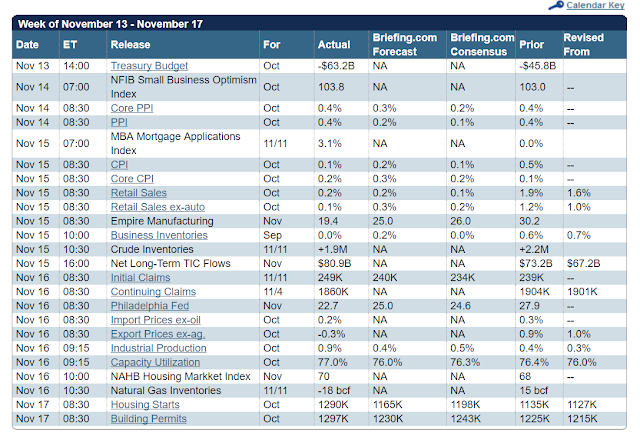

Today was a stock options expiry.

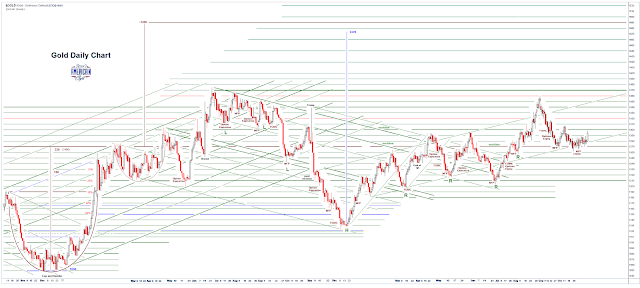

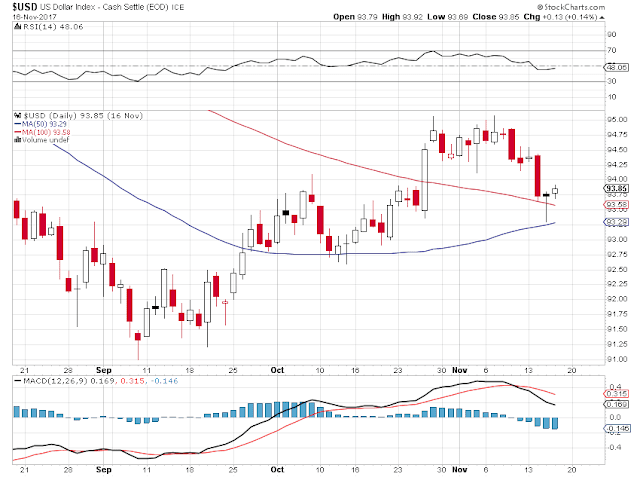

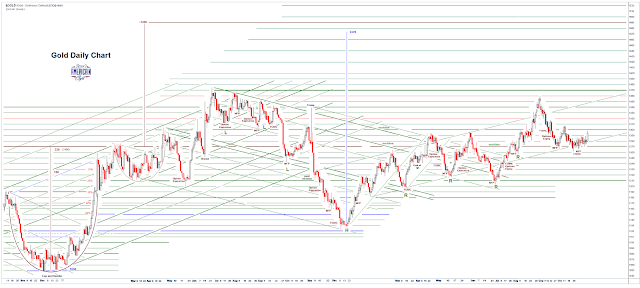

Gold and silver rallied smartly, back up to the levels where they roughly were before they were bushwhacked on the Comex into the FOMC meeting and Non-Farm Payrolls boogie woogie.

I guess the theory that this smackdown of gold to retest 1270 earlier this week was a gambit ahead of stock option expiry was tradeable.

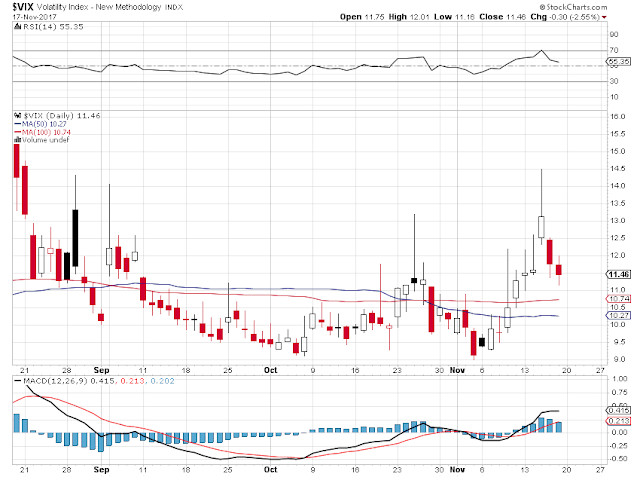

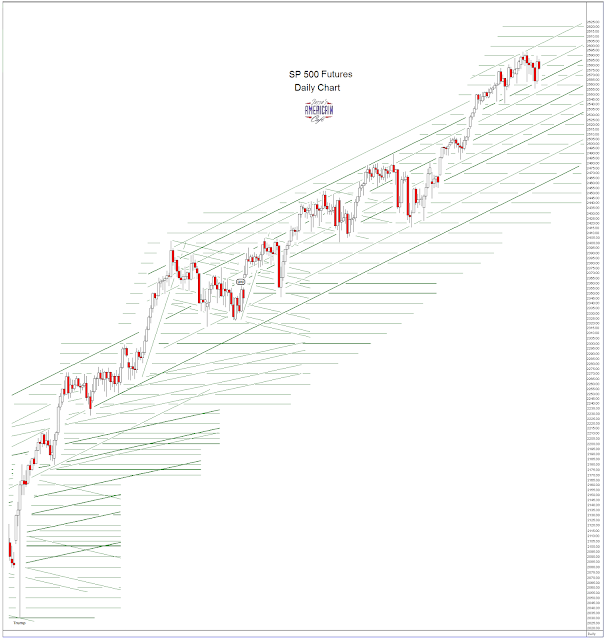

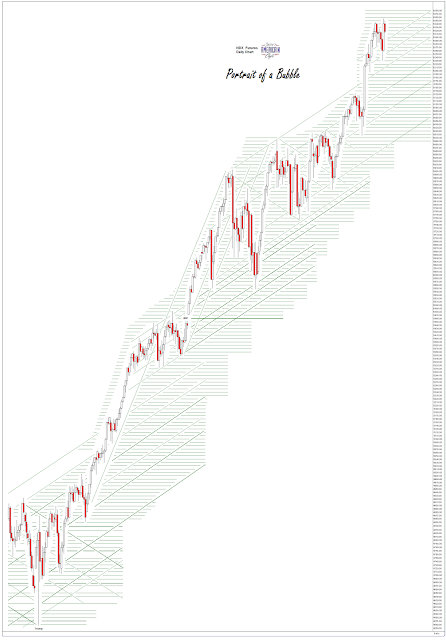

We are in a new era. I am hearing this on TV and in comments and on chat forums.

We are in an era where risk has been abolished by the central banks and their free money. So there is little difference between prime and subprime, between 2 year and 10 year Treasuries, and between stocks and bonds.

Actually according to the Pied Piper pundit stocks are better than riskless cash, because stocks are going to keep rallying forever after, and cash is trash. Buy buy buy, and don’t be left behind.

This is the kind of mantra that the sell-side and wiseguys of the Street put out when they are taking profits and unloading mispriced junk on mom and pop, through the funds and institutions.

Once the selling starts in earnest, and it will beyond any doubt at some point, by whatever event that may happen to trigger it, this is going to get ugly very quickly.

And no one could have seen it coming.

Who runs Bartertown?

Leave A Comment