I love debunking false narratives, mostly because these narratives do nothing but hurt the investors and traders who read them. E.g. if you’re an investor who’s constantly reading permabear narratives in this environment, you’re going to miss out on the stock market’s gains.

Here are some false bearish narratives that I’ve noticed from fintwit over the past week.

*If you haven’t already, feel free to follow me on twitter @BullMarketsco

False narrative #1

Brought to you from permabear David Rosenberg:

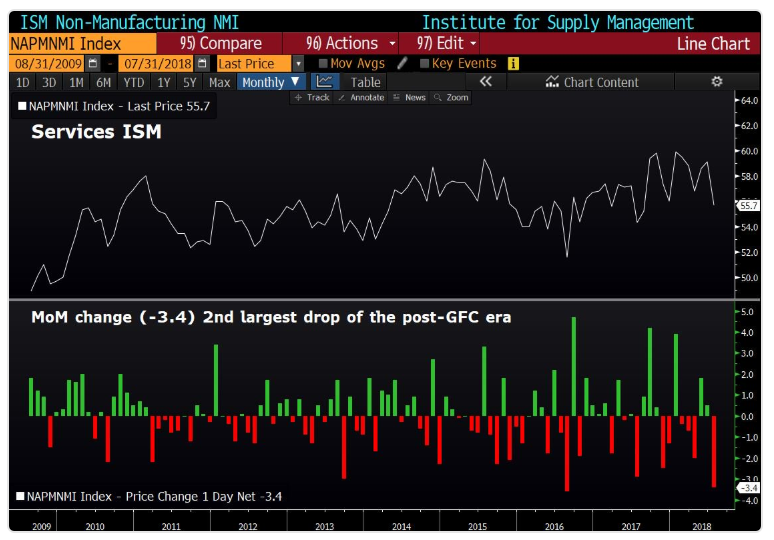

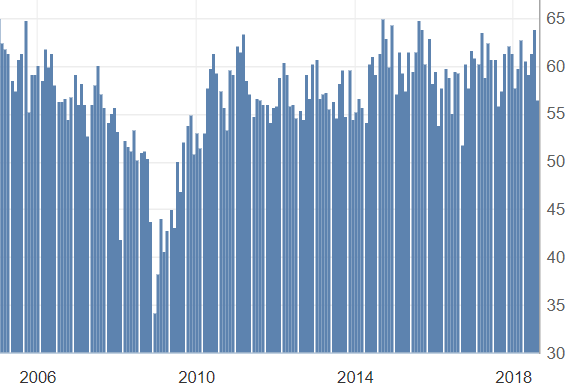

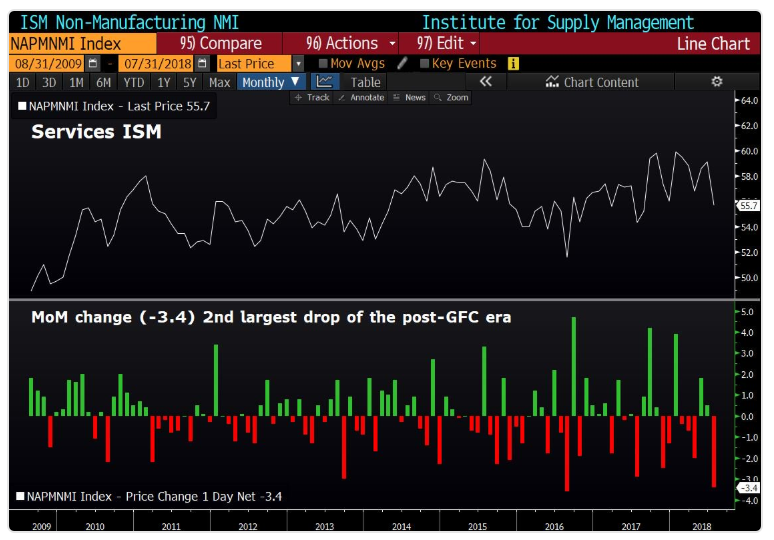

Look out below! The non-manufacturing ISM business activity index just fell the most in any month since…November 2008! Eighty percent of the time when it declines this much we’re either in recession or crawling out of one.

