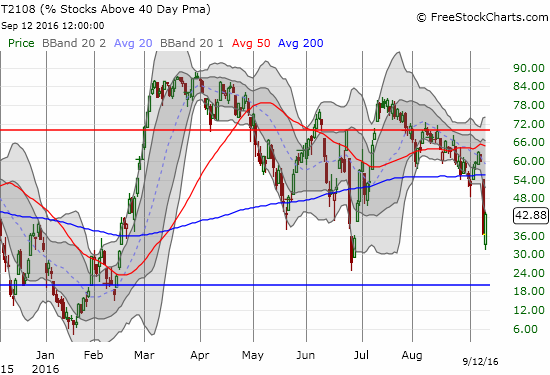

T2108 Status: 42.9% (as low as 31.2%)

T2107 Status: 71.8%

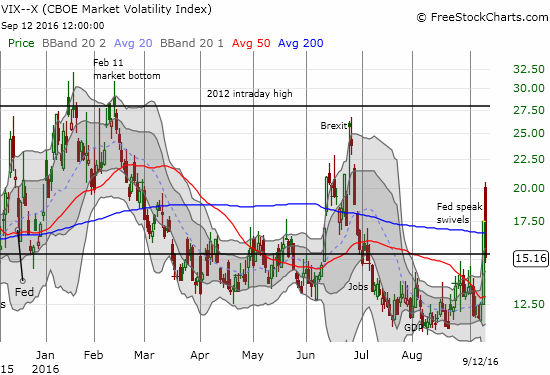

VIX Status: 15.2 (as high as 20.5 and a 17% gain from Friday’s close)

General (Short-term) Trading Call: neutral

Active T2108 periods: Day #144 over 20%, Day #50 over 30%, Day #1 over 40% (overperiod ending 1 day under 40%), Day #2 under 50%, Day #2 under 60%, Day #26 under 70%

Commentary

Ah. The soothing sounds of Fedspeak are back. Fedheads lining up today to remind us to stay calm. 🙂 $SPY #VIX back to 13 by end of week?

— Dr. Duru (@DrDuru) September 12, 2016

It was hard to guess how low would be low enough, but the stock market got to that point where the sellers completely exhausted their power of persuasion. In the last T2108 Update I outlined my expectations and conditions for a bounce. T2108, the percentage of stocks trading above their respective 40-day moving averages (DMAs), dropped as low as 31.2% before buyers rushed into the vacuum left behind by the sellers. As a reminder, when the market is in a bullish mood, T2108 around 30% has proven close enough to oversold to spark the next rally. Such was the case after Brexit, and buyers are clearly looking for a repeat performance here.

T2108 stretched downward as far as it could go. Will T2108 rush back to its earlier downtrend?

The volatility index, the VIX, had an even more dramatic day. The highs surprised me more than the lows given how the S&P 500 (SPY) was already so extended. At its high of the day, the VIX gained 17% from Friday’s close. That stretch alone had reversal written all over it. After the dust settled, the implosion of volatility was near complete. The VIX managed to close below the important 15.35 pivot point and may have signaled a very rapid return to the zone of complacency that dominated trading for the last two months.

Volatility implodes in spectacular fashion.

The only solace the bears could find on the day was the failure of the S&P 500 (SPY) to punch through resistance at its 50DMA. The buyers ran out of runway and settled for a 1.5% gain on the day.

Leave A Comment