Image Source: Pixabay

Image Source: Pixabay

It’s the time of year when I take a hard look at my portfolio.Which stocks do I keep? Which do I sell?Based on my analysis, one thing is clear:One set of stocks has got to go.

Sell Your Stocks in This Sector NOWAs the banking sector was melting down earlier this year, I told you to go long and strong.If you followed my advice, you’re a happy camper today — and you’re sitting on some impressive gains.For example:

But that was six months ago. Today, it’s time to shift gears…Because if there’s one sector that’s flashing the “get out now” sign, it’s banking.Let me explain…

A Look at the Hiring DataWhenever I need to determine if I’m bullish or bearish on a sector, my first step is to analyze the hiring data.Here’s hiring for a handful of banking companies, starting with JPMorgan Chase (JPM): And for Citibank (C):

And for Citibank (C): Notice anything? Meanwhile, here’s hiring for regional banks like Fifth Third Bancorp (FITB):

Notice anything? Meanwhile, here’s hiring for regional banks like Fifth Third Bancorp (FITB): And hiring for Citizens Financial Group (C):

And hiring for Citizens Financial Group (C): It should be obvious by now. Hiring in banking across the board is down, down, down.What’s going on here?

It should be obvious by now. Hiring in banking across the board is down, down, down.What’s going on here?

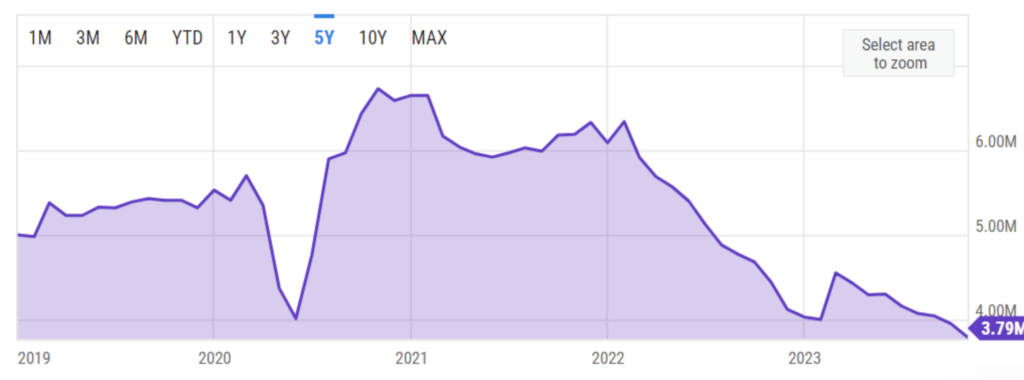

Banking Goes BustKeep in mind that every sector has its boom cycles and bust cycles. And during Covid, banks were boomin’.Trillions of dollars were being pumped into the economy. Interest rates were near zero. Mergers and Acquisitions were humming. And banks thrived in this environment.During this time, they also reaped the benefits of a bustling housing market. After all, interest rates were minuscule. So buyers scooped up houses at a record pace. Take a look: In 2021, more than six million homes were sold in the U.S. And banks raked in profits facilitating all these mortgages.But look at the right side of this chart. As we close out 2023, the housing market is anemic.Interest rates are high, buyers are priced out, and sellers are unwilling to move. That’s led to a 42% drop in housing transactional activity in just two years. And without these mortgages, banks have gone from boom to bust.But is there hope on the horizon?

In 2021, more than six million homes were sold in the U.S. And banks raked in profits facilitating all these mortgages.But look at the right side of this chart. As we close out 2023, the housing market is anemic.Interest rates are high, buyers are priced out, and sellers are unwilling to move. That’s led to a 42% drop in housing transactional activity in just two years. And without these mortgages, banks have gone from boom to bust.But is there hope on the horizon?

Don’t Hold Your BreathShort answer? Nope — at least not anytime soon.Yes, interest rates may start to drop in 2024. But any rate cuts will take time to ripple throughout the economy and into the housing and banking sectors. Translation? Pain for the banking sector is still on the menu for much of next year.Based on the data, banks are downsizing and preparing for a lean 2024. And that’ll inevitably send the stock prices of many of these companies crashing.My message to you? Get rid of your banking stocks now. But don’t despair. If you’re a Pro reader, the banking-related move I suggest you make today will help you lock in returns of around 30%.We’re in it to win it. Zatlin out.More By This Author:China Is Coming After U.S. Companies – Is Your Portfolio Exposed?

Is The US Economy Slowing Down?

Are We Just In A Dead Cat Bounce? Or Are We Headed For New Highs?

Leave A Comment