The latest statement by Paul Ryan, the Speaker of the House, was that tax reform could take longer to get done than healthcare reform. That’s an interesting way of putting it since healthcare reform still hasn’t gotten done. The first step of healthcare reform, which is voting on it in the House, wasn’t even completed. Paul Ryan stated that neither the Senate nor the President have completed a budget. As per usual, government isn’t functioning as quickly as the private sector. That’s not a political point because some would argue we don’t want government to pass important laws quickly. The point is that it was never a good idea to buy stocks based on the hope of fiscal stimulus before Trump was inaugurated. Usually the market likes to get ahead of results, but with government actions, caution is a better approach.

The members of the Fed who pushed the expectation of stimulus back to 2018 look to be correct in their assessment. I was wondering how the Fed would react to such a delay. It seems that it’s not affecting their outlook on rates yet. Once sentiment surveys weaken because of the lack of fiscal policy actions, the Fed will likely alter its tune. It’s possible that the stimulus plan may end up being crafted to get the economy out of the next recession.

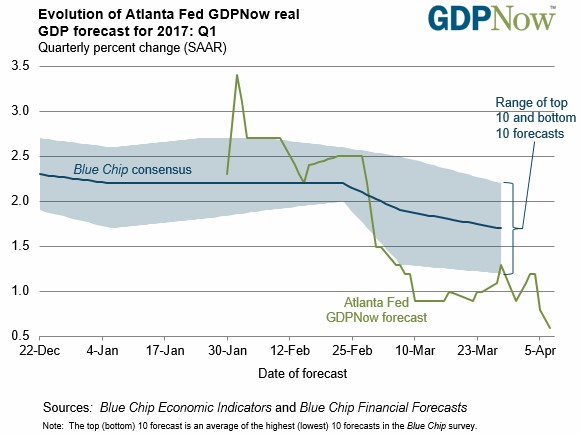

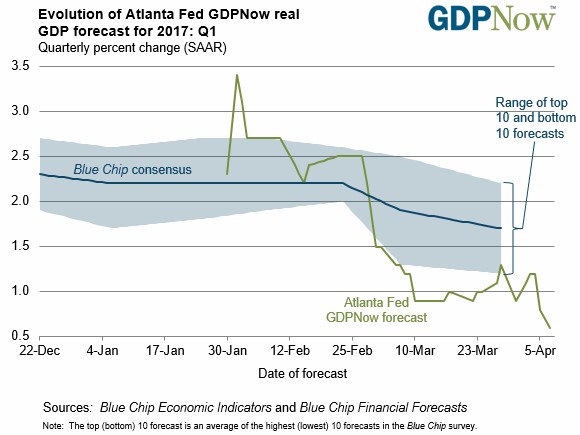

One argument that the next recession is coming soon comes from the Atlanta Fed’s GDP Now Forecast. The GDP Now forecast was revised lower by 0.6% in the last update. It’s now showing 0.6% growth expected in Q1. The NY Fed’s model is still differing as it expects 2.8% growth. As you can see in the chart below, the blue-chip consensus estimate is exactly in the middle of these two as it’s at 1.7% growth. There were a few reasons why the Atlanta Fed’s estimate was lowered. The ones I’ve previously covered were the weaker than expected BLS and ISM reports.

The reports I haven’t discussed which also contributed to the lower estimate were the light weight vehicle sales report and the wholesale trade data. All four of these reports caused the consumer spending growth estimate to fall from 1.2% to 0.6%. The estimate for real nonresidential equipment investment growth fell even further as it dropped from 9.7% to 5.6%. There is a chance that bullish investors are going to be able to support their narrative by blaming the bad weather in March. However, that would be biased analysis because the warm January and February helped growth. It wouldn’t be the first time a weak report was ignored as this has been the weakest recovery since 1949, yet the stock market is in its second longest bull market ever.

Leave A Comment