The market opened higher today and then quickly reversed lower into negative territory. This comes after a day of solid gains across the board, so maybe it’s partly profit taking. I think it’s also the continued underperformance of the small cap stocks that ran into resistance today.

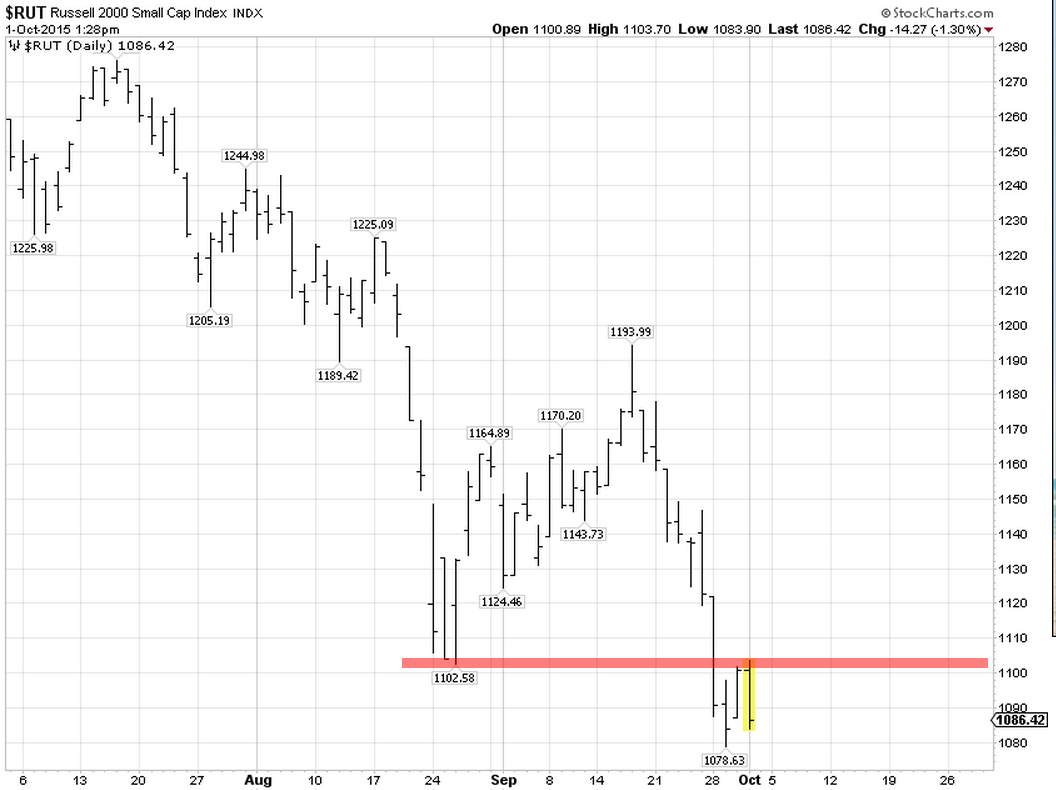

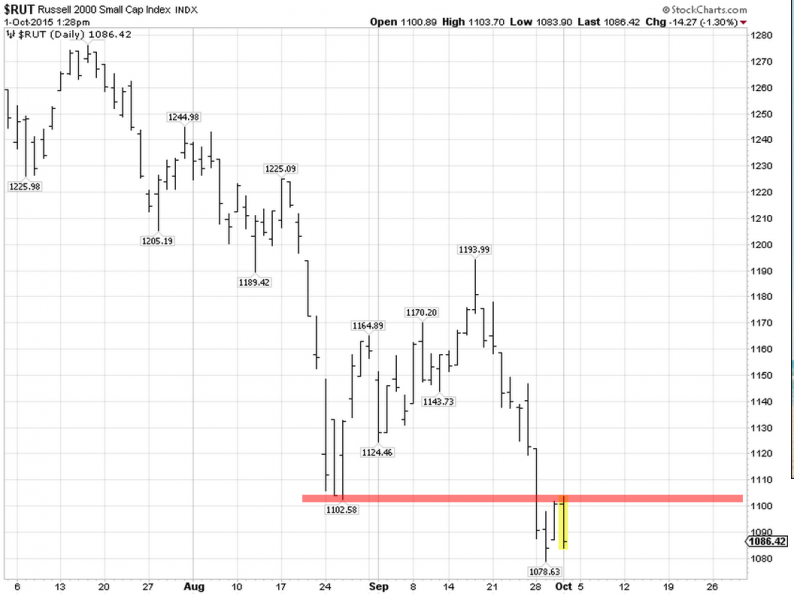

Click on picture to enlarge

The chart above shows the Russell 2000 index opened higher but hit resistance at the August 24th lows and has since lost all of the gains from yesterday. The Russell 2000 is the only major average that is trading below it’s August 24th lows. This will need to change in order to put in a sustainable bottom in equities.

