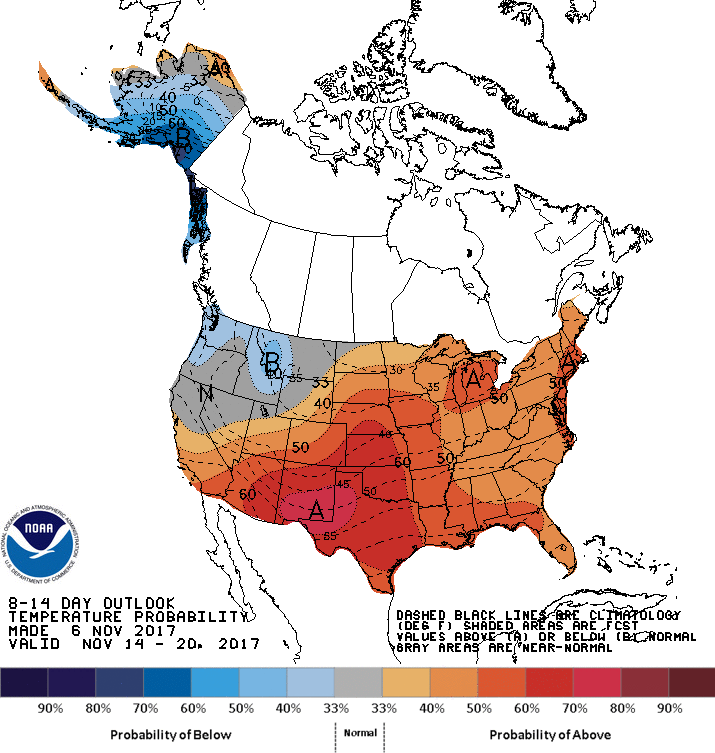

December contract natural gas prices gapped up last evening, and despite some early morning selling saw afternoon model guidance that pushed prices even higher into the settle.

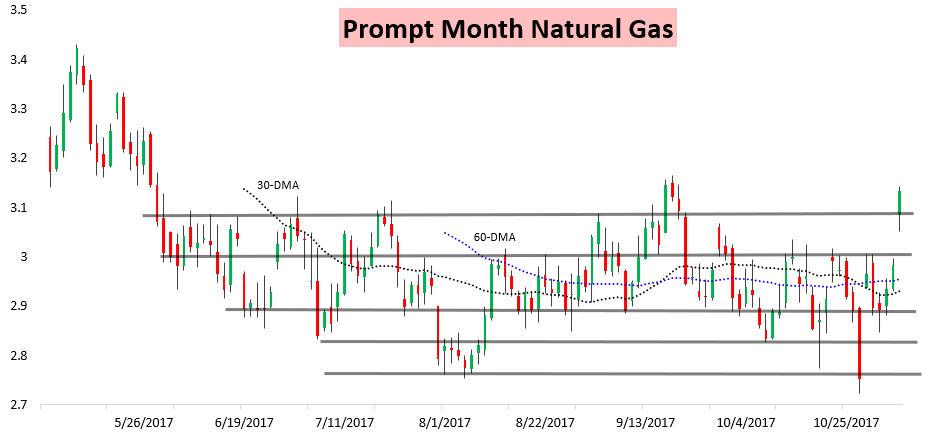

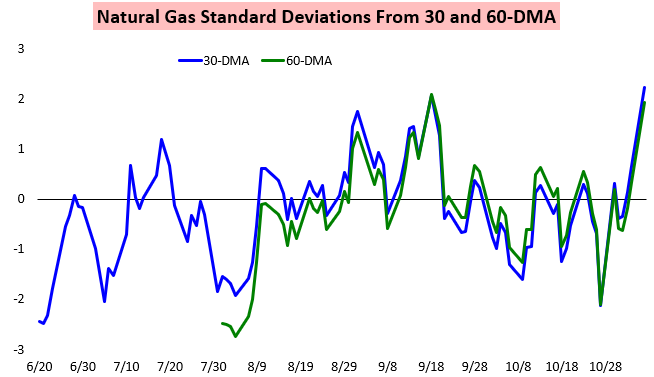

This marks only the second time that the prompt month natural gas contract has settled more than 2 standard deviations above the 30-DMA since June.

