Tax Bill Timeline

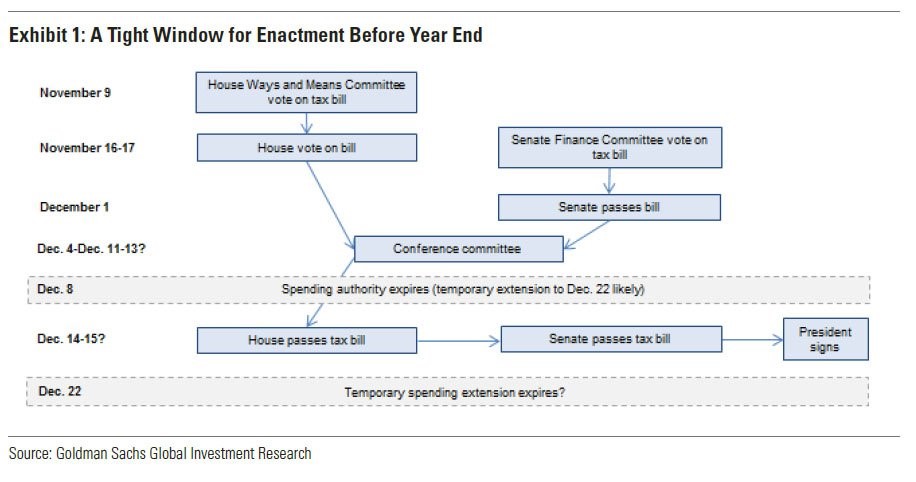

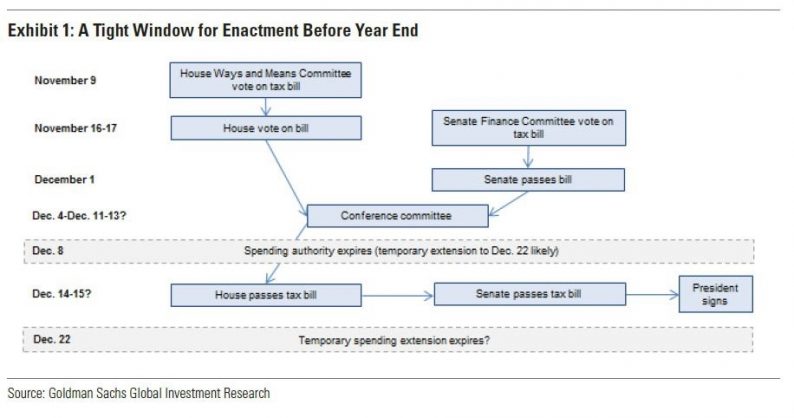

Monday’s market trading was affected by the changes in tax policy, once again, with the Dow underperforming the Nasdaq. Let’s first look at the timeline of the legislative process. The bill has gotten through the critical steps of passing the House and the Senate, but since both bodies passed different bills, there needs to be a reconciliation. As you can see from the timetable below, the bill is expected to be in the conference committee for the next 2 weeks. The conference committee reconciles the differences between the two plans.

Differences Between The House & Senate Plan

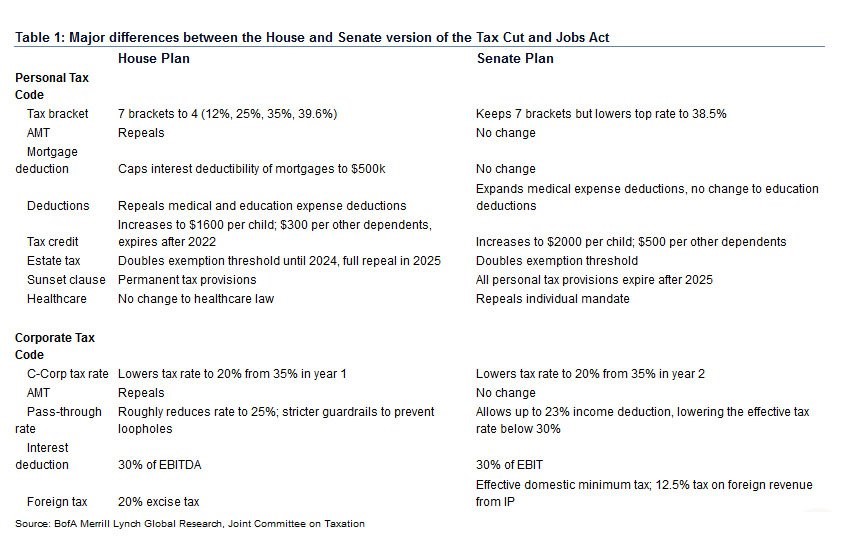

The first difference is the Senate plan has the alternative minimum tax for corporations, but the House version repeals it. The second difference is the House plan has 4 tax brackets, with the top rate at 39.6%, while the Senate has 7 brackets, which is how many there are now, with the top tax rate at 38.5%. The third difference is the Senate plan keeps the mortgage interest deduction cap at $1 million, while the House version caps the deduction at only $10,000. The final major difference is the House plan doubles the estate tax exemption and eliminates it in 10 years, while the Senate plan doubles it, but leaves it in place.

The image below lists all the differences between the plans, some of which I didn’t mention. As you can see, the Senate plan is closer to what we have now, while the House plan is closer to what the President wants. The Senate only passed its plan with 51 votes. Given the fact that the House plan adds more to the deficit, I doubt Corker will come back on board when the reconciliation plan is voted on. Any of these differences can cause one or two Senates to balk at the plan. This means the Senate has more leverage. Therefore, I think the final version will look more like the Senate plan than the House version.

The Odds Of It Passing

I think the plan will be worked out, but it’s far from a foregone conclusion. The PredictIt website has the odds of an individual tax cut by the end of the year at 66%, the odds of a corporate tax cut at 83%, and the odds of the individual mandate being repealed at 76%. The stock market has been pricing in the tax plan for the past few trading sessions. The stock market always tries to calculate the odds of an event happening before it does. This means by the time the plan is signed by the President in 2.5 weeks, it will be about 95% priced in to the market. The only parts that might not be priced in are the last-minute changes. You’re more likely to get lucky by profiting off the current headlines during this time of year because trading is light right before Christmas.

Leave A Comment