Without giving any reasons, South African President Jacob Zuma has fired his finance minister (after just 19 months in office). This has shocked investors, already anxious about the nation’s surging debt and sluggish economy and South African bonds and FX have collapsed. 10Y yields spiked 140bps to 10.18% – the highest since July 2008 – and CDS have soared. The Rand has crashed to new record lows above 15 to the USD.

The Rand has collapsed to record lows…

Bonds have crashed to 7 year high yields

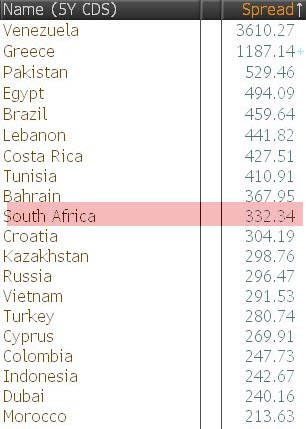

And South Africa is now the 10th riskiest sovereign in the world…

As Bloomberg reports,

The shock move came less than a week after credit-rating companies pushed the nation closer to junk status, citing concerns over a sluggish economy and rising debt. Nene’s departure, and uncertainty relating to his successor, raises questions about whether the National Treasury can stick to its spending targets.

“Especially at this point in time, we can ill afford to antagonize international investors,” Mohammed Nalla, head of strategic research at Nedbank Group Ltd., said by phone from Johannesburg. “An event of this magnitude can even be the catalyst for a credit-rating downgrade to junk status. It could lead to a complete loss of investor confidence in South Africa, which could push us into a recession.”

“We are not so concerned about the person but rather whether Treasury controls the line on fiscal deficits and the debt stock, which we are watching,” Ravi Bhatia, director of sovereign ratings at Standard & Poor’s in London, said in an e-mailed response to questions. “South Africa is on negative outlook and our concerns highlighted in our last outlook statement remain.”

The economy is under strain because of plunging metal prices and power constraints. The central bank is forecasting growth of 1.4 percent this year, which would be the slowest pace since the 2009 recession.

Investors are concerned that “worsening macro performance will lead to a more politicized approach to fiscal policy and structural reform,” Arnab Das, head of EM Macro at Invesco in London, said by e-mail. “There is also a threat that further ratings downgrades may well lead to South Africa’s exclusion from global government bond indices in the next one to two years.”

Leave A Comment