(T2108 measures the percentage of stocks trading above their respective 40-day moving averages [DMAs]. It helps to identify extremes in market sentiment that are likely to reverse. To learn more about it, see my T2108 Resource Page. You can follow real-time T2108 commentary on twitter using the #T2108 hashtag. T2108-related trades and other trades are occasionally posted on twitter using the #120trade hashtag. T2107 measures the percentage of stocks trading above their respective 200DMAs)

T2108 Status: 42.9%

T2107 Status: 27.1%

VIX Status: 18.8

General (Short-term) Trading Call: bearish

Active T2108 periods: Day #32 over 20%, Day #31 over 30%, Day #2 over 40% (overperiod), Day #4 below 50%, Day #6 under 60%, Day #346 under 70%

Reference Charts (click for view of last 6 months from Stockcharts.com):

S&P 500 or SPY

SDS (ProShares UltraShort S&P500)

U.S. Dollar Index (volatility index)

EEM (iShares MSCI Emerging Markets)

VIX (volatility index)

VXX (iPath S&P 500 VIX Short-Term Futures ETN)

EWG (iShares MSCI Germany Index Fund)

CAT (Caterpillar).

IBB (iShares Nasdaq Biotechnology).

Commentary

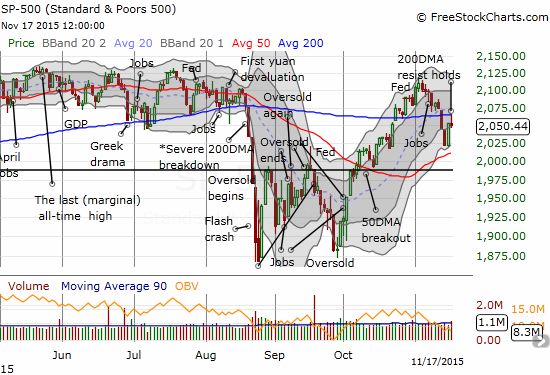

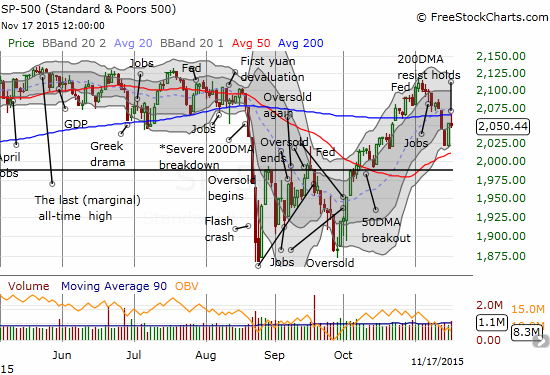

The S&P 500 (SPY) failed its first big test since confirming a failure to break into overbought territory. The index rallied right to its 200-day moving average (DMA) and then faded in picture-perfect form (who says 50 and 200DMAs do not matter?!?!). This follows a strong rally on Monday that seemed to demonstrate support at the 50DMA.

The S&P 500 fails at 200DMA resistance.

T2108 closed at 42.9%. Monday’s bounce once again demonstrated how strongly T2108 can surge after dropping into the 30% range.

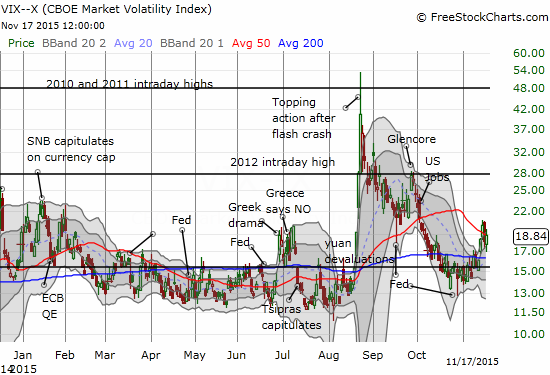

The volatility index has gyrated along with the market. It remains elevated above the 15.35 pivot and still looks like it is ready to resume lift-off.

The volatility index looks ready for lift-off

At the open, I put in a small order for call options on the ProShares Ultra VIX Short-Term Futures ETF (UVXY). I wanted to use the position as a small play on a fade of the S&P 500. The low-ball order never filled. UVXY went on to print a nice 10.6% gain. While my trading call remains bearish, I am now on watch for an opportunity to play ProShares Short VIX Short-Term Futures ETF (SVXY) for a quick bounce. (I put in a low-ball order for shares on Monday morning that never filled. Like UVXY, I missed out on a nice day trade). Note how SVXY is struggling with its 50DMA. I want to buy the next time it over-extends below the lower-Bollinger Band.

Leave A Comment