T2108 Status: 19.9% (Day #3 of oversold period that followed 11-day oversold period after one day).

T2107 Status: 22.3%

VIX Status: 23.2

General (Short-term) Trading Call: Bullish

Active T2108 periods: Day #3 under 20% (this oversold period followed 11-day oversold period after one day), Day #16 under 30%, Day #39 under 40%, Day #79 under 50%, Day #96 under 60%, Day #294 under 70%

Reference Charts (click for view of last 6 months from Stockcharts.com):

S&P 500 or SPY

SDS (ProShares UltraShort S&P500)

U.S. Dollar Index (volatility index)

EEM (iShares MSCI Emerging Markets)

VIX (volatility index)

VXX (iPath S&P 500 VIX Short-Term Futures ETN)

EWG (iShares MSCI Germany Index Fund)

CAT (Caterpillar).

Commentary

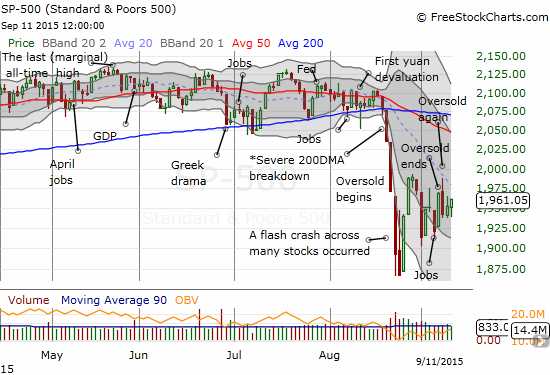

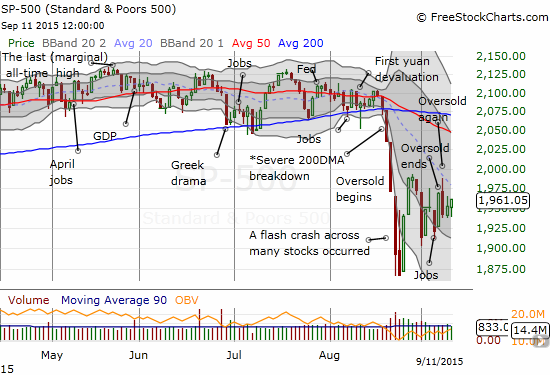

Sometimes I have the feeling I am not the only one following T2108 when the market goes oversold. T2108 closed the week at 19.9% and just barely stayed oversold after going as high as 20.1%. The marginal gain on T2108 was matched by a marginal 0.45% gain on the S&P 500 (SPY).

The S&P 500 has settled into a wide chopping pattern since August’s dramatic bottom

Note carefully that the S&P 500 has settled into a chopping pattern ever since the dramatic bottom from August. Under these conditions, T2108 could very well move in and out of oversold trading conditions without signalling any major change in market sentiment. The main target waving the red cape this coming week is Fedageddon: the moment the U.S. Federal Reserve delivers a much anticipated decision on monetary policy on September 17, 2015. It makes a lot of sense that buyers and sellers will remain locked into a stalemate until the Fed delivers a decisive moment.

Volatility is still sinking ahead of Fedageddon. I may not get a chance to do the pre-Fed fade of volatility at a steal of a price.

Volatility closed the week at its lowest level since the big run-up began ahead of August’s flash crash

One of the more interesting charts of the key tells of the market remains Google (GOOG, GOOGL). The 50-day moving average (DMA) continues to provide post sell-off support. There is now a notable wedge formed by the 20DMA at the top and 50DMA at the bottom. I am on alert to follow the breakout (what I expect) or a breakdown.

Leave A Comment