Belgian PM Charles Michel said earlier that “this is the deadliest attack on Brussels ever,” and as we noted in this morning’s pre-open wrap:

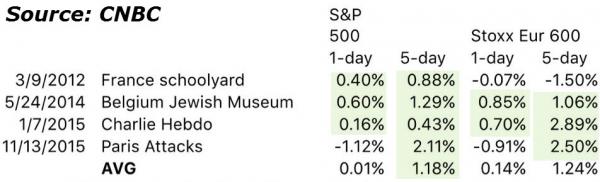

This morning’s Brussels bomb attacks have led to risk-off sentiment across European asset classes, with Bunds higher and equities firmly in the red, although if the Paris terrorist attacks of November are any indication, today’s tragic events may be just the catalyst the S&P500 needs to surge back to all time highs

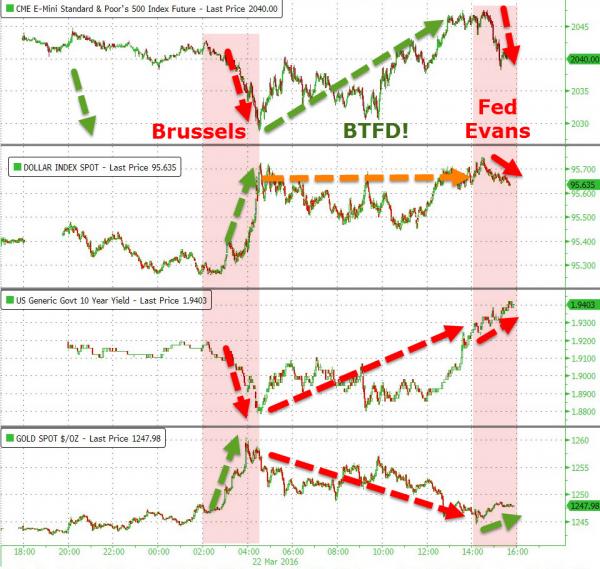

So it should be no surprise that panic-buying ensued off the reaction lows of a terror attack…

From BTFPTAD to BTFBTAD

Because whoever is buying knows that if stock sell-off then the terrorists win… which can be summed up as…

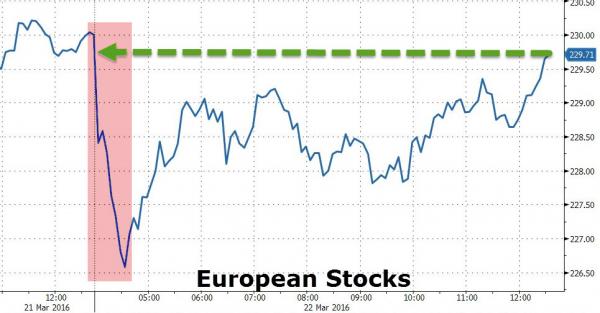

European “investors” bought the deadliest terror attack dip…

Because in the new normal – It’s easy…

BUT… The Fed had different views and unleashed The Hawks to tamp down the terror attack exuberance:

Across asset classes, only The USD Index maintained the reaction (stocks, bonds, and gold reverted)

On the day, in The US, Nasdaq was bid (thank sto Biotechs) and Trannie whacked (airlines) but Dow and S&P battled between bullish terrorism and hawkish fed…

Dow Futures show exactly what happened – machines ran stops off the lows but were unable to maintain momentum (no matter what JPY did) to new highs and so collapsed into the close…

As USDJPY and Stocks tracked each other perfectly…

Traders rushed for the safety of Biotechs..

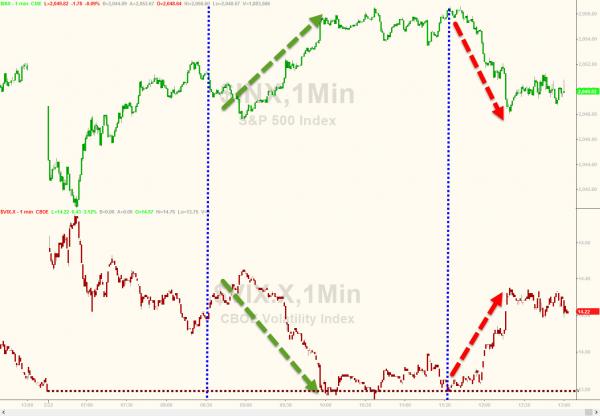

VIX was slammed to a 13 handle once again but Fed’s Evans’ hawkish comments sparked a lift in VIX…

VIX term structure drops to notably complacent levels…

Treasury yields and stocks decoupled early, then yields spiked after EU closed…

until Europe closed then a flood of selling struck…

Leave A Comment