Most of technical analysis that one can read about gold and gold stocks is based on these markets alone. This is quite strange given the multitude of intermarket relationships, but still that’s the case. While it is true that looking at the performance of a given market is the most important thing that one can do when estimating the future performance of a given asset, it doesn’t mean that it’s all there is to it. Conversely, looking at the bigger picture and considering the less known factors can give investors and traders extra insight necessary to gain the Holy Grail of trading – the edge. So, we thought that you might appreciate a discussion of factors that are not as popular as the analysis of the precious metals market on its own, but that is still likely to have an important effect on its price.

In today’s free analysis, we discuss three such issues: the non-USD silver price (the average of silver prices in terms of currencies other than the U.S. dollar), the Dow to gold ratio and the long-term USD Index picture. The latter is quite often analyzed, but such analyses are generally conducted based on only the most recent data and thus what we discuss should put such comments in proper perspective. In other words, it should make sure that one doesn’t miss the forest for individual trees. Let’s start with the former (chart courtesy of http://stockcharts.com):

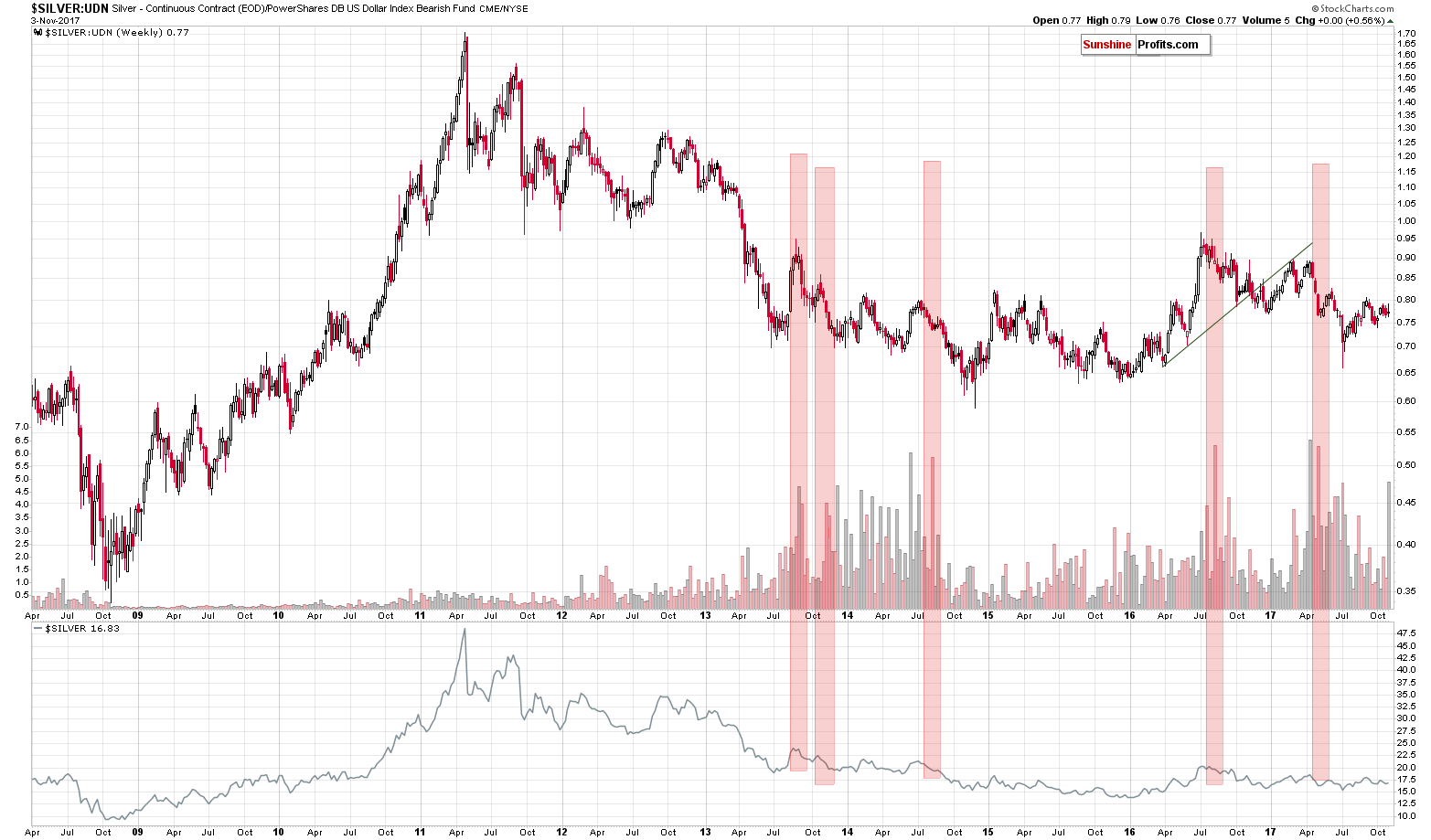

Silver’s non-USD performance is something that should be kept in mind and the same goes for the ratio of weekly volumes between silver and the UDN ETF (as that’s how we obtain the non-USD price). The above should not be ignored because silver is an important part of the precious metals sector (and the one that provided biggest gains in the 70s bull market) and the non-USD perspective should not be neglected because, after all, the USD is only one of the major currencies.

It is not the value of the ratio that is currently extraordinary, but the volume (the ratio of volumes, to be precise). Spikes in this ratio indicate extraordinary interest in the price of the white metal and there were many cases in the past when this served as an indication of much lower prices in the following weeks and months. This signal doesn’t say anything about the short term, but the medium-term implications are bearish.

Leave A Comment