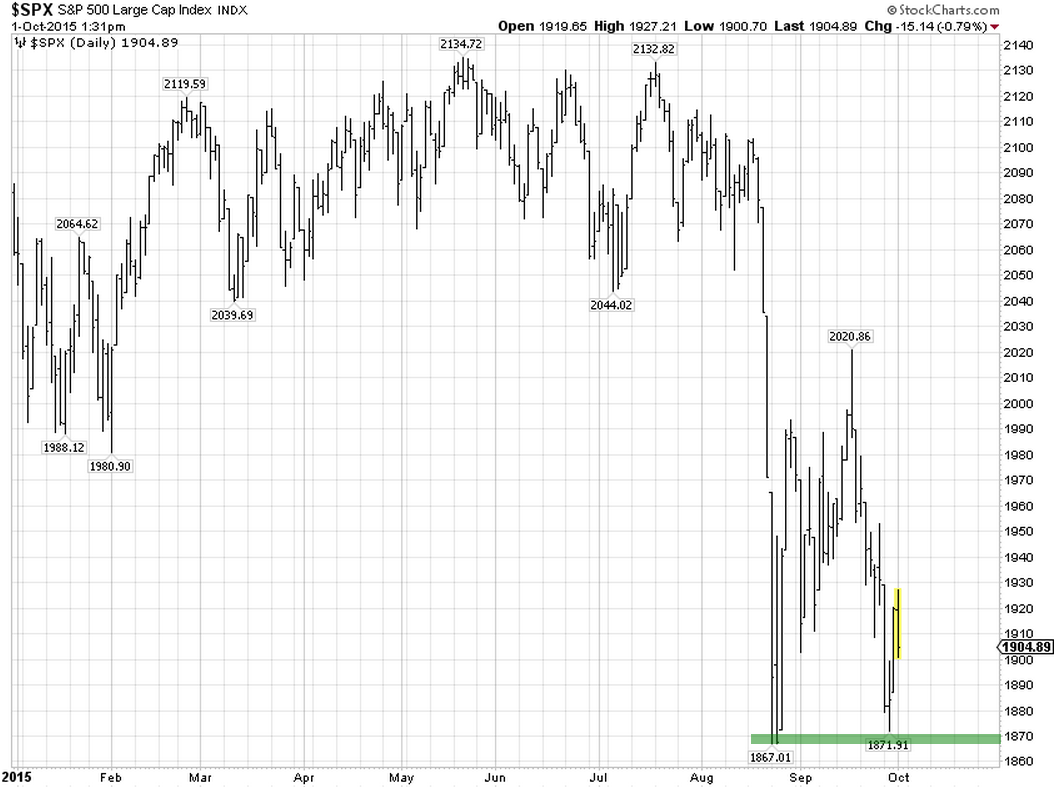

Click on picture to enlarge

On a positive note, the other three major averages are still trading above their August lows. On Tuesday of this week, the SP 500 came close to that pivot low at 1867. We’ll have to see if this continues to hold, however as we pointed out there is much support in the 1850-1820 area as well. So even if the August lows get violated, I believe it’s unlikely to expect it to decline much further. I suspect the next move to be a sustained rally back above 2020.

Tomorrow the US non-farm payroll reports numbers are set to be released. This may have market moving implications.

Leave A Comment