We all know the rapid rise in U.S. yields was the proximate cause for the selloff that, as some people seem to have understandably forgotten given the gravity of what happened on Monday, actually started last week, when equities finally had all they could take of the bond selloff and fell in sympathy.

On Wednesday, the bond jitters were back after a lackluster 10Y auction came hot on the heels of a spending bill that looks like it will further increase the deficit and raise Treasury supply. So, yields rose and stocks once again wavered as fears of the bond selloff resurfaced and everyone suddenly remembered that this wasn’t all about XIV.

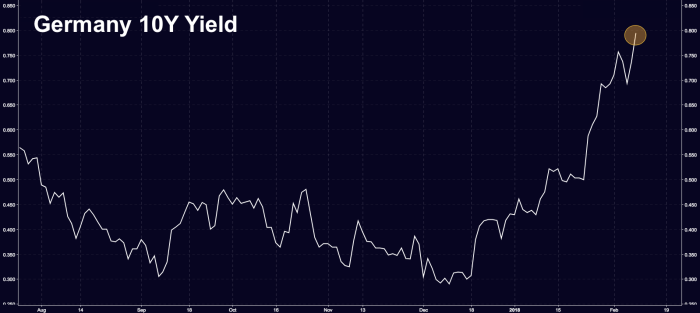

Well as you ponder this, don’t forget that the selloff in bunds has been pretty damn dramatic too as investors ponder what the beginning of the end of ECB QE will mean amid increasingly upbeat econ data that will likely force Draghi and the doves to make concessions to the hawks although thanks to Steve Mnuchin’s efforts to jawbone the dollar lower, it looks like assuming APP will end completely come September might not be a safe bet.

In any event, here’s what 10Y yields in Germany have done over the past several months:

Again, that’s pretty dramatic and it raises questions not only about the extent to which Europe will contribute to the bearish global rates shock but also about what the spillover might look like for other assets across the pond.

This discussion is particularly interesting because as with most other dynamics in the post-crisis world, traditional relationships might not necessarily apply thanks to QE distortions.

“Bund yields had at some pointed moved 45bp from the local lows; the largest standard deviation move since 1999,” BofAML writes, in a new note out Thursday, before asking the following rhetorical question:

Who would have imagined that when 10yr bund yields reach the highest level in 2.5 years, credit spreads would have been setting new 11-year record tights, totally defying the moves in the rates market?

Leave A Comment