(T2108 measures the percentage of stocks trading above their respective 40-day moving averages [DMAs]. It helps to identify extremes in market sentiment that are likely to reverse. To learn more about it, see my T2108 Resource Page. You can follow real-time T2108 commentary on twitter using the #T2108 hashtag. T2108-related trades and other trades are sometimes posted on twitter using the #120trade hashtag. T2107 measures the percentage of stocks trading above their respective 200DMAs)

T2108 Status: 64.3%

T2107 Status: 52.3%

VIX Status: 13.9

General (Short-term) Trading Call: Hold (bullish positions); aggressive bears should have stopped out (and I am still recommending that shorts stop trying to call a top here)

Active T2108 periods: Day #22 over 20%, Day #20 over 30%, Day #17 over 40%, Day #15 over 50%, Day #10 over 60% (overperiod), Day #92 under 70% (underperiod)

Reference Charts (click for view of last 6 months from Stockcharts.com):

S&P 500 or SPY

SDS (ProShares UltraShort S&P500)

U.S. Dollar Index (volatility index)

EEM (iShares MSCI Emerging Markets)

VIX (volatility index)

VXX (iPath S&P 500 VIX Short-Term Futures ETN)

EWG (iShares MSCI Germany Index Fund)

CAT (Caterpillar).

Commentary

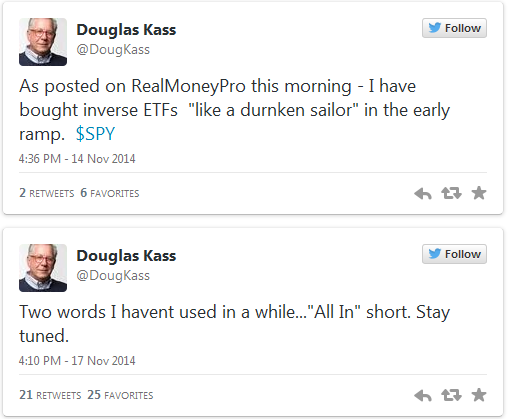

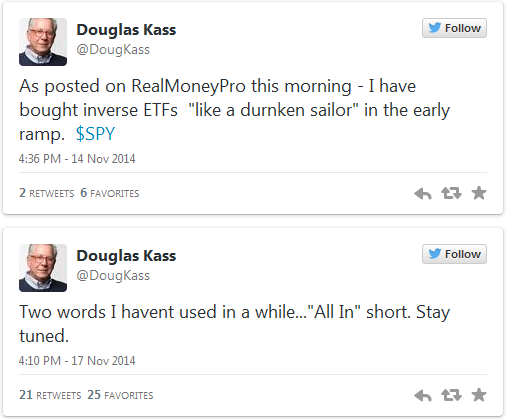

Bears are still itching for a top in the stock market, and the market continues to stubbornly refuse to comply. I post fund manager Doug Kass’s quotes in my blog not to pick on him specifically, but because I find them very useful accounts of bearish sentiment, especially the permabear kind. The aggressiveness of shorting into this strong uptrend surprises me, but it is indicative of the impatience that is likely growing among bears for a return to the palpable fear of October’s oversold period.

At this point, bears who continue to try to call a top are not using any definable method except that they do not like the market, think valuations are too high (probably for years at this point), are latched to memories of so many negative catalysts and headwinds that the market has long since left behind, and/or are over-estimating the small odds of a sudden market collapse and crash. Mind you – at SOME point, the bears will really nail it (and I hope to be there among them!). It will happen because the bears are consistently repeating the same song all the way up, and simple history tells us that sell-offs are inevitable. The problem of course is that it does us little good to miss, or even worse to FIGHT, a 20% rally to catch a 10% sell-off or anything similar. It is even sub-optimal to fade every little uptick and then cover on the next downtick while failing to notice the steady upward march of the indices (staring at trees and missing the forest). In an uptrend like this it is much better for bears to wait for SOME kind of confirmation; in other words, let the market come to you.

Leave A Comment