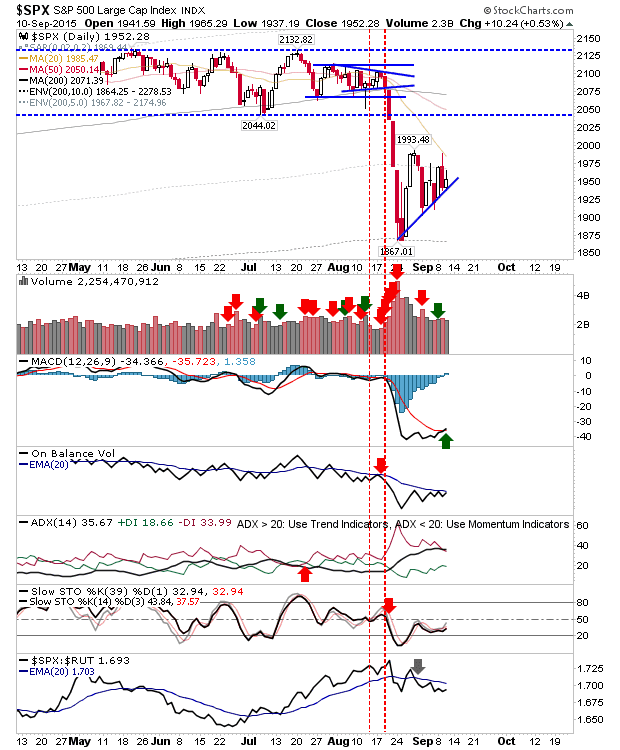

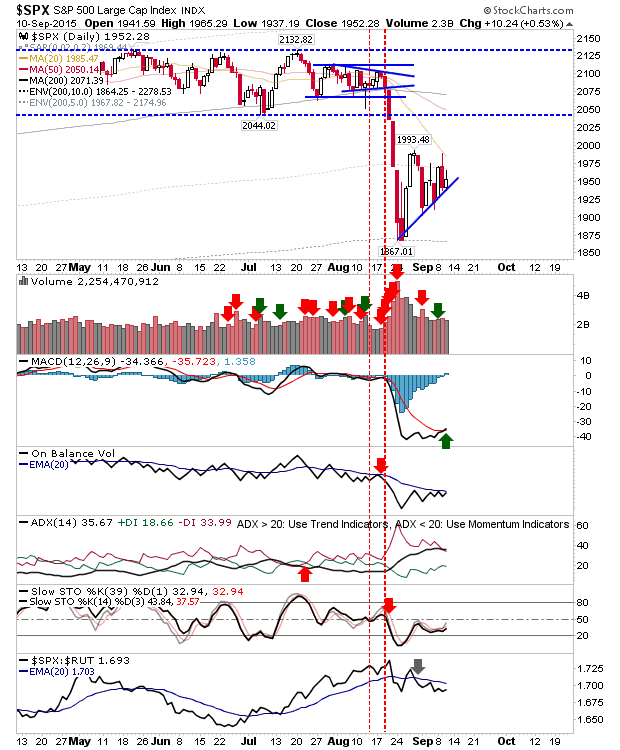

Bulls managed to reclaim most of yesterday’s ‘real body’ losses, but by the close of business had given back half of those gains. Creeping higher highs across indices will be under threat tomorrow, and if they break, then things are likely to get ugly quickly.

The S&P finished with a MACD trigger ‘buy’ as it closed on rising support. A loss of this opens up a retest of 1,867, and maybe a measured move lower (which is 1,760). Bulls will be looking for a fresh challenge of today’s losses and a ‘buy’ in On-Balance-Volume.

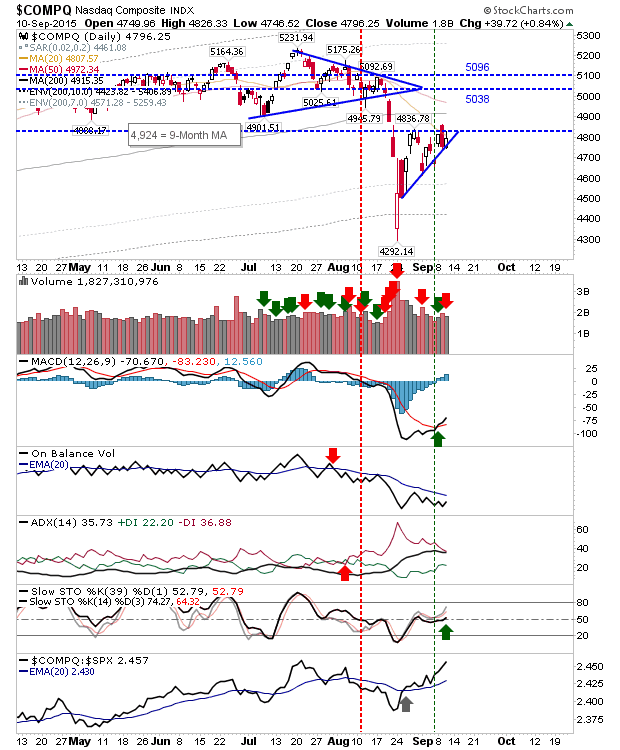

The Nasdaq continues its relative advance against the indices. Technicals are working off an earlier MACD trigger ‘buy’ and a ‘buy’ in Slow Stochastics. The index is nearest resistance, and one which open up for a burst to 5,038. Bulls may get their best chance here.

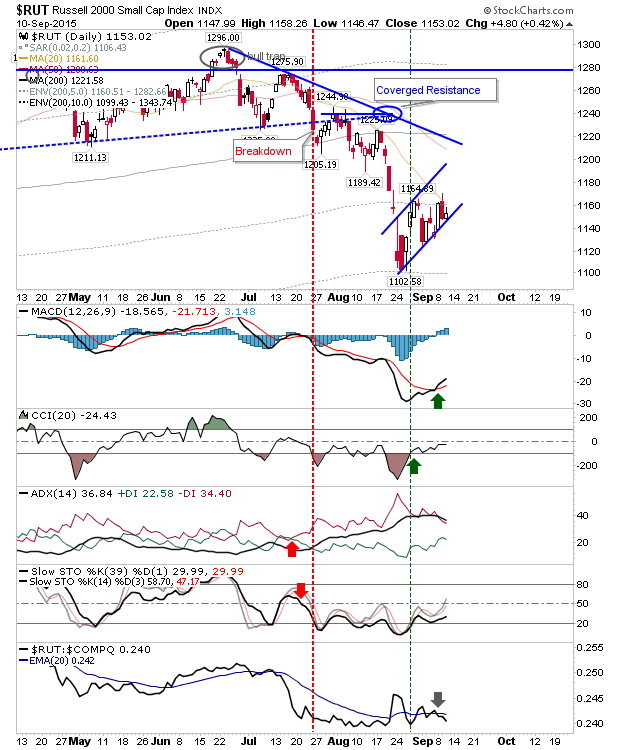

It was a similar story for the Russell 2000, although it’s playing to a ‘bear flag’. The damage to this index has greater relevance than for the S&P and Nasdaq, given the importance of speculative issues in driving bull rallies. Should the ‘bear flag’ break down it will set up for another round of selling in the key indices.

Tomorrow is nicely set for both sides. Shorts will be looking at the risk:reward of a nearby break of support. However, longs have the lowest risk:reward option with a stop just below rising support. With the upper wicks of today’s and yesterday’s candles suggesting supply, the likelihood of a downward move is probably a little greater.

Leave A Comment