Stocks Fall Slightly

The S&P 500 is still in that awkward phase where it hit a record high on Tuesday but hasn’t closed above its record high in January. I may be making too big of a deal of this because it could be purely fundamentals driving the market. However, I know many short term technical traders have the 2,872 close in mind when they see the market at this level. The fears of trade wars and the slowing economy are enough to make me neutral on stocks.

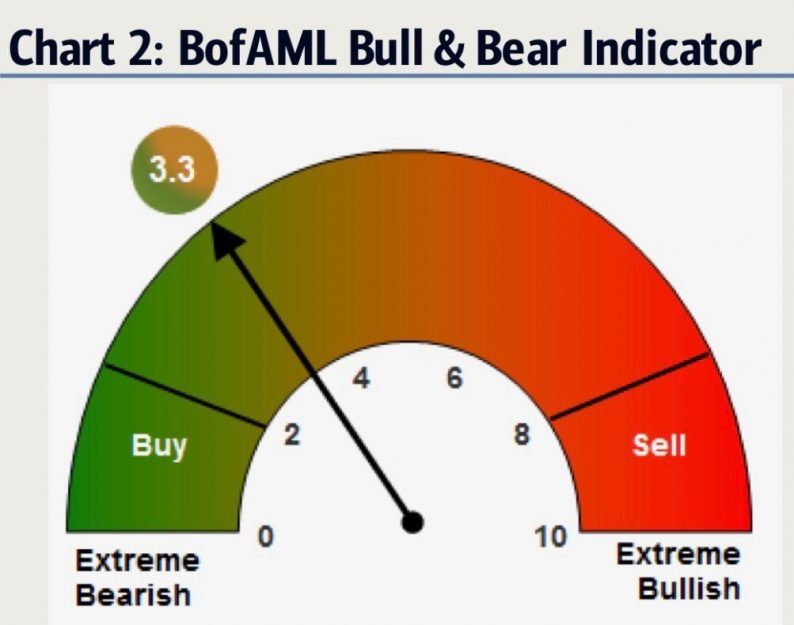

The CNN Fear and Greed index is still at 59 even though the market has been down two days in a row. The S&P 500 was down 0.17% and the Russell 2000 was down 0.32%. The material and energy sectors were down the worst as they fell 0.7% and 0.52% respectively. Technology was the only one in the green as it was up 0.18%. The Bank of America bull & bear indicator, shown in the chart below, shows a bearish reading which means now is a decent time to buy the S&P 500.

Tariffs Hurt Stocks

The Dow was pulled down by Caterpillar which was down 2% on trade war fears. The August 23rd tariffs were implemented on China as expected. A 25% tariff on $16 billion worth of goods was enacted, and China responded in kind. Once I heard about the discussions between mid-level ambassadors, I knew that the market would negatively react to these new tariffs going into place because you don’t tax a country you are having serious positive negotiations with. This tariff proves Trump’s statement that there wasn’t much chance of a deal occurring was correct.

Dollar, Oil, & Treasuries

You may be wondering how stocks are rallying if there have been a few bad economic reports, earnings season is over, which means fewer positive catalysts for individual names, and the tariffs are providing negative headlines. The reason international names have done well is the dollar has been falling. After peaking at $96.73, it is down to $95.44. You can say, the dollar isn’t helping stocks; it’s just not hurting them anymore as it had been a thorn in their side for the past few months.

Leave A Comment