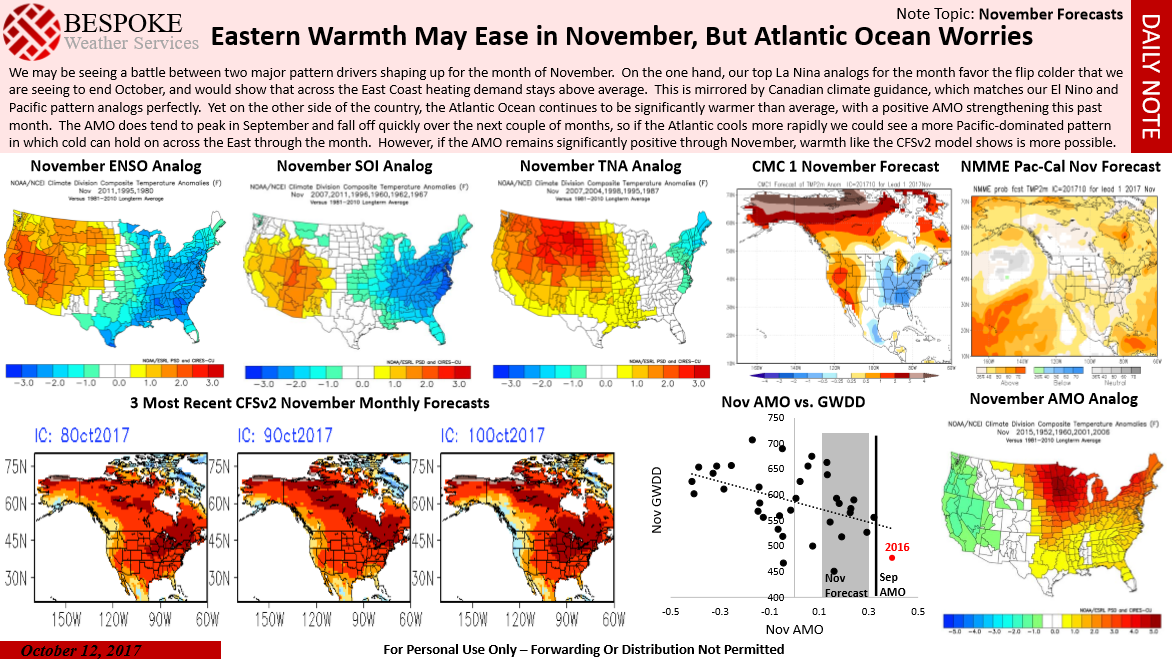

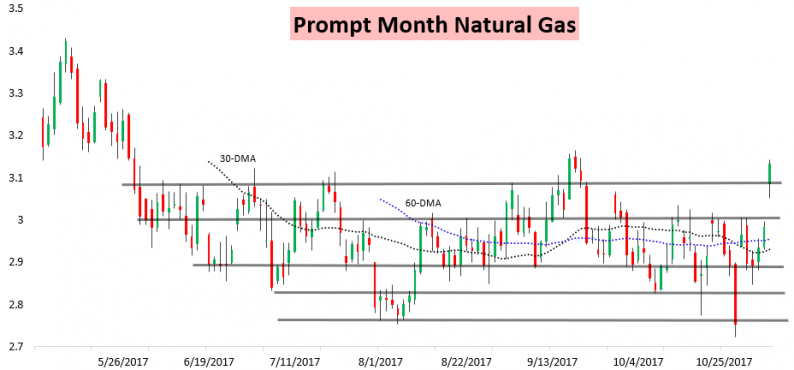

These colder trends in the forecast are thanks in part to a Pacific pattern that is relatively favorable for cold into the latter portion of November and an Atlantic that is not as unfavorable for sustained eastern cold as previously expected. All the way back on October 12th we issued a Note of the Day on the November forecast explaining that we expected the eastern half of the country to cool as we moved into November, where we saw increased cold risk. We noted, however, that one uncertain variable was the Atlantic Ocean, as too positive of an Atlantic Multidecadal Oscillation could increase ridging.

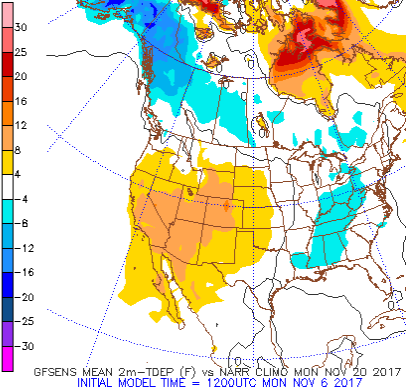

We see the forecast pattern in the long-range potentially matching our November ENSO and SOI analog decently, with the American GEFS temperature anomaly forecast for November 20th shown below (courtesy of the Penn State Electronic Wall Map Site).

