Today marks the 30th anniversary of the 1987 Black Monday Crash, an event that had a major impact on the behavior of investors who experienced it. While it would be completely irrational, given human nature, one would think that the 22% decline in DJIA on 10/19/87 would cause investors to become a little more risk averse at this time of year. If nothing else, the increase in articles every year around this time talking about how bad the crash was would be reason enough to scare some investors every year around this time.

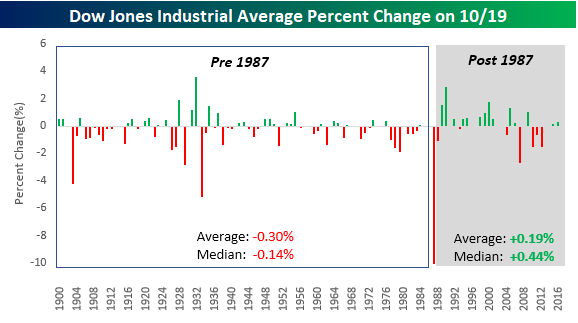

Interestingly enough, looking at the historical performance of the DJIA on October 19th of every year where the market was open on that day shows an interesting trend.In the years from 1900 through 1986, the DJIA averaged a one day decline of 0.30% (median: -0.14%) on 10/19 with positive returns just 43% of the time. In the 30 years since the crash, however, the DJIA has averaged a gain of 0.19% (median: 0.44%) on 10/19 with positive returns two-thirds of the time.So much for scars of 1987.

Leave A Comment