T2108 Status: 20.7% (the 44% gain brought an end to an 11-day oversold period)

T2107 Status: 23.2%

VIX Status: 24.9 (still “elevated”)

General (Short-term) Trading Call: Bullish

Active T2108 periods: Day #1 over 20% (ended 11 days under 20%, aka oversold), Day #13 under 30%, Day #36 under 40%, Day #76 under 50%, Day #93 under 60%, Day #291 under 70%

Reference Charts (click for view of last 6 months from Stockcharts.com):

S&P 500 or SPY

SDS (ProShares UltraShort S&P500)

U.S. Dollar Index (volatility index)

EEM (iShares MSCI Emerging Markets)

VIX (volatility index)

VXX (iPath S&P 500 VIX Short-Term Futures ETN)

EWG (iShares MSCI Germany Index Fund)

CAT (Caterpillar).

Commentary

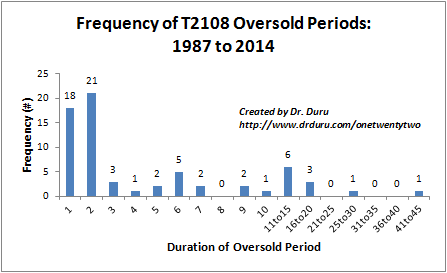

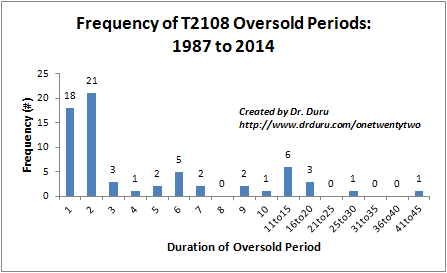

T2108 closed today at 20.7%. The 44% rise from Friday’s close at 14.3% brings an end to a historic oversold period (where T2108 is under 20%). Since 1986, only 10 other oversold periods lasted longer than the 11-day duration of this now concluded oversold period.

The majority of oversold periods last one or two days

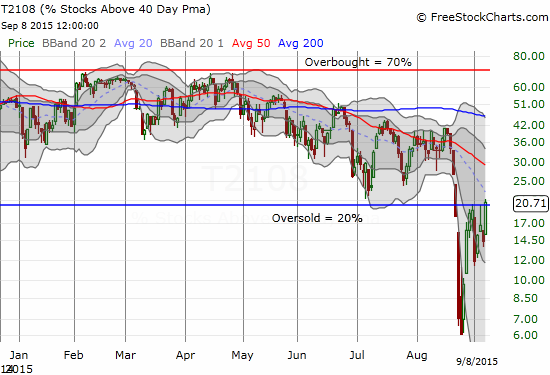

T2108 has now reversed all its losses from the flash crash on August 24th.

A small breakout for T2108 as it climbs out of oversold territory for the first time in 12 days.

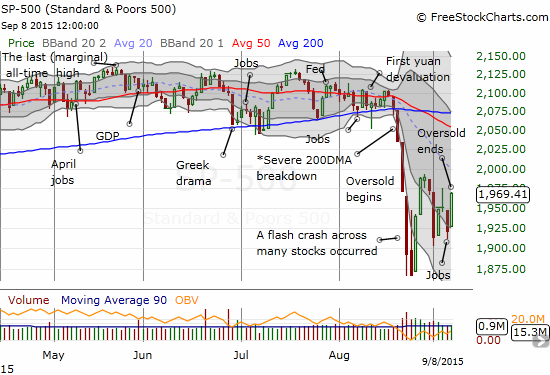

The S&P 50 (SPY) has now returned almost exactly to its close on the FIRST day of the oversold period.

The S&P 500 has returned to its close on the first oversold day. The index has NOT yet made a new post-oversold high.

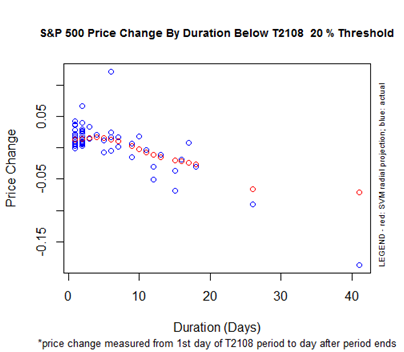

The -0.08% performance of the S&P 500 coming out of an 11-day oversold period places it exactly where the T2108 model would project the index to perform. This accuracy is another great validation of the model.

S&P 500 Performance By T2108 Duration Below the 20% Threshold (Oversold)

While the end of the oversold period is good news, the S&P 500 is still lagging. This oversold period was special not only for its flash crash but also for the ability of the S&P 500 to close with a gain WITHOUT first exiting the oversold period. The S&P 500’s current close leaves it below the high from the oversold period. This relative positioning means buyers still hold a heavy burden of proof for the recovery. The “good news” is that the proof will come in the form of a close at or above 2000 which should serve as an important psychological accomplishment.

Leave A Comment