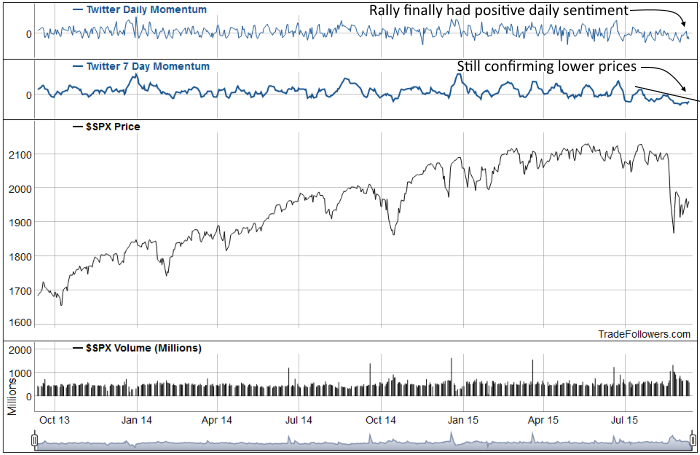

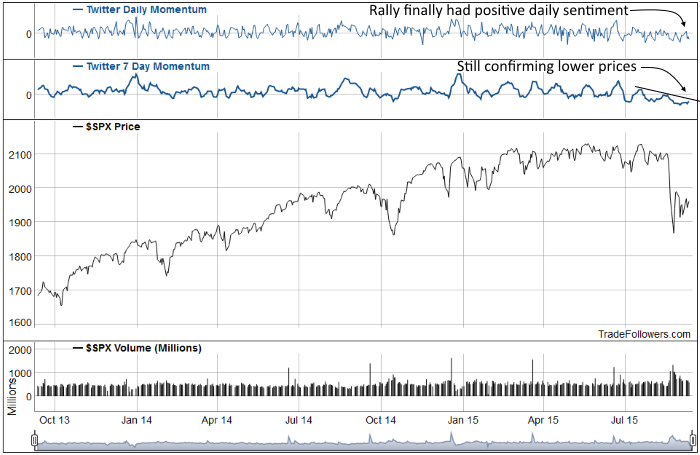

I’m finally starting to see some signs of hope on the Twitter (TWTR) stream for the S&P 500 Index (SPX). Last week’s rally lifted daily sentiment readings for the most part, and the strong rally on Tuesday resulted in a positive daily print in momentum. This shows a bit of hope, but the negative readings during the rest of the week indicate traders are uncertain. 7 day momentum is still in a clear downtrend even though price has been mostly rising since the first of the month. This suggests that there is still a lot of fear for lower prices.

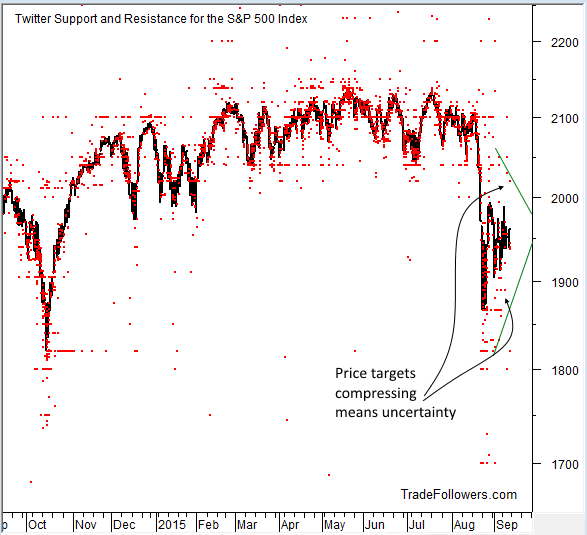

The uncertainty becomes more apparent in price targets tweeted by traders for SPX. The range is compressing which is showing that traders are reluctant to call for substantially higher or lower prices. Basically, they just don’t know so they’re making smaller bets.

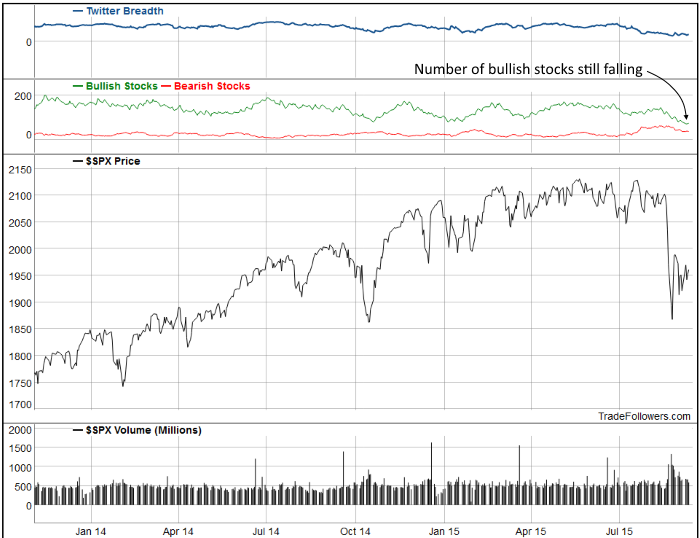

Breadth calculated between the number of bullish and bearish stocks on Twitter is stabilizing, but showing fewer bullish stocks almost every day. The number of bearish stocks is falling as well. This indicates market participants are taking profit or selling their leaders and nibbling at the most beaten down stocks. The bulls want to see a clear rise in the number of bullish stocks which would signal that dip buying is occurring in leaders. The worst outcome for the market would be a continued fall in bullish stocks accompanied in a rise in bearish stocks. That would almost certainly result in a resumption…and likely acceleration of the downtrend in SPX.

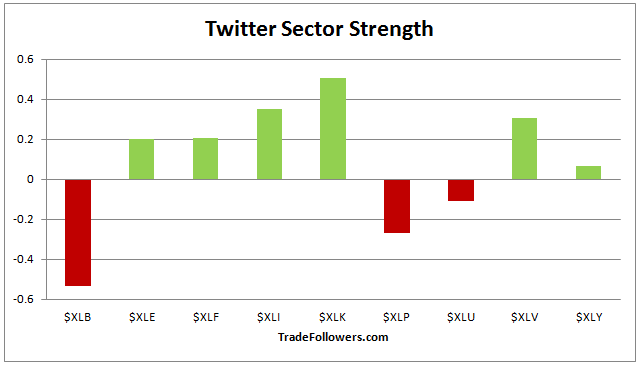

A sign of hope comes from sector sentiment. This week had strong readings for leading sectors and negative readings for defensive sectors. This is what we want to see continue for a healthy market going forward.

Conclusion

Fear is slowly turning to uncertainty sprinkled with a bit of hope. Daily sentiment readings are mostly negative, but recorded one positive print this week. Price targets are compressing which suggests uncertainty, but sector sentiment shows some hope with defensive sectors lagging.

Leave A Comment