The robo-machines are now having a grand old time hazing the August lows at 1870 on the S&P, and may succeed in ginning up another dead-cat bounce or two. But this market is going down for the count owing to a perfect storm.

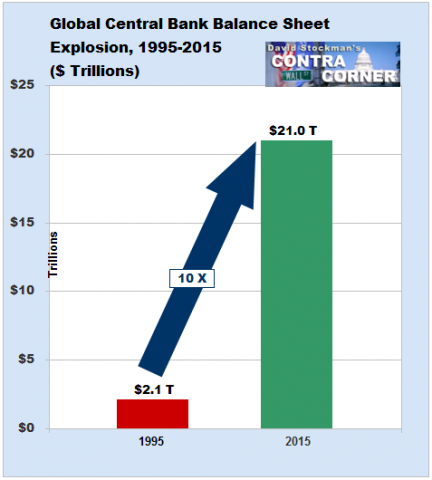

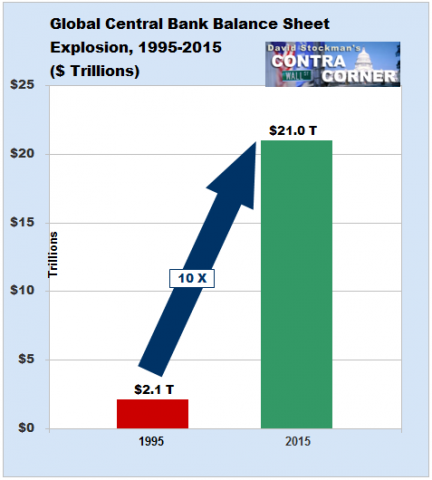

To wit, the global and US economies are heading into an extended deflationary recession; S&P earnings peaked at $106 per share more than a year ago and are already at $90, heading much lower; and the central banks of the world are out of dry powder after a 20-year binge of balance sheet expansion.

The latter is surely the most important of the three. It means there will be no printing press driven reflation of the financial markets this time around. And without more monetary juice it’s just a matter of time before a whole generation of punters and front-runners abandon the casino and head for the hills.

Even with today’s ragged bounce, the broad market has now gone sideways for nearly 700 days. The BTFD meme is loosing its mojo because it only worked so long as the Fed following herd could point to more printing press cash flowing into the market or promises of “accommodation” that were credible. But that will soon be ancient history.

^SPX data by YCharts

As we have long insisted, the GDP does not measure true gains in national wealth or Main Street living standards. That’s because you can borrow your way to higher GDP, as the US did through an explosion of household borrowing in the 20-year prior to the 2008 crisis, or as China and its EM supply convoy did during the last seven years.

But that only pulls activity forward in time. At the towering levels of debt which exist in the world today, borrowing does not create new wealth; it only mortgages future income.

Indeed, with $220 trillion credit outstanding on a worldwide basis, we have reached “peak debt” for all practical purposes.

(to be continued)

Leave A Comment