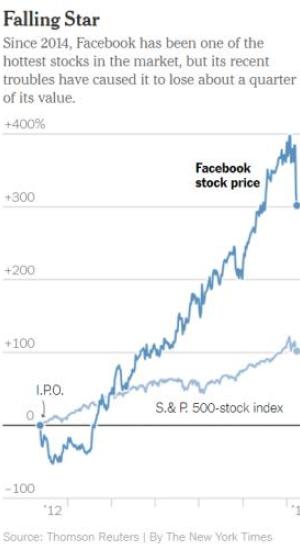

Facebook is an epic growth story. It now has an astounding 2 billion active users and a stock that – from an already richly-valued level – rose by 53% in the previous year. In February its market cap peaked at $560 billion, a number that exceeds the GDP of many countries. Over 90 percent of Wall Street analysts covering it rated it a “buy.”

Everyone knew that it had data privacy issues but no one cared in the face of that massive subscriber growth.

Then, like flicking a light switch, everyone began to care after all. A data scandal that was simple enough for investors and politicians to understand broke out, and now high-profile users like Elon Musk (who deleted his Tesla and SpaceX Facebook accounts), big investors, and of course spotlight-seeking politicians around the world are all reacting.

Facebook’s market cap is down by $100 billion in the past week.

Before this month, investors were looking for the next Facebook. They still are, but with a completely different set of criteria. Where previously they were seeking companies with soaring popularity and addictive products, now they’re looking for malfeasance and other potential landmines. Does Google have data privacy issues that will come back to bite it? Has Amazon antagonized the president enough to be slapped with a national sales tax? Did Apple over-price its latest phone to the point that customers don’t want it?

Virtually no one outside of a tiny, long-suffering group of short sellers had been asking these questions. Now everyone is.

And that, in a nutshell, is how markets morph from bull to bear. It’s not about fundamentals, but about which aspect of the fundamentals are seen to matter. And generally it takes a high-profile object lesson to shift investor psychology from one extreme to the other. During the 2000s housing bubble, for instance, stock prices held up even as mortgage defaults were surging. Then Lehman Brothers collapsed and all anyone wanted to know was “which bank is next.” From CNN in 2008:

Leave A Comment