The U.S. stock market indexes were mixed between -0.9% and -0.1% on Wednesday, as investors hesitated following Friday-Monday’s sell-off and Tuesday’s bounce. Stocks extended their upward correction, before reversing lower. The S&P 500 index lost 0.5% and closed below the level of 2,700. It currently trades around 6.7% below its January 26 record high of 2,872.87. The Dow Jones Industrial Average was relatively stronger than the broad stock market yesterday, as it lost 0.1%, and the technology Nasdaq Composite lost 0.9%.

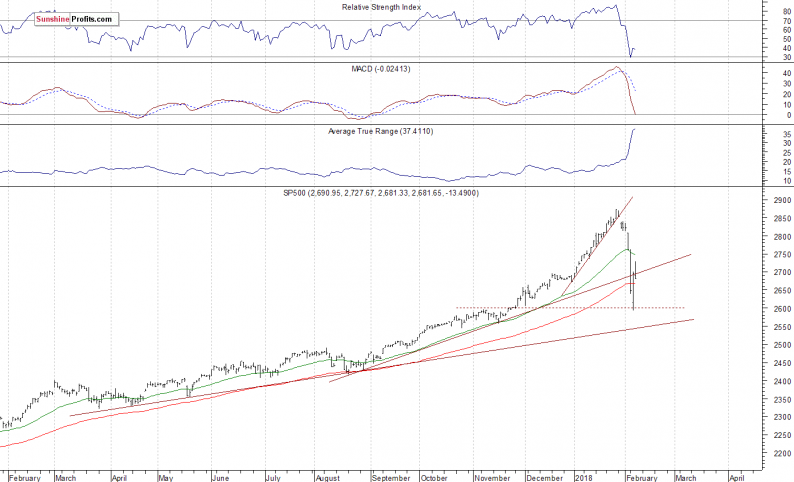

The nearest important level of support of the S&P 500 index remains at around 2,640-2,650, marked by Monday’s daily low. The next support level is at 2,600-2,620, marked by Tuesday’s daily low and some early December fluctuations. On the other hand, level of resistance is at 2,700, marked by previous support level. The next resistance level remains at 2,730, marked by yesterday’s daily high. The resistance level is also at 2,750-2,760.

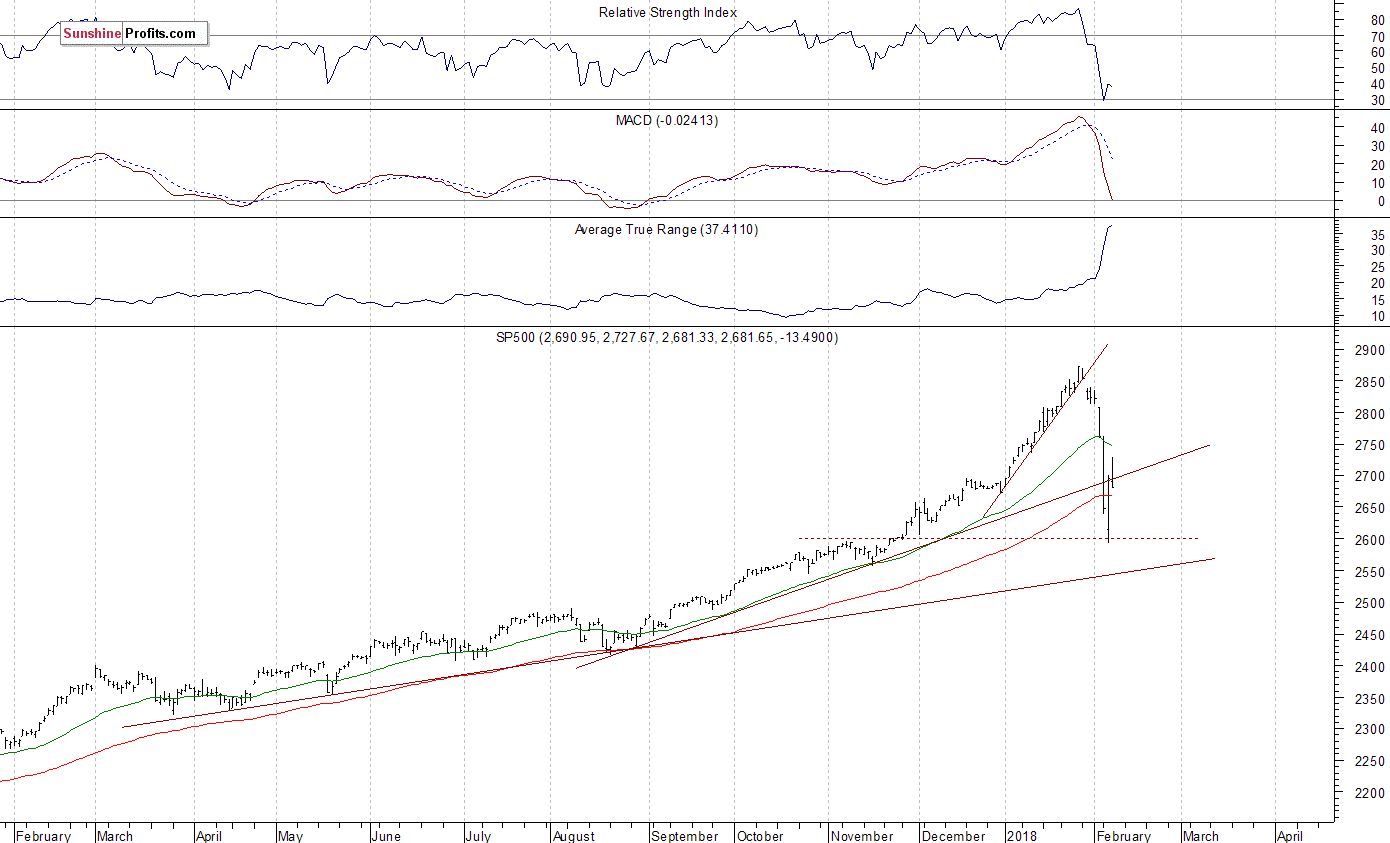

The index reached its record high almost two weeks ago on Friday. It broke below month-long upward trend line on Tuesday last week following gap-down opening of the trading session, confirming reversal of the uptrend. Then it retraced all of its January rally and continued lower. Tuesday’s bounce stopped the decline, but will stocks reverse their new downtrend? Yesterday’s trading session showed that the market is far from being bullish at this moment. We can see that stocks are sharply reversing their medium-term upward course following the whole retracement of last month’s euphoria rally:

More Short-Term Fluctuations

The index futures contracts trade 0.1-0.3% lower vs. their Wednesday’s closing prices this morning. So, investors’ expectations ahead of the opening of today’s trading session are slightly negative. The European stock market indexes have lost 0.8-1.3% so far. Will the sentiment change before cash market opening at 9:30 a.m.? For now, it looks like the market won’t continue its two-session-long bounce off Tuesday’s low. One thing’s for sure, volatility will remain relatively high. Investors will wait for the Initial Claims number release at 8:30 a.m. The market expects that it was at 232,000 last week. Investors will also wait for more quarterly corporate earnings releases.

Leave A Comment