Earlier this week I discussed Zimbabwe – the country that took and continues to take ineptitude to a whole new level.

Specifically, we discussed how the liquidity of assets gets impacted when things go really pear shaped. I think it’s worth understanding this process. There are certain dynamics that are very pertinent to countries and economic systems which we’ve come to incorrectly associate with stability, safety, and people who, with their hand on the tiller, really should know better. But based on their actions they clearly don’t.

As mentioned, Zim had a serious problem with liquidity and collateral. Like hydrogen and oxygen they can be tightly interconnected, and when they are (in the right formation) we get something almost miraculous (it keeps us alive) but when they’re not they’re just… meh.

Under the watchful eye of their great leader Zimbabwe had – and in fact still has – a massive problem with its collateral since it became worthless and consequently liquidity dried up.

Liquidity, at its very foundations, is a consequence of trust, and collateral can’t be created or maintained without trust. I suggest reading or re-reading my article on collateral where I argued that the basis of a healthy global financial system is an ability to create collateral – something central banks and governments have been actively destroying but I digress.

Anyway, I promised you in my last article that there was a solution to all of this.

I’ll tell you what I think is going to be THE solution for this sort of problem in the next couple of decades if not sooner, but first (and in order to provide additional context)… let’s cover what solutions did crop up for this truly buggered country because they provide us a glimpse into some of the components necessary to solve these sorts of problems.

Not to belabour the point but Mugabe and his cronies made a truly epic mess of the place.

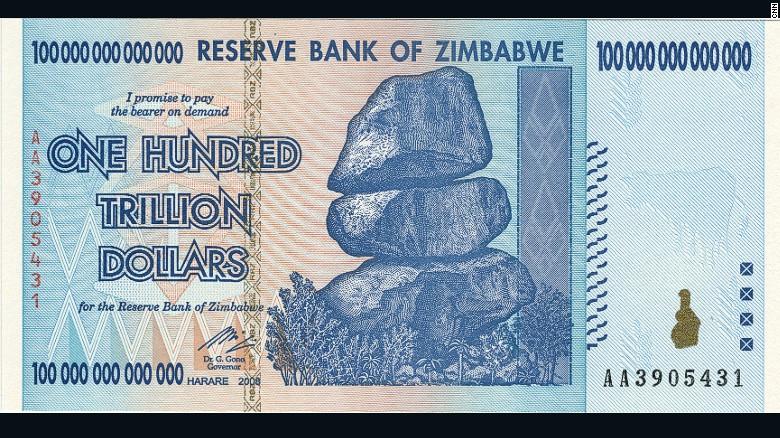

Everyone became a billionaire and promptly proceeded to starve. Even that mad bitch Kirchner from that other Southern land of great steaks never cocked things up this badly, and she really was one daft bat. Everyone knows that the worst harm you can do to any man, after forcing him to go shopping and spending time with his mother in law (or both together), is to destroy his store of value and means of exchange.

Mugabe did just that.

Add in capital controls and folks had precious few places left to move their capital to.

Enter Old Mutual.

Old Mutual is a holding company involved in asset management, life insurance, banking, and a few other bits and pieces. What matters is that Old Mutual is listed on the LSE, the JSE, and on the Harare Stock exchange. Bingo!

Leave A Comment