Thoughts

*I’m introducing some new thoughts with the hashtag #PermabearParody. These thoughts will tell you what financial dogma to ignore.

1 am: The stock market’s breadth is rather strong. S&P 500’s equal-weighted index confirms the market cap weighted index.

One of the biggest complaints I see on financial media is “the entire stock market rally relies on FANG. Without FANG, we’re all doomed”.

This is factually incorrect. The S&P 500 is a market cap weighted index. This means that big stocks will naturally have a bigger impact on the index than small stocks.

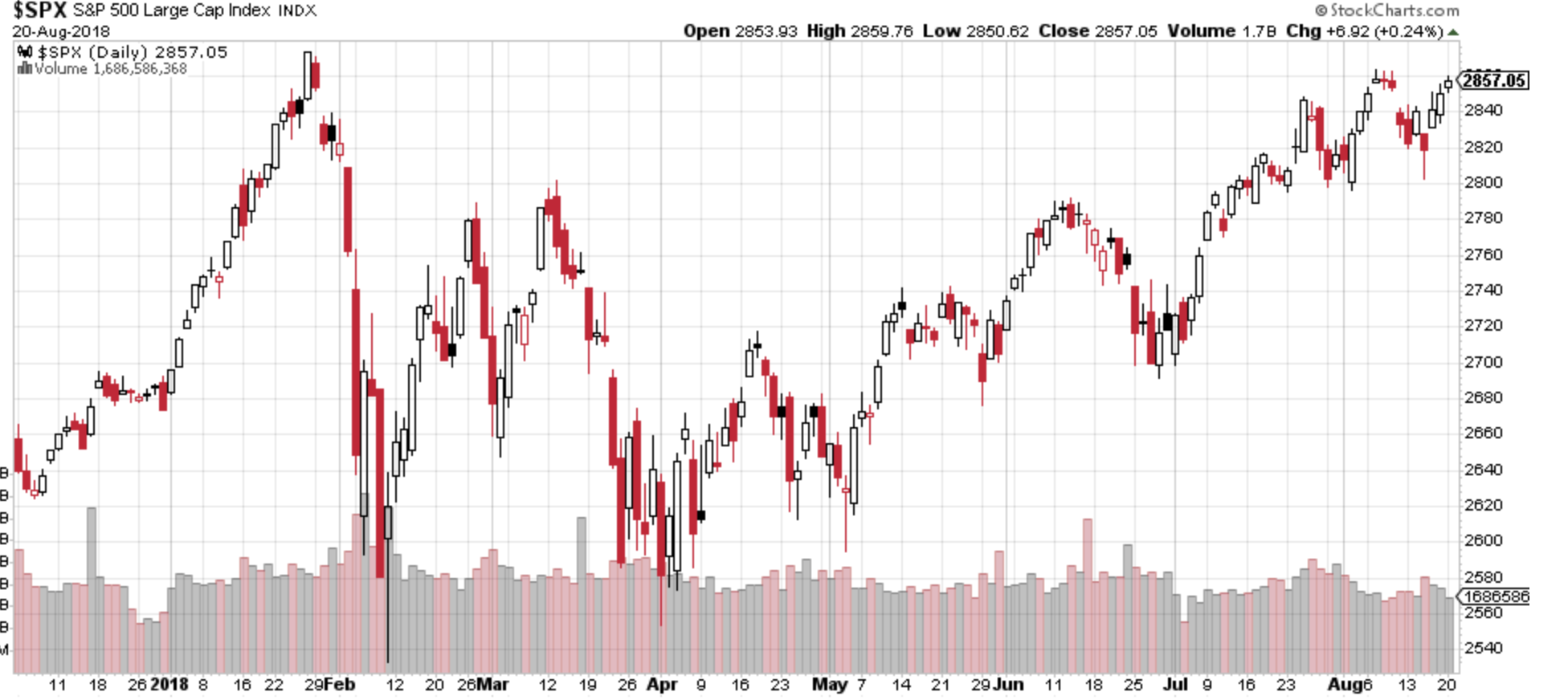

The market cap weighted index is near all-time highs right now.

The S&P 500 has an equal-weighted counterpart. This means that FANG stocks don’t have an outsized impact on the equal-weighted index.

The S&P 500’s equal-weighted index is also near all-time highs. The stock market’s breadth isn’t “weak”. It’s not “just relying on a few big tech stocks”.

1 am: #PermabearParody: the stock market is rallying on falling volume. Bearish!

The U.S. stock market is rallying on falling volume right now. This is bearish for the stock market, according to conventional technical analysis.

Except conventional technical analysis is wrong. The stock market’s volume ALWAYS trends lower after it comes out of a correction. There is nothing bearish about the stock market rallying on falling volume. From what we’ve seen, volume is neither bullish nor bearish for the stock market. It’s a mostly irrelevant factor for the stock market (see study).

Leave A Comment