The economy and stock market move in the same direction in the medium-long term. Hence, leading economic indicators are also leading indicators for the stock market.

Thoughts

1 am: Rising interest rates are not hurting the stock market or economy.

The mainstream story is that “rising interest rates caused this stock market crash”. In reality, that is not true. Rising interest rates are only the trigger/excuse. If rising interest rates “caused” the stock market’s crash, then there should be no reason for why stocks tend to go up more often than down when interest rates rise.

The “reason” (if any, because most short term movements are random) is more likely due to the stock market’s extremely low volatility in September, which led to a volatility explosion this month.

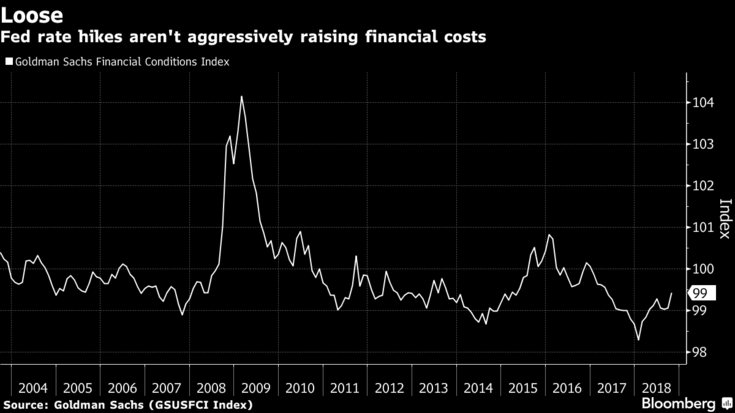

Even Bloomberg itself admitted “there is little evidence that rates are too tight given current economic conditions”.

As we’ve said before, financial conditions are still extremely easy and conducive of more stock market gains. Bloomberg echoed this thought.

Moreover, the inflation-adjusted Fed Funds Rate is still negative….

… whereas the inflation-adjusted 10 year yield is barely above zero.

1 am: VIX is in backwardation. Stock market is close to bottoming.

The VIX futures curve is usually in contango, whereby the spot price is lower than future prices. This is because traders generally expect volatility to increase as time goes on.

Leave A Comment