went down in 2017 even though it was a great year, shows how high its beta is. Since the presidential election, the indicators in recession went from about 70% to zero and have stayed there. Don’t get too complacent. The next time the economy flirts with danger, I expect it to fall into a recession. The higher the inflation gets this year, the more likely the next downturn will be worse than the previous ones within this cycle. As of January 5th, the 10 year breakeven inflation rate was 2.01%, so there’s still room for inflation to increase without a problem.

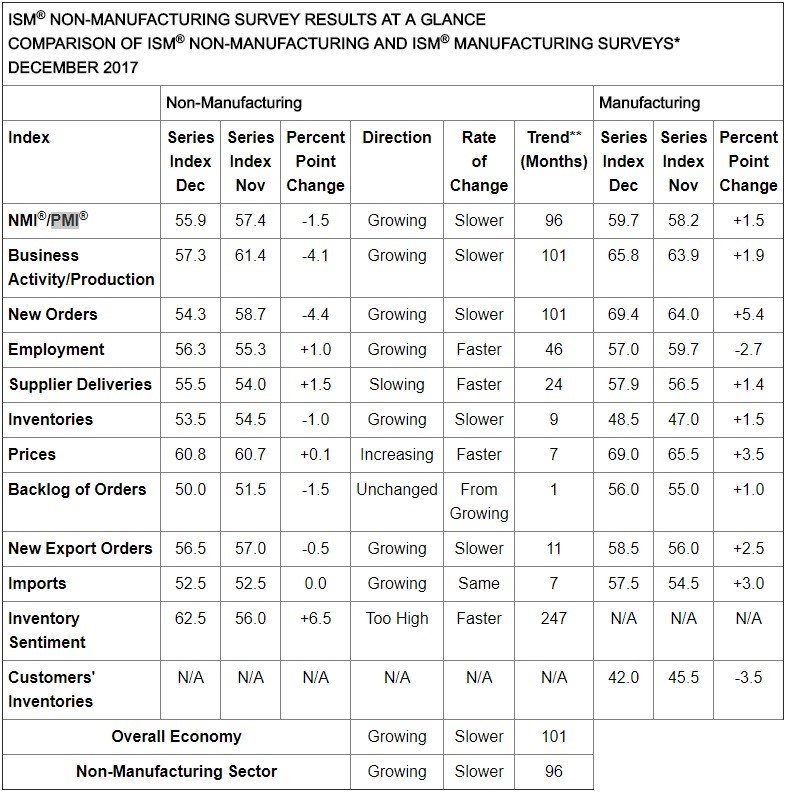

Non-Manufacturing ISM Shows Another Good Result

Last week the non-manufacturing ISM report signaled the economy had a good December just like the manufacturing ISM showed. The PMI was 55.9 which was 1.5 points below the report in November. This was slightly below the 12 month average of 57. It represents 2 straight months of weakening. This report is consistent with 2.7% annualized real GDP growth which is exactly in tune with expectations. As I stated at the beginning of the year, the actual results are coming in line with expectations. The business activity index fell from 61.4 to 57.3. As you can see from the chart below, most of the indicators showed growth slowing. Price were up 0.1 to 60.8 signaling a slight pickup in inflation.

Make no mistake about it, this was a solid report. A finance and insurance company said: “Ending the year with profits and business levels on track. 2018 is projected to be as productive with an optimistic outlook.” Financial stocks reflect this positivity as the XLF financial sector ETF is up 9.12% since November 27th. An ‘other services’ company said: “We are seeing a resurgence in the business activity of our oil and gas customers, in a positive direction that is impacting our sales.” It’s not surprising to see oil services doing well since American production is about to hit a cycle high this year. Production in 2018 is expected to be over 10 million barrels per day. Finally, an accommodation and food services company said the following: “Many suppliers are proposing price increases, but few are being implemented. Increases in volume and efficiencies seem to be outperforming commodity pricing.” This shows price increases are going to come online shortly. We’ve seen grocery price inflation recently start to pick up. The CRB commodities ETF is up slightly this year from $193.86 to $194.16.

Leave A Comment