(T2108 measures the percentage of stocks trading above their respective 40-day moving averages [DMAs]. It helps to identify extremes in market sentiment that are likely to reverse. To learn more about it, see my T2108 Resource Page. You can follow real-time T2108 commentary on twitter using the #T2108 hashtag. T2108-related trades and other trades are occasionally posted on twitter using the #120trade hashtag. T2107 measures the percentage of stocks trading above their respective 200DMAs)

T2108 Status: 57.1%

T2107 Status: 56.8%

VIX Status: 14.7

General (Short-term) Trading Call: bearish

Active T2108 periods: Day #65 over 20%, Day #64 over 30%, Day #61 over 40%, Day #58 over 50% (overperiod), Day #3 under 60% (underperiod), Day #10 under 70%

Commentary

Today feels like last Tuesday with a rally “out of nowhere.” Starting to wonder whether $SPY setting up for a long summer of chop.

— Dr. Duru (@DrDuru) May 16, 2016

In the last T2108 Update, I provided a list of reasons for getting more bearish on the market. So of course I was caught completely off guard by the strength of today’s rally.

If anything, I would have expected a fade into the close that pulled the S&P 500 (SPY) just under its 50-day moving average (DMA). Instead, buyers stayed defiant and closed out the day near the highs.

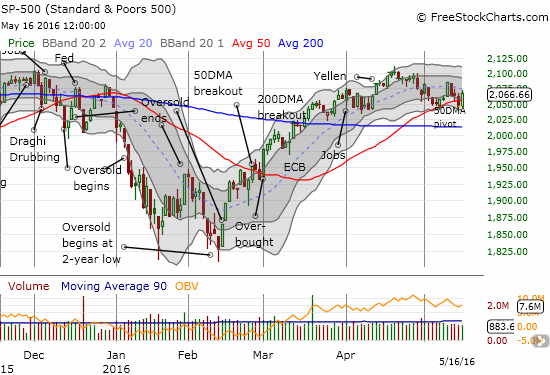

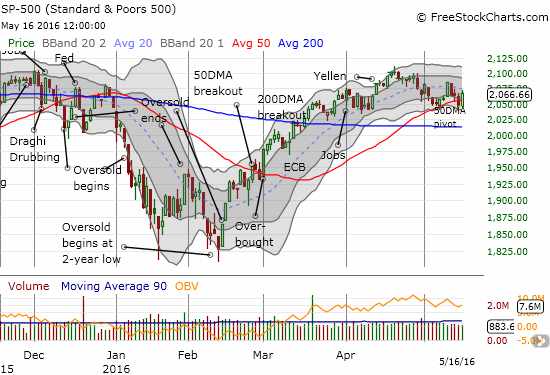

The S&P 500 defies the bearish gravity from Friday’s breakdown by leaping over 50DMA resistance.

T2108, the percentage of stocks trading above their respective 40DMAs, closed at 57.1% and essentially erased Friday’s loss. T2107, the percentage of stocks trading above their respective 200DMAs, almost reversed Friday’s loss with a close at 56.8%. These moves are encouraging but not quite enough to whiplash me into reversing the change in my trading bias. I will stay unconditionally bearish unless (until?) T2108 gets back to overbought status.

Yesterday’s action did remind me of the benefits of staying patient with positioning. If indeed the market is embarking on an extended period of choppiness, then the market will provide more opportunities to fade rallies than to chase breakdowns. For the day, I proceeded with my action plan going into the morning by scaling into (two) tranches of call options in ProShares Ultra VIX Short-Term Futures (UVXY). The underlying VIX finished the day at 14.7 after failing to hold the 15.35 pivot.

Leave A Comment