My Swing Trading Approach

Should the market pullback today, I will look to spot any of the stocks that are providing a solid dip buying opportunity. Should the market continue higher, I’ll look to add 1-2 new momentum plays to the portfolio. The 2801 price level remains key going forward.

Indicators

Sectors to Watch Today

Technology is back and the go-to sector for traders. Energy – entirely unpredictable still. While there are times it does well, it lacks day-to-day consistency of any kind. Staples very strong and breaking out of its base. Telecom looking to establish another higher-high in its existing uptrend. Utilities breaking out of an eight month long base.

My Market Sentiment

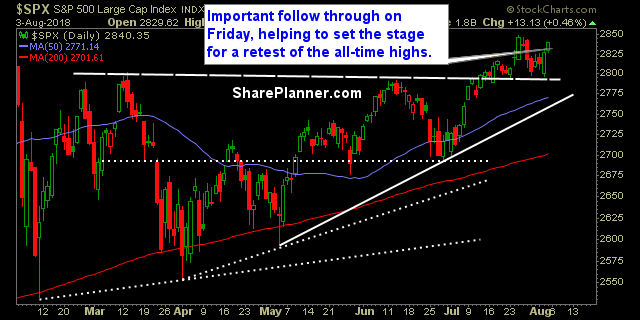

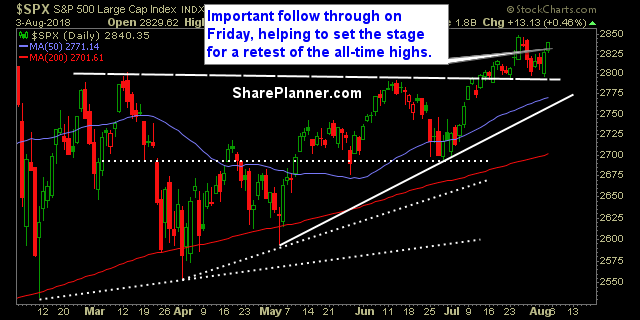

Friday’s follow through was important for the bulls, and while breadth was poor, we saw another example of how a handful of stocks are managing to propel the market higher on their own. SPX is once again setting up to retest the all-time highs again from January.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

Leave A Comment