In 2016 BofAML’s global equity derivatives desk expects volatility to maintain its gradual upward trend, however, to continue to be punctuated with violent but short-lived shocks owing to poor liquidity, extreme positioning and a market still heavily manipulated by (and dependent on) the central bank put.Despite below-normal levels of volatility across asset classes, we are in uncharted waters in terms of a lack of stability:

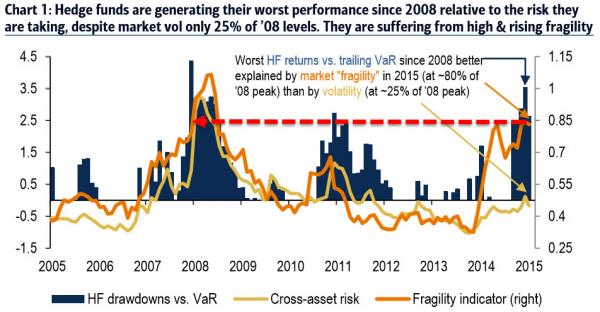

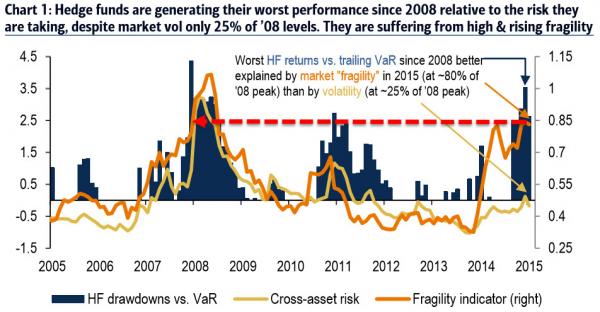

Asset managers are struggling, with the poorest hedge fund performance relative to the risk they are taking since 2008, despite overall market volatility being only 1/4th of 2008 levels. Their poor performance is better explained by the extreme levels of market fragility, which by our metric is at 80% of its 2008 highs (Chart above).

Bloomberg Sponsored Content

Unfortunately, we don’t see conditions improving and only becoming more acuteas liquidity continues to deteriorate, asset valuations become increasingly stretched, and the Fed navigates the unwind of the greatest policy experiment in history.

Measuring fragility

Normally, there is a strong relationship between the size of a market shock, and the amount of volatility generated by the aftershocks before markets calm to normal levels. However, in a local tail event the relationship is very different with a tendency for markets to see extreme dislocations which reverse at record pace. This is precisely what we have seen over the last 18 months across asset classes (Chart below).

Illustrating this for US equity volatility specifically, we note the relationship between the peak height in the VIX to the total volatility generated during the shock before it retraced back to pre-spike levels. Since 2014, we have been in uncharted territory in terms of large shocks occurring with very little total damage done to markets. This allows average volatility to remain muted but creates challenging conditions for managing risk and generating returns.

Leave A Comment