Thoughts

1 am: We’ve exited the “blackout” period for stocks buybacks, which will be bullish for the stock market this month

As we’ve shown repeatedly over the past few months, corporate buybacks are surging this year. This is a bullish factor for the stock market in the medium term (more buyers for stocks).

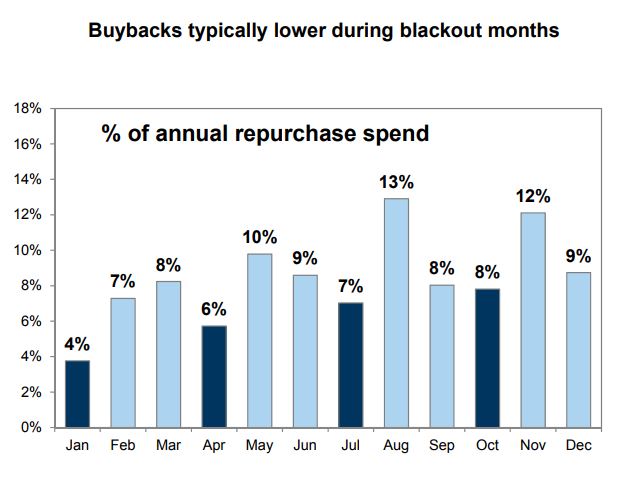

Under SEC rules, companies are required to pause stock buybacks approximately 5 weeks (1 month) before they release their earnings reports.

Of course not all companies release their earnings reports on the same day. But since most companies do release their earnings during “earnings season” months (January, April, July, October), these months are also typically blackout months.

This chart demonstrates how corporate buybacks tend to fluctuate throughout the year.

As you can see, July typically does not see a lot of corporate share buybacks because it is a blackout month. However, August usually experiences the largest % of share buybacks.

Now that we are in August, the renewed vigor in share buybacks could push the S&P 500 to new highs by the end of this month. The S&P is already very close to new highs.

1 am: China’s “crashing” stock market is not a bearish factor for the U.S. stock market

The Chinese stock market has fallen significantly this year due to Trump’s trade war. This has investors worried about that China’s stock market crash will lead to “contagion in the U.S.”

Leave A Comment