(T2108 measures the percentage of stocks trading above their respective 40-day moving averages [DMAs]. It helps to identify extremes in market sentiment that are likely to reverse. To learn more about it, see my T2108 Resource Page. You can follow real-time T2108 commentary on twitter using the #T2108 hashtag. T2108-related trades and other trades are occasionally posted on twitter using the #120trade hashtag. T2107 measures the percentage of stocks trading above their respective 200DMAs)

T2108 Status: 20.0% (right on the edge of oversold!)

T2107 Status: 23.2%

VIX Status: 20.7 (“elevated”)

General (Short-term) Trading Call: bullish – see below for caveats

Active T2108 periods: Day #4 over 20%, Day #7 under 30%, Day #8 under 40%, Day #12 below 50%, Day #27 under 60%, Day #368 under 70%

Reference Charts (click for view of last 6 months from Stockcharts.com):

S&P 500 or SPY

SDS (ProShares UltraShort S&P500)

U.S. Dollar Index (volatility index)

EEM (iShares MSCI Emerging Markets)

VIX (volatility index)

VXX (iPath S&P 500 VIX Short-Term Futures ETN)

EWG (iShares MSCI Germany Index Fund)

CAT (Caterpillar).

IBB (iShares Nasdaq Biotechnology).

Commentary

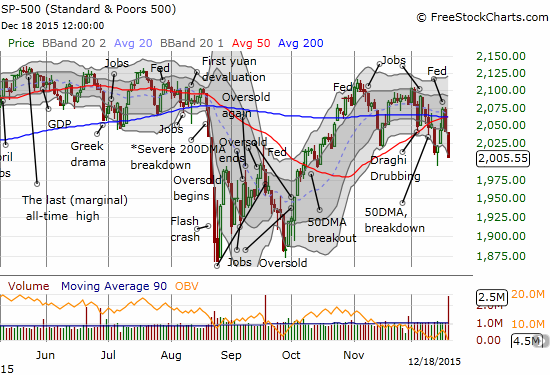

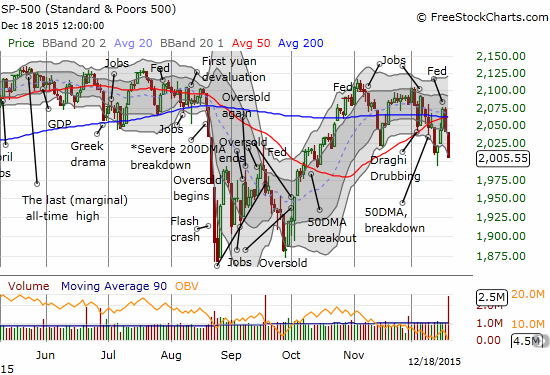

The week closed with a continuation of the post-Fed fade. The traditional year-end Santa Rally is now in doubt with the S&P 500 finishing at a fresh 2-month closing low.

S&P 500 is limping into the end of the month and the year.

My assumption that the December intraday low would hold is also in doubt in the wake of all this selling. However, T2108, the percentage of stocks trading above their respective 40-day moving averages (DMAs), is teetering right on oversold trading conditions. T2108 closed at 20.05%; it has to close below 20% to hit oversold. This next visit to oversold trading conditions makes the potential of A Santa Rally even more interesting than usual. As a reminder, the numbers very clearly show a tendency for the second half of December to deliver gains – see “The Numbers And Setup Behind This Year’s Potential Santa Claus Rally.”

Leave A Comment