After opening the trading day in green, share markets in India continue to trade firm in the morning trade amid firm Asian markets. Barring realty sector and metal sector, sectoral indices are trading on a positive note, with stocks in the energy sector and stocks in the capital goods sector witnessing maximum buying interest.

The BSE Sensex is up by 202 points and the NSE Nifty is trading up by 50 points. Meanwhile, the BSE Mid Cap index is trading up by 0.6%, while the BSE Small Cap index is trading up by 0.5%. The rupee is trading at 65.37 to the US$.

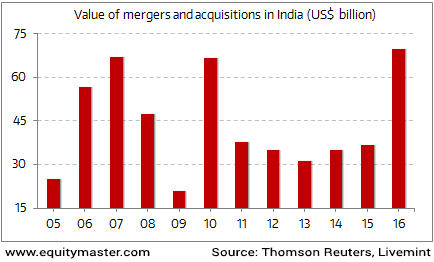

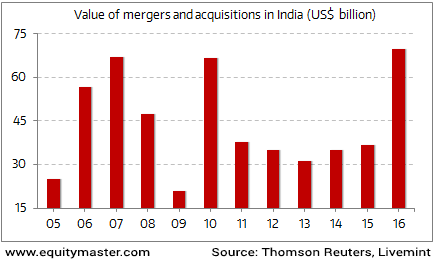

As per an article in The Hindu Business Line, India mergers and acquisitions (M&A) are expected to touch US$46.5 billon with 944 deals in 2017 boosted by Rosneft’s US$13-billion takeover of Essar Oil. This is a 165% rise in value and a 70% jump in volume from 2016.

India recorded 553 deals worth US$17.5 billion last year. M&A activity is expected to continue to gather pace on the back of the Modi government’s continued efforts in removing regulatory hurdles and simplifying laws to further attract foreign investment, until it reaches its cyclical peak of US$52.8 billion in 2019.

Indian M&A activity at an All Time High in 2016

Also, as per the reports Indian Initial Public Offering (IPO) is set to reach the record-breaking value of US$6.8 billion this year. Finance Minister Arun Jaitley plans to raise Rs 725 billion from disinvestment in 2017 and 2018, including Rs 150 billion from strategic asset sales, to help sustain this IPO momentum.

The Indian IPO market continues to flourish as institutional and retail investors look for productive avenues to invest in, in a market with a shrinking interest rate, low bond yields, capped gold investments and real estate investments under scrutiny.

The market euphoria is something similar to what was seen in 2007-08. When everyone around you is clamoring to get a piece of the IPO pie, it makes sitting tight difficult. And, why should you sit tight when stocks like Avenue Supermart lets you pocket a cool 100% gain from day 1 of the listing?

Leave A Comment