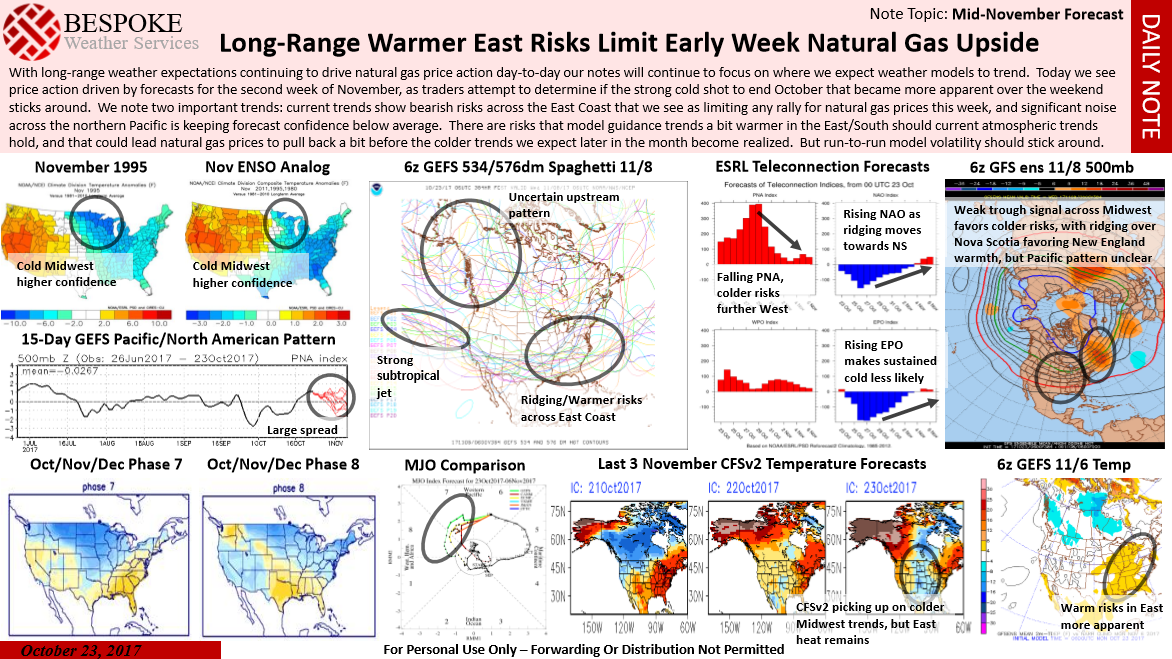

Then later on October 23rd, we issued a note cautioning that the first portion of November would likely be warmer than expected “before the colder trends we expect later in the month become realized.” We outlined how “that could lead natural gas prices to pull back a bit,” and in fact this Note was published right at the short-term high on the 23rd before selling brought us into November.

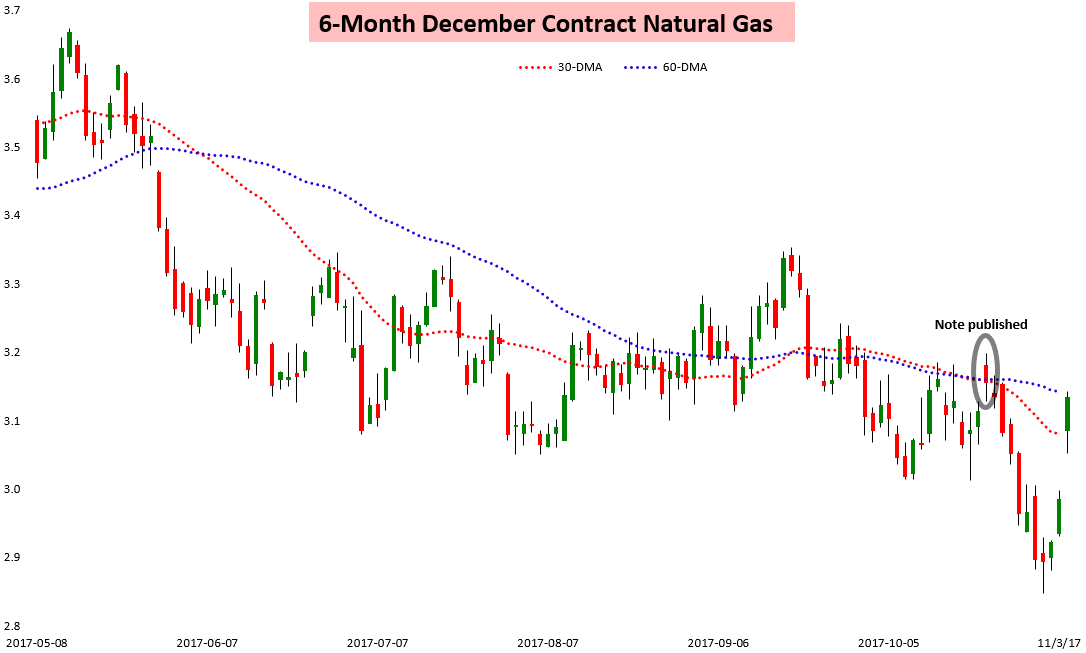

Recent Climate Prediction Center forecasts do show that even into the middle of November there will be some lingering warmer risks before those long-range cold risks likely become realized.

Leave A Comment