Indian share markets began the trading week on a weak note amid mixed global markets. At the closing bell, the BSE Sensex stood lower by 231 points (down 0.9%), while the NSE Nifty finished down by 91 points (down 1.1%). Meanwhile, the S&P BSE Mid Cap & the S&P BSE Small Cap finished down by 1.1% and 0.7% respectively. Losses were largely seen in auto sector and banking sector.

Asian markets finished in the red as of the most recent closing prices. The Hang Seng and the Shanghai Composite were down by 1.4% and 2.5%, respectively. European markets edged lower in early trade with the CAC 40 down by 0.11%, Germany’s DAXis off 0.35% and London’s FTSE 100 is lower by 0.16%.

The rupee was trading at 67.46 against the US$ in the afternoon session.

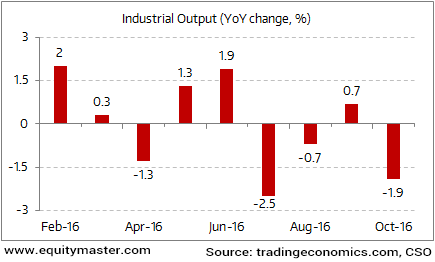

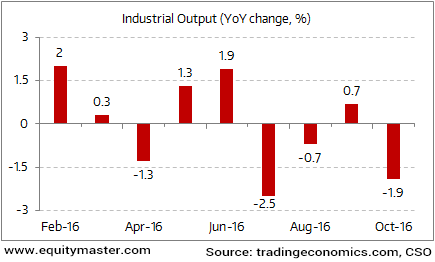

The index of industrial production (IIP) slipped 1.9% in October. This was recorded as against a 0.7% rise in September and up 9.9% YoY in the same month last year. The historical trend can be seen in the chart below:

Factory Output Deteriorates, More Pain Ahead

As Richa wrote in a recent edition of The 5 Minute WrapUp…

The slowdown in business activity would also have an adverse impact on the India’s job market as well. As Tanushree wrote an interesting follow up on the destruction of jobs due to demonetisation:

Leave A Comment