Sherwin-Williams (SHW) is one of 51 dividend aristocrats and has annually increased dividends each year since 1979 while outperforming the market by more than 9% per year over the last decade.

While watching paint dry has been anything but boring with coatings producer Sherwin-Williams, past performance is not necessarily indicative of future results.

Let’s take a closer look at Sherwin-Williams to learn more about its long-term competitive advantages, assess the potential of its large acquisition of Valspar, and see if the stock’s valuation could be attractive today for dividend growth investors.

Business Overview

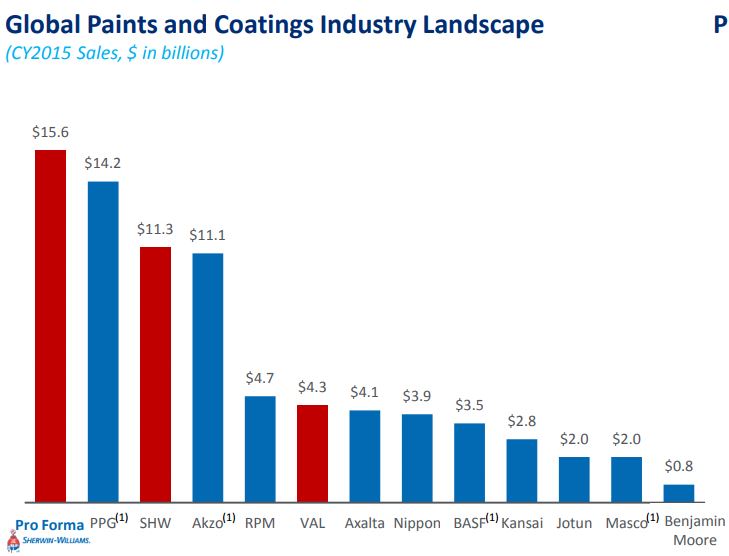

Sherwin-Williams has been in business since 1866 and is the largest producer of paints and coatings in the U.S. and third-largest worldwide.

The company primarily serves the needs of architectural and industrial painting contractors and do-it-yourself homeowners through a network of more than 4,200 company-operated retail stores, but it also sells some industrial coatings, automotive finishes, and protective and marine coatings.

Segments

Sherwin-Williams previously operated in four segments: Paint Stores Group, Consumer Group, Global Finishes Group and Latin America Coatings Group.

Post the completion of its acquisition of Valspar in June 2017, Sherwin-Williams has reorganized its reportable segments as follows:

Americas Group (65% of Q2 17 sales) which comprises of the erstwhile Paint stores and Latin America groups.

Performance Coatings Group (15% of sales) which comprises of Valspar Coatings, Valspar Automotives and the erstwhile Global Finishes group.

Consumer Brands Group (20% of sales) which comprises of Valspar Paint and Sherwin-William’s erstwhile Consumer group.

Following its acquisition of Valspar, Sherwin-Williams derives close to 75% of its revenue from the U.S.

Business Analysis

Sherwin-Williams’ biggest competitive advantage is arguably its controlled distribution model. The company operates over 4,200 retail stores, about as many as Home Depot and Lowe’s combinedand four times as many as PPG (see our analysis of PPG here.)

Controlled distribution accounts for the majority of Sherwin-Williams’ total sales and provides the company with greater control over its brand image, in-store product experience, pricing, customer relationships, and inventory.

The majority of Sherwin-Williams’ customers are contractors, and many of them prefer to deal with dedicated paint specialists rather than working with big box stores like Home Depot.

Sherwin-Williams can offer the best range and quality of paints, and its higher quality paints are more valued by contractors, which tend to be less price sensitive than consumers.

Contractors know that Sherwin-Williams’ paints can help them complete jobs faster because of their higher quality (e.g. faster dry time, fewer coats required, etc.), which means more money in their pockets.

Sherwin-Williams is also likely to have a convenient location for contractors almost anywhere around the country – more than 90% of the U.S. population lives within a 50-mile radius of a Sherwin-Williams store.

As contractors continue taking market share from do-it-yourself consumers, Sherwin-Williams’ business should continue to benefit.

However, that didn’t stop Sherwin-Williams from acquiring Valspar, a paint manufacturer primarily for do-it-yourselfers, for approximately $11 billion.

The merger between Sherwin-Williams and Valspar combines the third and fourth largest players in the industry and creates a company with more than $15 billion in sales that can better compete with PPG.

Source: Sherwin-Williams Investor Presentation

Valspar brings the number two do-it-yourself paint brand in the U.S., strong market share positions in packaging and coil segments, over 10,000 distribution points, and numerous new technologies.

The deal also gives Sherwin-Williams more exposure in international markets, which accounted for 50% of Valspar’s revenue, and can help the company sell more product through big-box retailers such as Lowe’s, Home Depot, and Ace, where Valspar already has a large presence.

The combination is expected to result in $320 million of estimated annual synergies within three years, largely from cutting overlapping expenses.

The above synergies have a good chance to materialize as the company has a sound track record of successfully integrating more than 20 acquisitions over the last decade, although Sherwin-Williams had to cut its guidance earlier this year as acquisition integration costs were running significantly ahead of expectations.

Leave A Comment