Thoughts

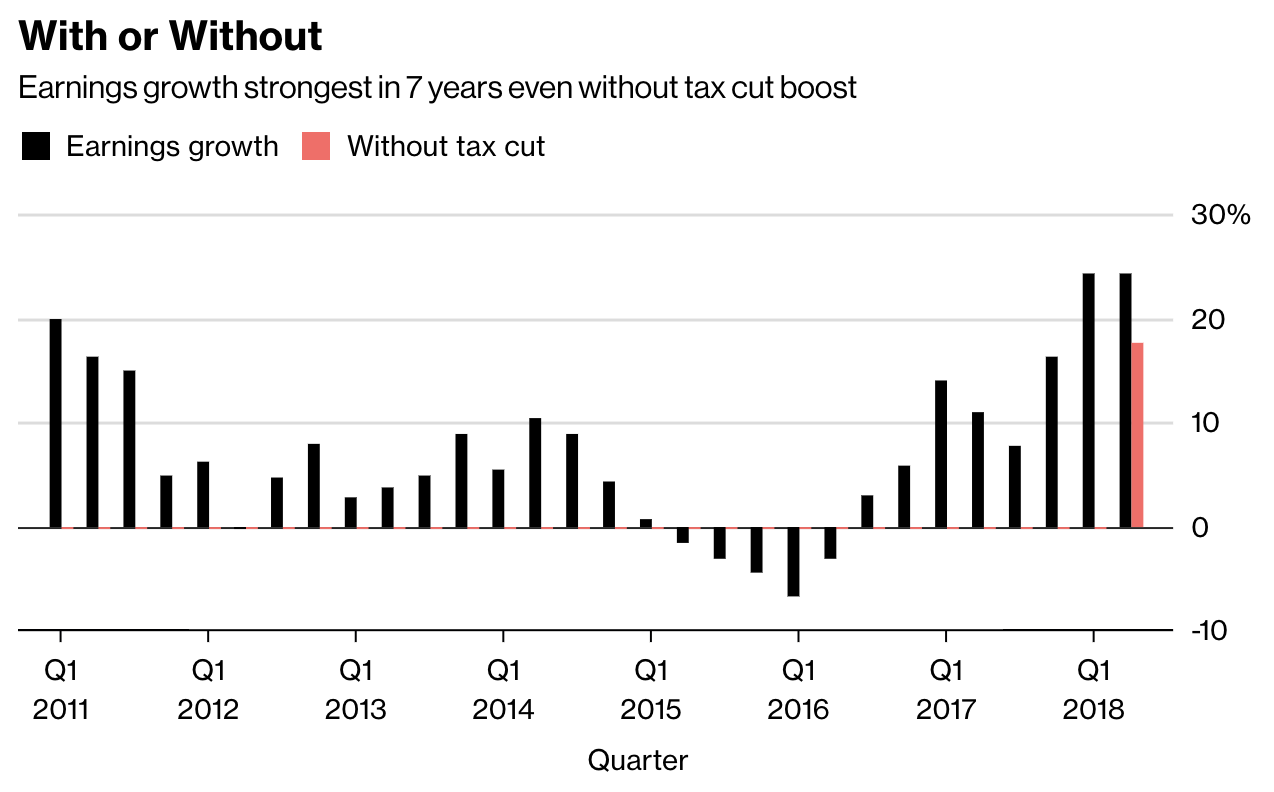

1 am: Corporate profits are surging, even without Trump’s tax cut. Medium term bullish for stocks

As you probably know, corporate profits are surging this year. Some people believe this is mostly due to Trump’s tax cuts. That’s not true.

Corporate profits are surging due to a combination of:

Corporate profits would be surging right now even without Trump’s tax cuts. From Bloomberg:

Strong earnings growth (even without Trump’s tax cut) is a medium-long term bullish factor for the U.S. stock market right now.

1 am: VIX is rising with the stock market. Not necessarily bearish for stocks.