For starters, the month-to-month fluctuations in non-manufacturing ISM are notoriously noisy. Focusing on the month-to-month fluctuations = losing sight of the forest for the trees.

Also, it’s important to remember that any reading for ISM above 50 represents “growth”. ISM growth may have fallen from the month before, but it is still growing. Also, this economic indicator is not useful. It is far too noisy.

False narrative #2

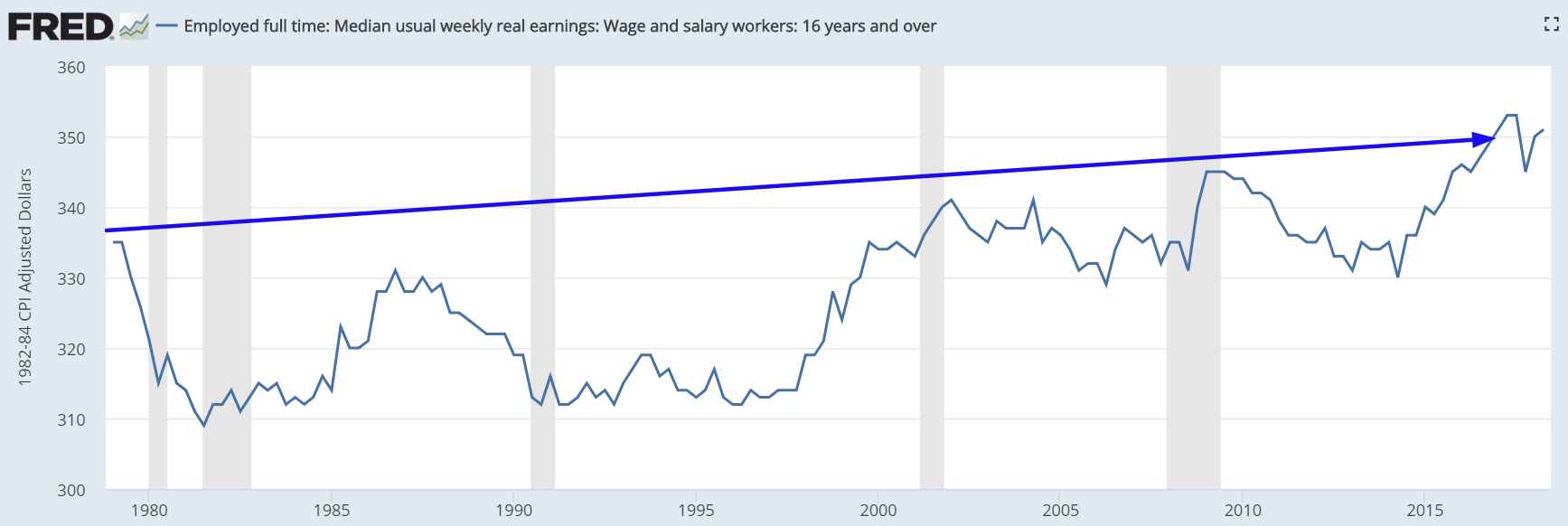

Real wage growth is nonexistent. This is bad for the stock market and economy.

Except history proves otherwise. Real wages have been stagnant for the most part of the past 40 years. Yet the stock market continues to grow and the stock market continues to go up. Why?

Because “the economy” is not real GDP per capita. It’s real GDP. In other words, an economy with zero real wage growth can still grow if its population is increasing. Moreover, not all economic growth goes towards wages. A large part of it goes towards corporate profits.

Real wage growth has very little impact on the stock market and economy. Real wage growth has been stagnant over the past 30-40 years while the stock market has soared.

Leave A Comment