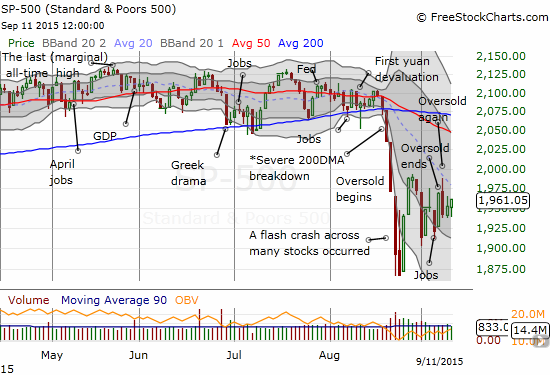

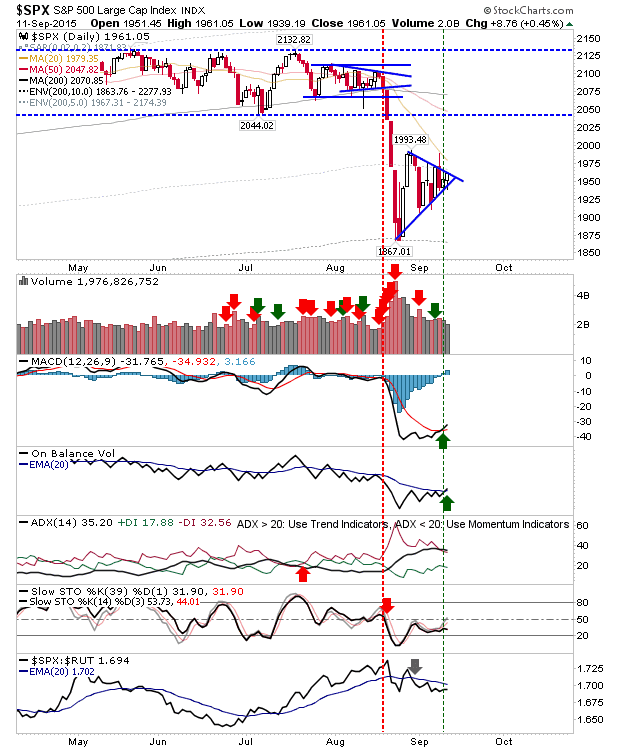

T2108 Status: 19.9% (Day #3 of oversold period that followed 11-day oversold period after one day).T2107 Status: 22.3%VIX Status: 23.2General (Short-term) Trading Call: BullishActive T2108 periods: Day #3 under 20% (this oversold period followed 11-day oversold period after one day),

September 13, 2015