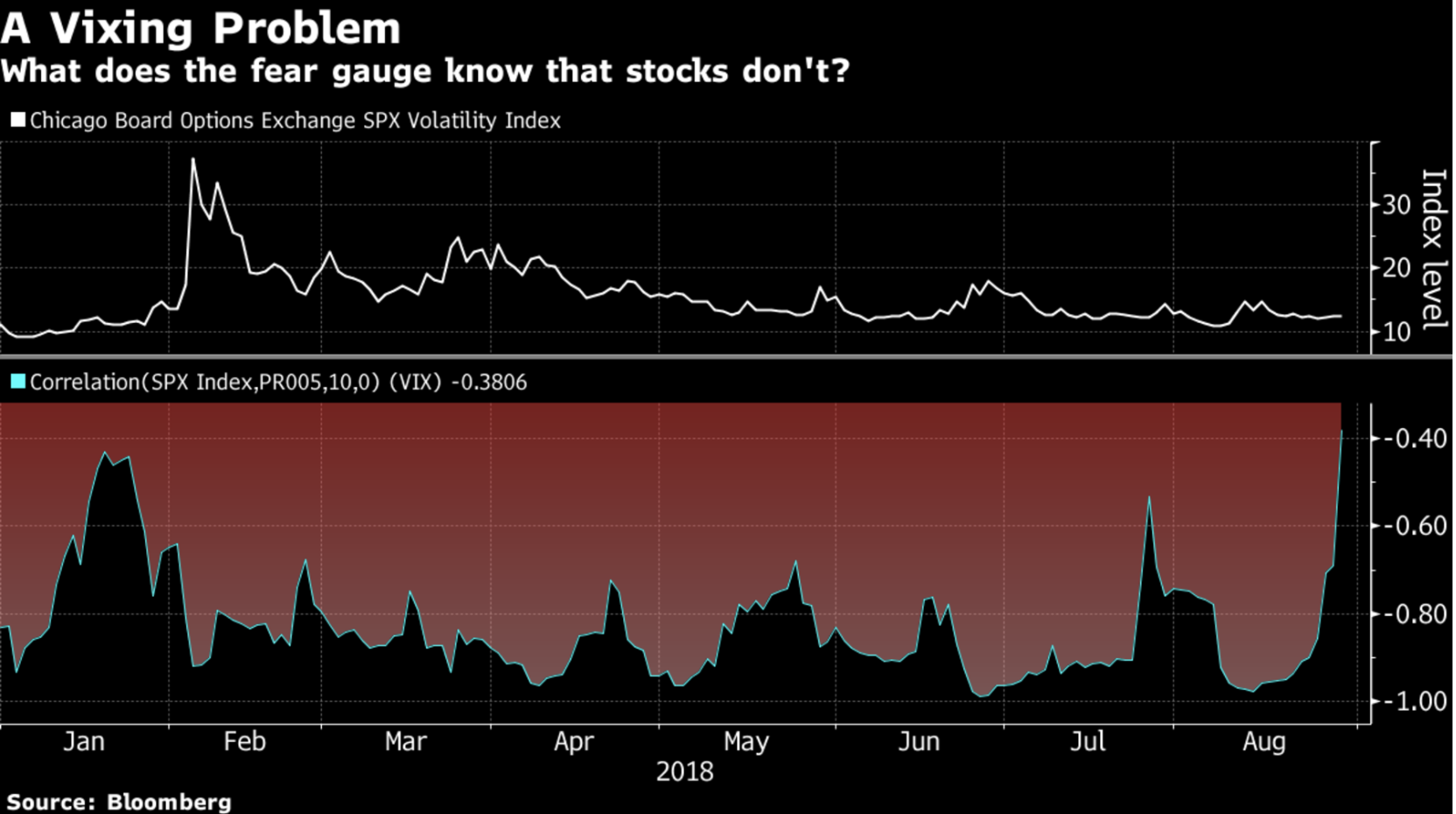

Bloomberg published an interesting chart, demonstrating that the S&P is no longer moving inversely with VIX.

The last time this happened was in January 2018, right before the stock market made a “small correction”. Is this a harbinger of another “small correction” to come?

