T2108 Status: 19.7%

T2107 Status: 18.8%

VIX Status: 22.6

General (Short-term) Trading Call: Bullish (upside target of 1996 on the S&P 500 before overbought conditions finally occur again. See “From the Edge of A Breakout to the Ledge of A Breakdown” for more details).

Active T2108 periods: Day #4 under 20%, Day #10 under 30%, Day #32 under 40%, Day #92 under 50%, Day #109 under 60%, Day #314 under 70%

Reference Charts (click for view of last 6 months from Stockcharts.com):

S&P 500 or SPY

SDS (ProShares UltraShort S&P500)

U.S. Dollar Index (volatility index)

EEM (iShares MSCI Emerging Markets)

VIX (volatility index)

VXX (iPath S&P 500 VIX Short-Term Futures ETN)

EWG (iShares MSCI Germany Index Fund)

CAT (Caterpillar).

IBB (iShares Nasdaq Biotechnology).

Commentary

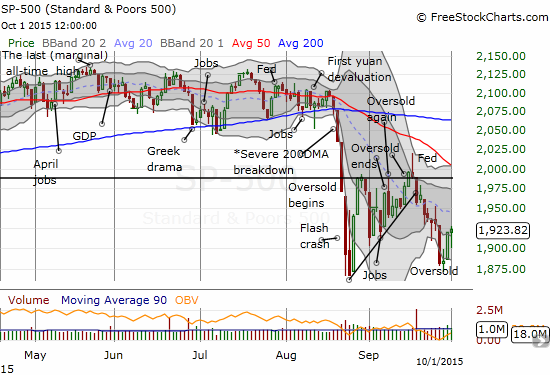

T2108 is itching to end this oversold period. On the eve of another job report, T2108 closed the day at 19.8% after getting as high as 22.0%. This is the fourth consecutive day of this oversold period. The S&P 500 (SPY) closed with a marginal gain and has ALMOST reversed the big one-day loss that started this week.

The S&P 500 (SPY) is angling for a flat week after a big sell-off on Monday caused a lot of consternation and began the current oversold period.

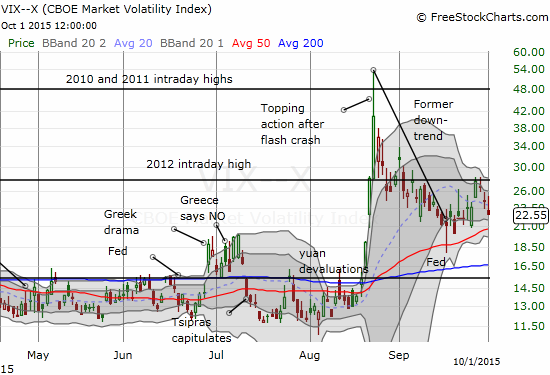

Along with the bounce, volatility is sinking once again. The VIX has already reversed all its gains from Monday.

The volatility index, the VIX, reverses quickly.

The technicals set up a relatively strong Friday, but the coming U.S. jobs report is likely to dominate the action. If the market interprets the report as good – I have NO feel for whether good news is good or bad at this juncture of rate hike anxiety – the S&P 500 (SPY) should at least finish the reversal of Monday’s loss and COULD surge to a retest of the downtrending 20DMA.

As promised, I have not added to my trades on T2108 oversold conditions. I actually sold my call options on ProShares Ultra S&P500 (SSO) into the previous day’s rally for a nice 50% gain. I am still holding the trading shares on ProShares Short VIX Short-Term Futures (SVXY).

Leave A Comment