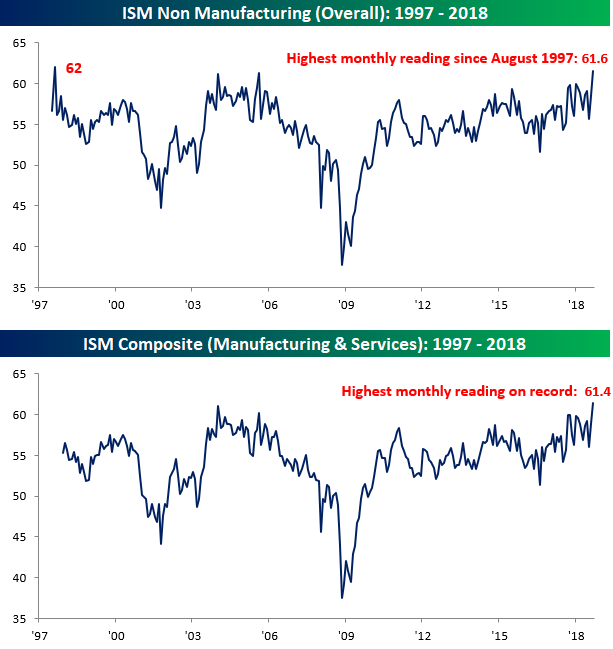

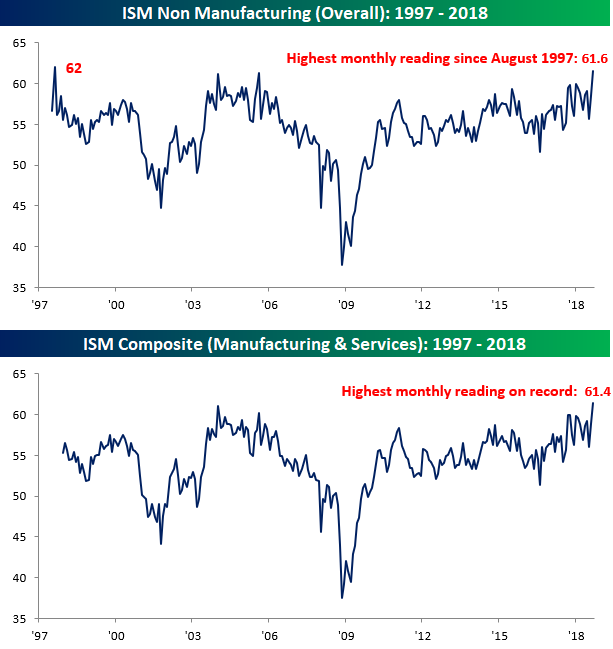

Within the commentary section of the September ISM Non-Manufacturing report today, one of the respondents noted that “Every day is a bit better than the last”. Looking at the details of this month’s report, that person’s comment may actually be an understatement. At the headline level, the September ISM Non-Manufacturing report came in at a level of 61.6 versus estimates of 58.0. That 61.6 reading is the second highest reading in the history of the series dating back to 1997 and the strongest report relative to expectations since last October. As the top chart below also illustrates, the headline index has also surged in the last two months rising from 55.7 up to 61.6. That 5.9 point increase is the largest two-month increase in the history of the index. The only other times where the headline index has increased more than five points over a two month period were in January 2009 and last September. A little ‘bit’ better? Looks more like a lot.

Taking today’s reading and combining it with Monday’s ISM report on the manufacturing sector and weighting each sector accordingly, the combined composite ISM for September came in at a record 61.6 versus August’s reading of 58.5.

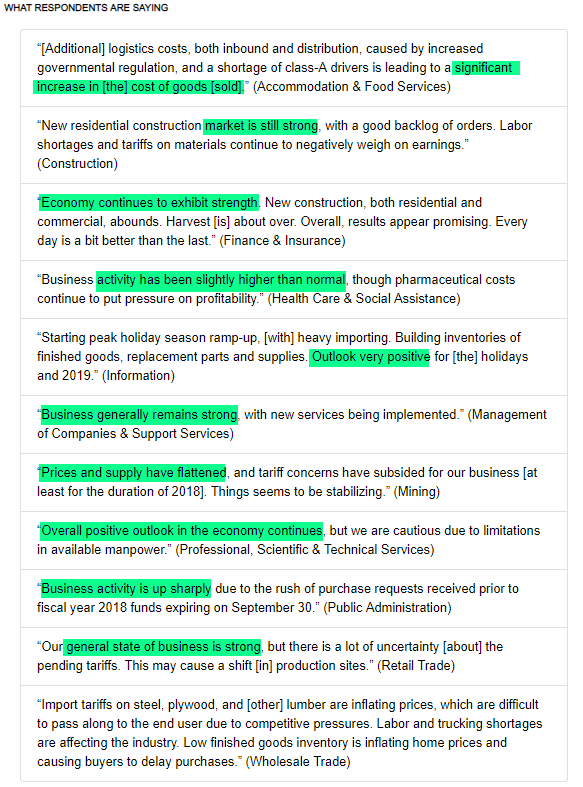

Looking at the commentary section of this month’s report shows a good deal of positive sentiment. In addition to the over-riding optimism, there was also mention of pricing pressures, worker shortages, and tariffs, although the discussion of tariffs was not nearly as widespread as it was in the Manufacturing report.

Looking at the internals of this month’s report, the m/m numbers were really strong as not a single sub-index was down versus August. Going all the way back to 1997, there has never been another month where not a single sub-index declined on an m/m basis. The biggest gainers were Employment (chart below), which surged to a record high, and Business Activity, which hit its highest level since January 2004. With the Employment component at record highs and today’s ADP Private Payrolls report coming in handily above forecasts, it’s hard to imagine a weak Non-Farm Payrolls report on Friday. On a y/y trends were also strong with just three components falling y/y.

Leave A Comment