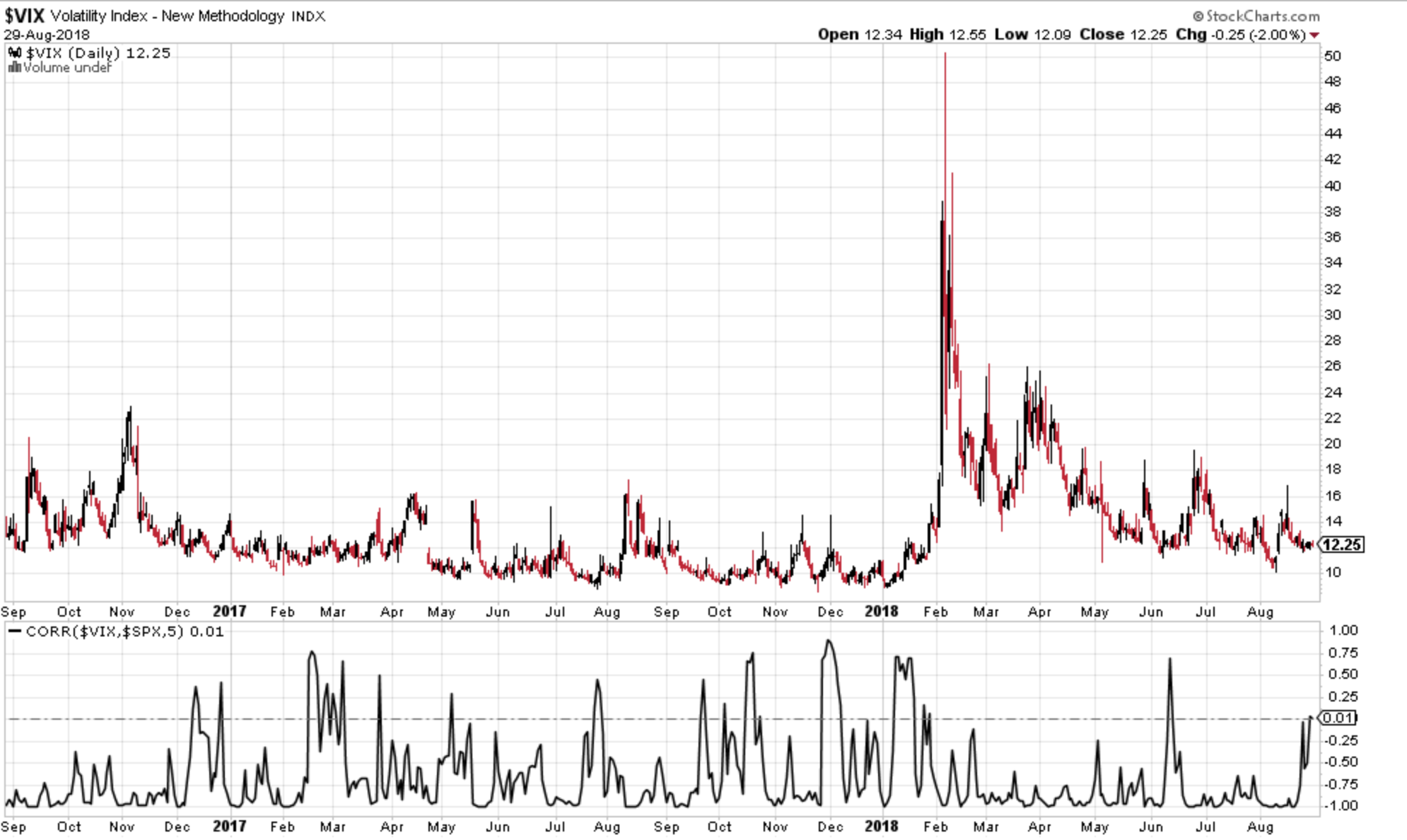

No. It’s very common for VIX to go up with the S&P when VIX is very low (VIX is lower-bound at approximately 10).

As you can see in the following chart, the 5 day correlation between the S&P and VIX is frequently positive. (The correlation was frequently positive in 2017, when the stock market soared).

As you can see in the following chart, the 10 day correlation between the S&P and VIX is frequently positive. (The correlation was frequently positive in 2017, when the stock market soared).

Leave A Comment